- United States

- /

- Construction

- /

- NYSE:EME

EMCOR Group (EME) Margin Expansion Reinforces Bullish Narratives Despite Slower Growth Forecast

Reviewed by Simply Wall St

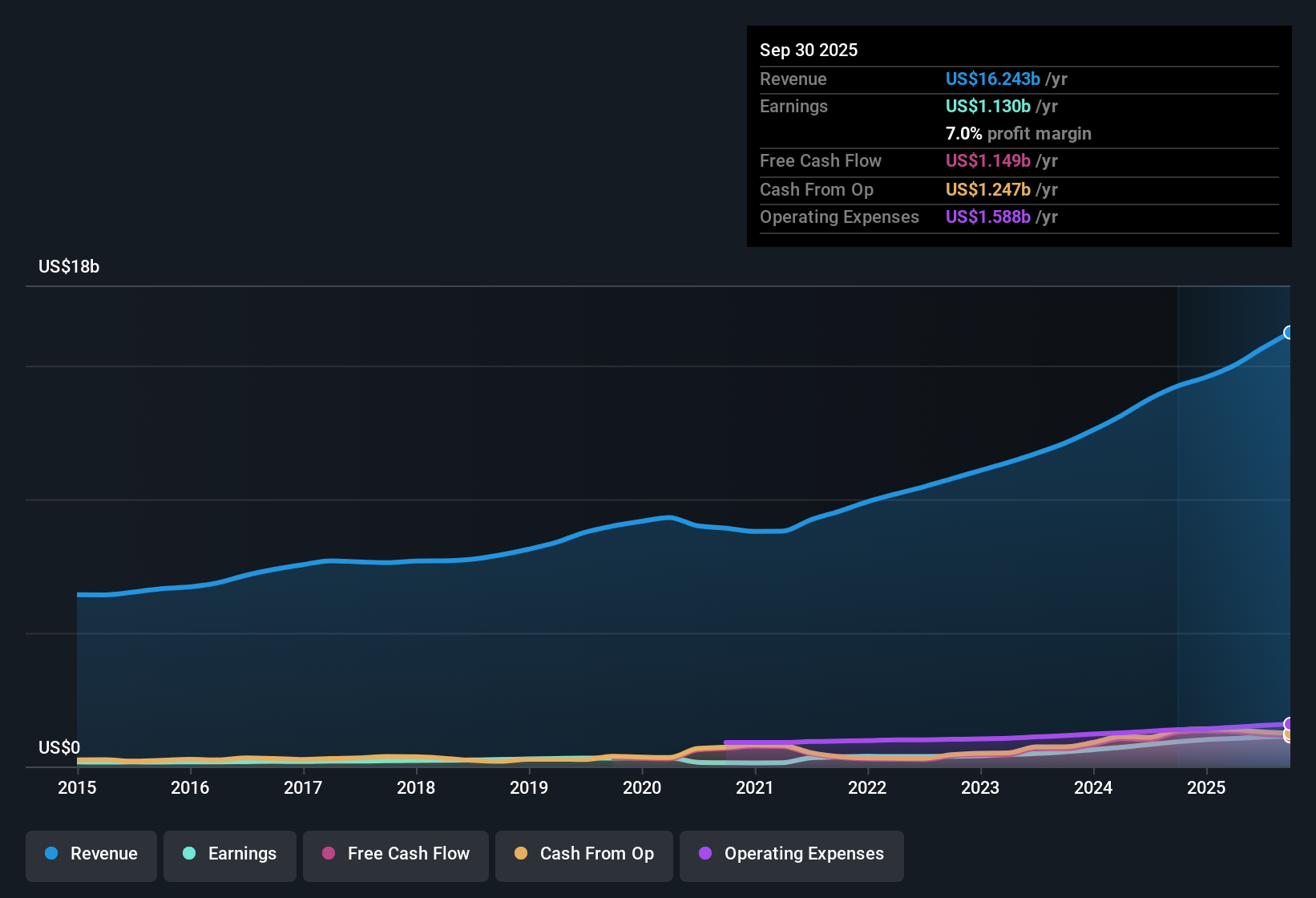

EMCOR Group (EME) reported net profit margins of 7.1%, up from 6% the previous year, as the company continued delivering high quality earnings. Over the last five years, earnings grew at an impressive 36.9% annually. The most recent year's growth of 33.9% fell just short of this pace. While revenue and earnings are projected to grow at 8.8% and 10.5% per year respectively, both figures lag the broader US market forecasts. This could potentially cap near-term excitement for investors. Strong historical performance and robust margins provide a solid foundation as the market considers what comes next.

See our full analysis for EMCOR Group.Next, we will set the latest numbers against the prevailing narratives to explore where the market's expectations line up with the results and where new themes could emerge.

See what the community is saying about EMCOR Group

Record $11.9 Billion Backlog Lifts Growth Outlook

- EMCOR's project backlog reached a record-high $11.9 billion, up 32% year over year. This positions the company for several years of sustained revenue growth above its historical run rates and adds multi-year visibility for investors.

- Analysts' consensus view heavily credits this backlog expansion. The consensus narrative points out that robust sector demand, sustainability projects, and digital integration are driving a more diversified backlog, which is expected to maintain revenue growth momentum and improve long-term margins.

- The narrative notes that verticals such as data centers and healthcare are key backlog drivers, contributing to higher-margin work and greater earnings stability compared to sector norms.

- Despite intensified labor market challenges, consensus highlights EMCOR’s continued investment in talent and prefabrication as key to keeping project delivery on track and supporting lasting margin improvement.

See what sets EMCOR apart from the rest in the Consensus Narrative for a complete view of the opportunities and risks tied to its order book. 📊 Read the full EMCOR Group Consensus Narrative.

PE Ratio Discount Versus Industry Average

- EMCOR trades at a 26.2x Price-To-Earnings ratio, materially lower than both its peer average (49.7x) and the broader US Construction industry (34.8x). This suggests the market remains cautious despite the company’s proven growth and execution.

- Analysts' consensus narrative underscores that this relative discount, combined with EMCOR’s strong historic growth and margin profile, contrasts with valuation models that see the company as undervalued given its DCF fair value of $1,301.01 versus today’s $648.00 share price.

- Consensus expects the PE ratio to stay well below the industry average out to 2028, assuming current earnings trajectories hold and the company continues outperforming on cost control and integration.

- This valuation gap could close quickly if backlog conversion outpaces forecasts or sector demand remains elevated. However, risks around cyclical market exposure and project mix may explain investors’ reluctance to pay a premium.

Margin Pressure Amid Slower Projected Growth

- Forecasts call for profit margins to slip from 7.1% today to 6.8% over the next three years, even as earnings are projected to grow to $1.4 billion by 2028. This creates a push-pull between rising costs and diversified project wins.

- According to the analysts’ consensus narrative, labor shortages and rising SG&A costs stand out as persistent headwinds that may limit further margin expansion, especially as organic growth necessitates higher incentive compensation and technical training.

- Consensus highlights how ongoing labor challenges and reliance on cyclical industries such as oil and gas increase volatility for both costs and revenues, creating less earnings resilience if macro conditions deteriorate.

- Despite this, the consensus view emphasizes that EMCOR’s investments in prefabrication and project scope diversity are partially offsetting these pressures. This is an important distinction in a sector facing similar wage headwinds.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for EMCOR Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a fresh take on these results? Shape your perspective and share your narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding EMCOR Group.

See What Else Is Out There

Despite EMCOR’s robust backlog and execution, investors face uncertainty from forecasted margin pressure, slower earnings growth, and exposure to cyclical industries compared to the sector’s best performers.

If you want steadier, more predictable results, use our stable growth stocks screener (2094 results) to find companies that consistently deliver reliable growth regardless of changing market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EMCOR Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EME

EMCOR Group

Provides electrical and mechanical construction and facilities, building, and industrial services in the United States and the United Kingdom.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives