- United States

- /

- Construction

- /

- NYSE:EME

Is EMCOR Group Now an Opportunity After 12.9% Pullback Despite New Project Wins?

Reviewed by Bailey Pemberton

- Thinking about whether EMCOR Group is a bargain or not? Let’s take a closer look at whether the current share price really matches up to what the business is worth.

- EMCOR shares have returned an incredible 43.0% so far this year and are up 37.8% over the last 12 months, but just had a 12.9% pullback this week.

- A series of major infrastructure contracts and new project wins have been headline makers for EMCOR Group lately, helping drive attention to the stock. Industry analysts have noted the company’s growth momentum seems closely tied to public sector investment themes in the U.S., getting investors interested in what comes next.

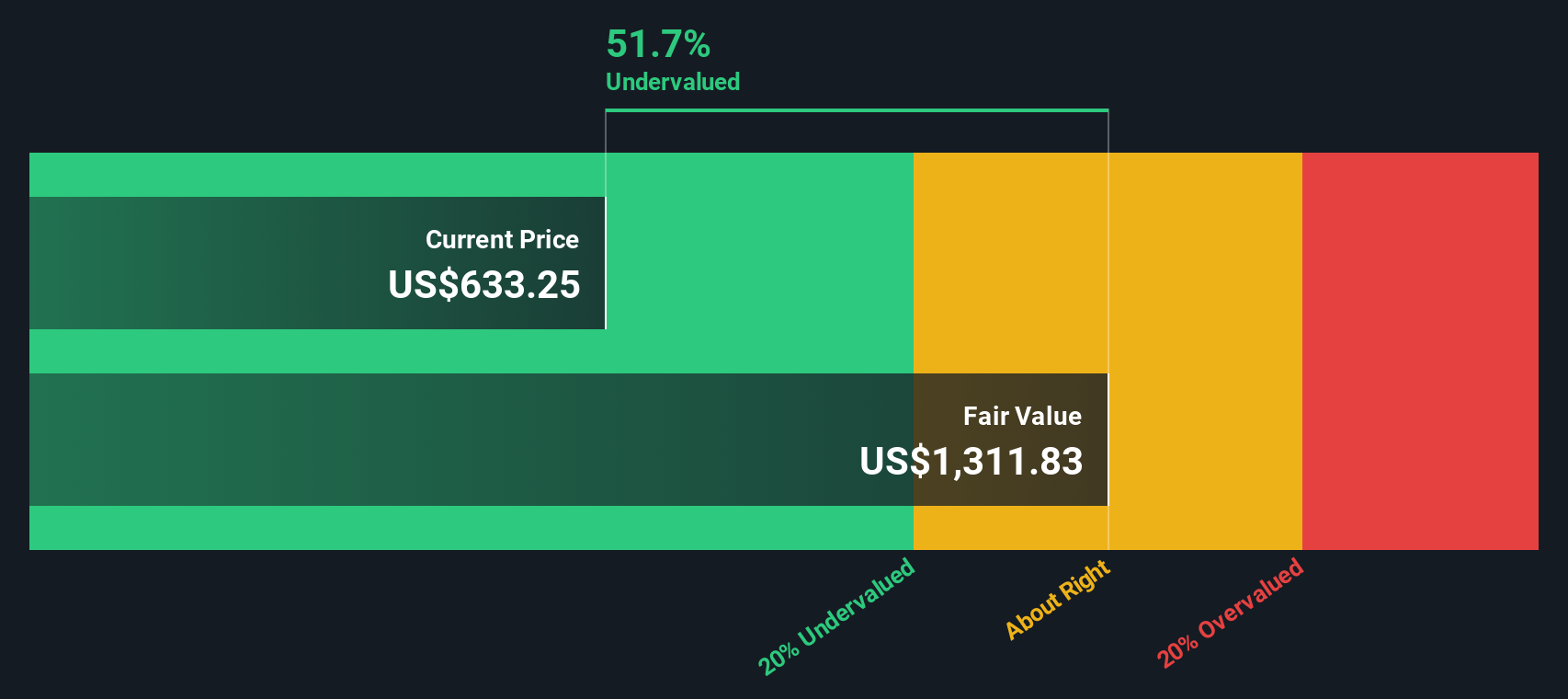

- On our valuation check, EMCOR Group scores 5 out of 6 for being undervalued. We’ll dig into what drives this score using different methods, and at the end of the article we’ll show you another way to interpret what “fair value” actually means for this stock.

Find out why EMCOR Group's 37.8% return over the last year is lagging behind its peers.

Approach 1: EMCOR Group Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a widely used method that estimates a company's intrinsic value by projecting its future free cash flows and then discounting those amounts back to today. This approach helps investors see what the business could be worth based on its potential to generate cash in the future.

EMCOR Group’s most recent twelve months’ Free Cash Flow stands at just over $1.15 billion. Analyst estimates project steady cash flow expansion, with anticipated Free Cash Flow rising to $2.01 billion by 2029. Although direct analyst projections are limited to about five years, the model includes extended estimates extrapolated using conservative growth assumptions.

Based on these cash flow projections and discounting them appropriately, EMCOR Group’s estimated intrinsic value is $918.66 per share. This suggests the current share price is 28.8% below the company’s true value according to this model, which indicates notable undervaluation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests EMCOR Group is undervalued by 28.8%. Track this in your watchlist or portfolio, or discover 844 more undervalued stocks based on cash flows.

Approach 2: EMCOR Group Price vs Earnings

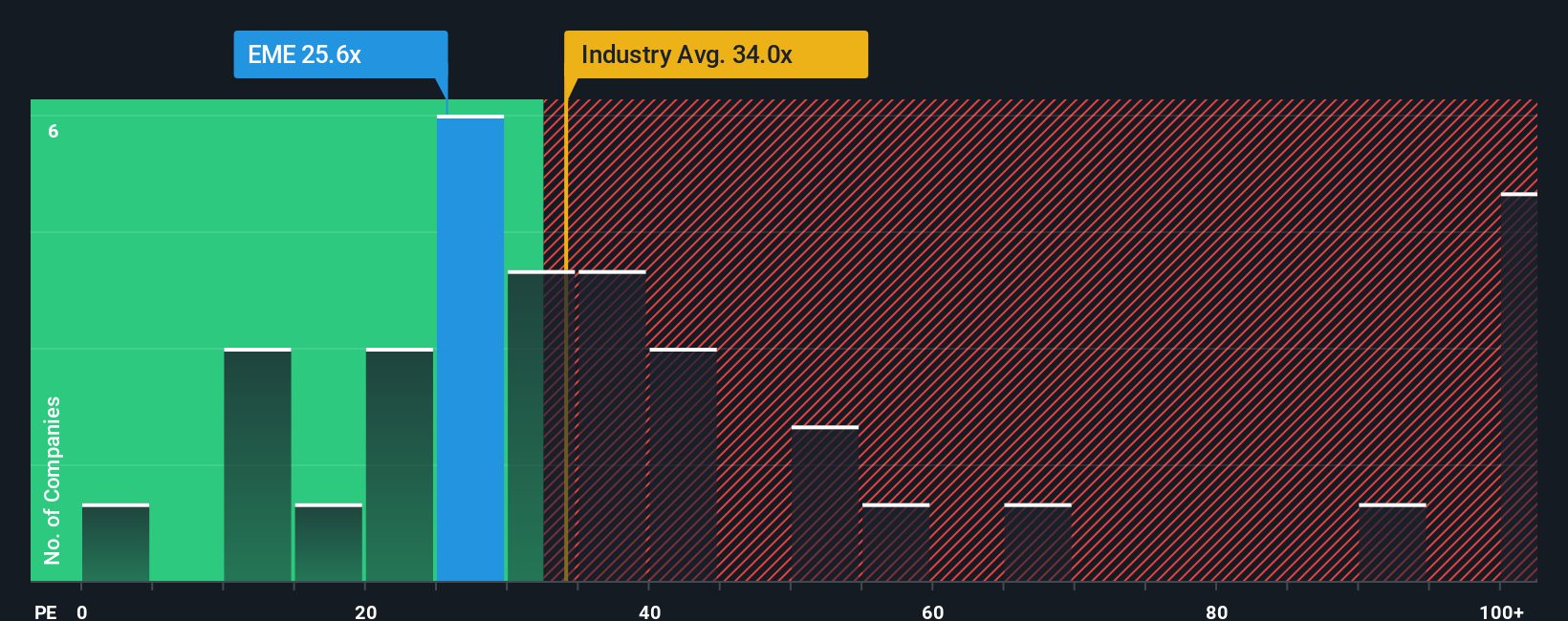

The price-to-earnings (PE) ratio is a widely used valuation metric for profitable companies like EMCOR Group because it reflects how much investors are willing to pay for each dollar of current earnings. It is especially relevant here, since EMCOR posts consistent profits and stable earnings growth, making the metric both reliable and meaningful.

What counts as a “normal” or “fair” PE ratio depends on several factors. Companies with higher expected growth typically command higher PE ratios, while those with greater risk or lower profitability deserve a discount. Market conditions, industry dynamics, and investor sentiment all play roles in determining the right benchmark.

EMCOR Group currently trades at a PE of 25.9x. That is below the construction industry average of 34.6x, and also lower than the peer average of 44.0x. This might make it look undervalued at first glance, but it is crucial to look deeper.

Simply Wall St’s Fair Ratio model provides a more robust benchmark by factoring in tailored criteria such as EMCOR Group’s earnings growth rates, industry outlook, consistent profit margins, market capitalization, and specific risk factors. For EMCOR, the Fair Ratio is assessed at 30.6x, making it a more insightful comparison than generic industry or peer averages.

Since EMCOR’s actual PE (25.9x) is below its Fair Ratio (30.6x), the shares currently look undervalued by this measure, even after considering growth and risk specific to the company.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1409 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your EMCOR Group Narrative

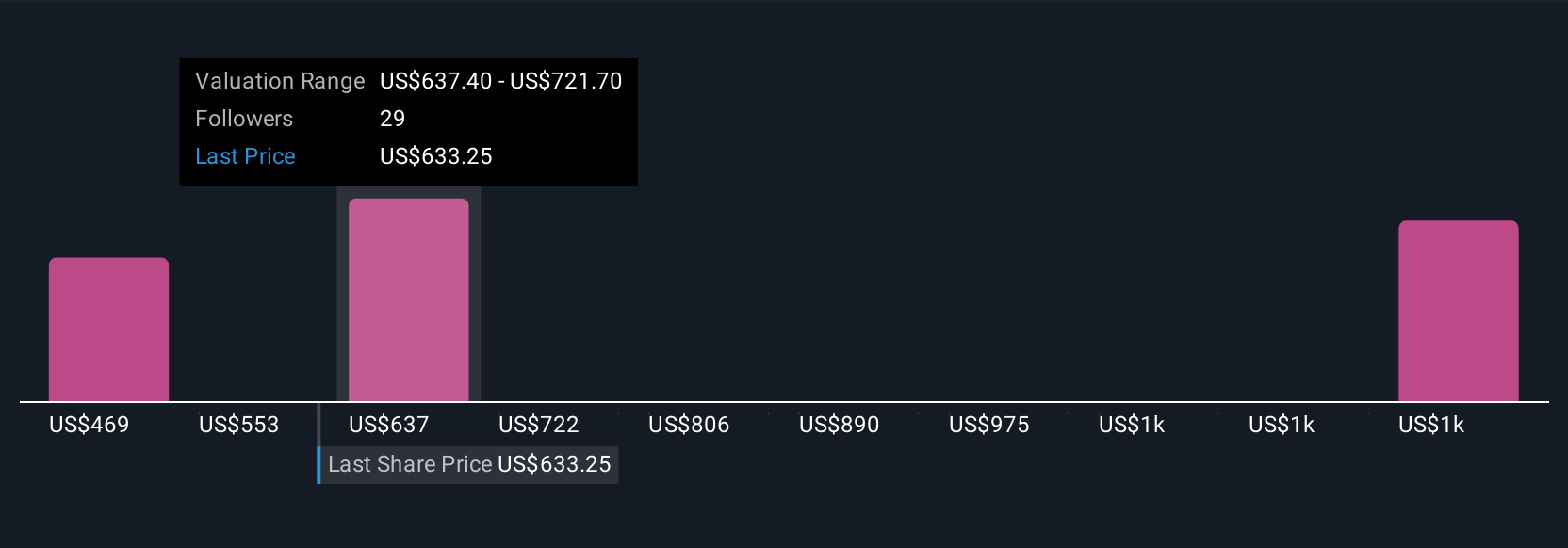

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. Narratives are a simple yet powerful tool that let you summarize your view of a company’s story, from expected revenue and profit margin growth to what multiple you would pay, and turn that perspective into a financial forecast and a fair value. By connecting the company's journey to hard numbers, Narratives help you see if the current share price aligns with your own expectations.

Available directly within the Community page on Simply Wall St’s platform, Narratives are easy to use and dynamically update as new information emerges, such as company news or earnings announcements. Narratives give you the power to compare your fair value to the market price, helping you clearly decide when EMCOR Group might be a buy or a sell for you as circumstances change.

For example, among EMCOR Group Narratives on Simply Wall St, some investors estimate fair value as low as $468.79 per share by using moderate growth assumptions, while others see the potential for a much higher fair value of up to $716.00 per share under more optimistic scenarios. This makes Narratives a flexible and user-friendly way to invest based on what you actually believe in the business, not just the numbers everyone else is using.

For EMCOR Group, we'll make it really easy for you with previews of two leading EMCOR Group Narratives:

Fair Value: $716.00

Undervalued by: -8.62%

Revenue Growth Assumption: 9.81%

- Analysts see robust sector demand, a record-high and diversified project backlog, and continued expansion into areas like data centers, healthcare, and advanced manufacturing supporting several years of revenue and margin growth.

- The strategy centers on acquisitions, digital integration, and investment in prefabrication and technical talent. These factors drive competitive strength, improve operational efficiency, and enable resilience to labor shortages.

- The consensus target assumes $20.6 billion in revenues and $1.4 billion in earnings by 2028. Ongoing risks include labor costs, integration challenges, and limited renewable exposure, which temper the outlook. The current price is close to analyst fair value.

Fair Value: $468.79

Overvalued by: 39.6%

Revenue Growth Assumption: 9.0%

- Bullish trends include ongoing infrastructure spending, booming demand for data center and electrification projects, and successful recent M&A activity, fueling consistent revenue and margin growth for EMCOR.

- Risks are visible in economic cyclicality, labor shortages, tight wage dynamics, supply chain inflation, and the company’s sensitivity to government spending and changing regulations. All of these factors could impact margins and long-term performance.

- The current share price is well above this intrinsic value estimate. While the fundamentals are solid, investors need to weigh strong growth prospects against the risks of overvaluation and industry volatility.

Do you think there's more to the story for EMCOR Group? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EMCOR Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EME

EMCOR Group

Provides electrical and mechanical construction and facilities, building, and industrial services in the United States and the United Kingdom.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives