- United States

- /

- Construction

- /

- NYSE:EME

EMCOR Group (EME) Raises Guidance and Sells U.K. Unit Will This Refocus Strengthen Its U.S. Growth?

Reviewed by Sasha Jovanovic

- EMCOR Group reported record third-quarter revenues of US$4.30 billion and raised its full-year 2025 revenue guidance, reflecting considerable growth across multiple sectors and successful acquisitions, including Miller Electric Company.

- The planned sale of EMCOR U.K. for approximately US$255 million further sharpens the group’s U.S. market focus and may enable additional organic growth and investment opportunities.

- We’ll examine how EMCOR’s raised guidance and targeted U.K. divestiture may alter the company’s investment narrative and forward outlook.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

EMCOR Group Investment Narrative Recap

To be a shareholder in EMCOR Group, one must believe in the company's ability to harness expansion opportunities from U.S.-focused growth, supported by a diversified backlog and focused capital allocation. The company’s record third-quarter results and raised 2025 guidance reinforce this narrative, while the planned sale of EMCOR U.K. brings a sharper domestic focus; however, these actions do not meaningfully alter the company’s biggest short-term risk, pressure on margins from persistent labor and wage costs.

Among recent developments, the announced sale of EMCOR U.K. for approximately US$255 million stands out as particularly relevant. By redirecting resources to organic growth and targeted M&A within core U.S. markets, EMCOR is positioning itself to potentially strengthen its leadership in electrical and mechanical construction, offering an important catalyst for the continued expansion of its high-growth segments.

On the other hand, investors should also be aware of ongoing exposure to labor market pressures, as these persistent cost challenges could...

Read the full narrative on EMCOR Group (it's free!)

EMCOR Group's narrative projects $20.6 billion in revenue and $1.4 billion in earnings by 2028. This requires 9.7% annual revenue growth and a $0.3 billion increase in earnings from the current $1.1 billion level.

Uncover how EMCOR Group's forecasts yield a $716.00 fair value, a 6% upside to its current price.

Exploring Other Perspectives

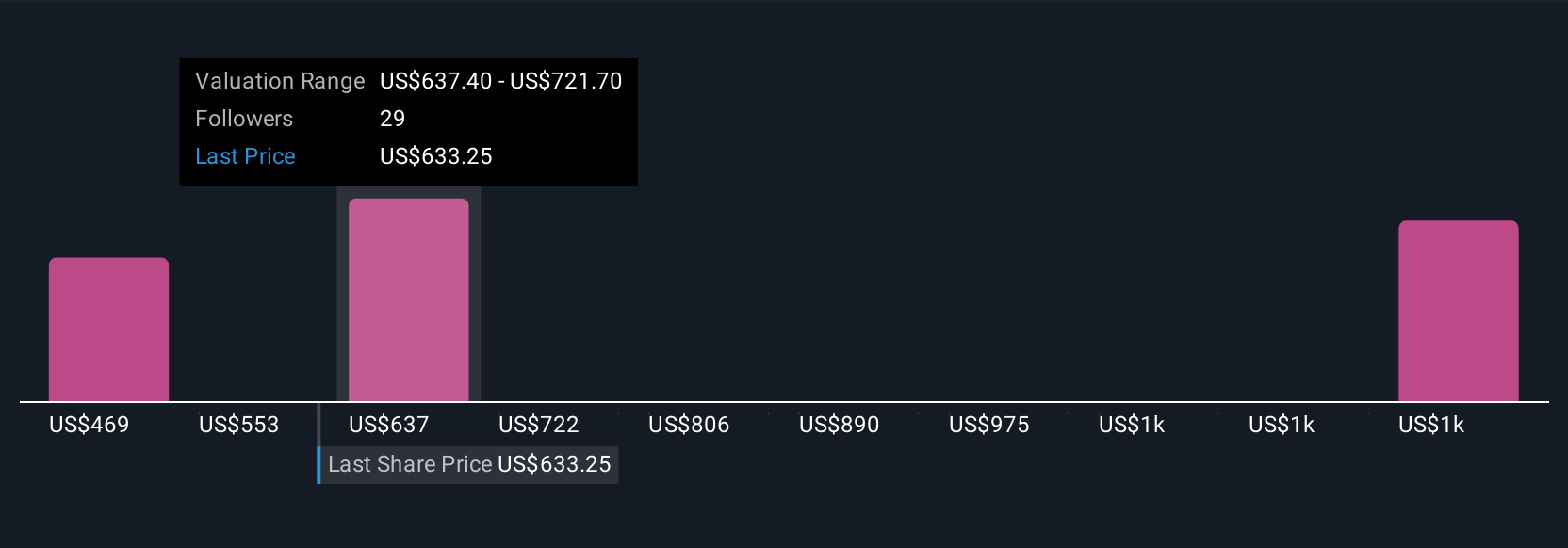

Eight estimates from the Simply Wall St Community put EMCOR’s fair value anywhere from US$468.79 to US$939.55 per share. While many see upside from a robust U.S. project backlog, the company’s reliance on large project wins means revenue and earnings could swing if sector momentum slows.

Explore 8 other fair value estimates on EMCOR Group - why the stock might be worth 31% less than the current price!

Build Your Own EMCOR Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your EMCOR Group research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free EMCOR Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate EMCOR Group's overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EMCOR Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EME

EMCOR Group

Provides electrical and mechanical construction and facilities, building, and industrial services in the United States and the United Kingdom.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives