- United States

- /

- Electrical

- /

- NYSE:EAF

GrafTech International Ltd. (NYSE:EAF) Looks Inexpensive After Falling 26% But Perhaps Not Attractive Enough

To the annoyance of some shareholders, GrafTech International Ltd. (NYSE:EAF) shares are down a considerable 26% in the last month, which continues a horrid run for the company. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 62% loss during that time.

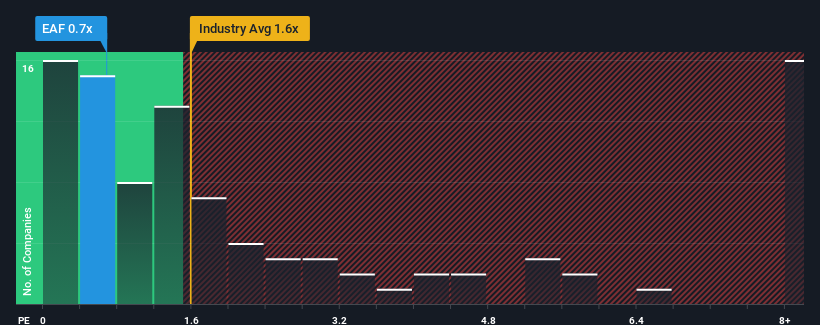

In spite of the heavy fall in price, GrafTech International may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.7x, considering almost half of all companies in the Electrical industry in the United States have P/S ratios greater than 1.6x and even P/S higher than 4x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for GrafTech International

What Does GrafTech International's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, GrafTech International's revenue has gone into reverse gear, which is not great. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on GrafTech International will help you uncover what's on the horizon.How Is GrafTech International's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as GrafTech International's is when the company's growth is on track to lag the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 48%. This means it has also seen a slide in revenue over the longer-term as revenue is down 44% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 4.5% as estimated by the three analysts watching the company. With the industry predicted to deliver 19% growth, that's a disappointing outcome.

In light of this, it's understandable that GrafTech International's P/S would sit below the majority of other companies. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Final Word

The southerly movements of GrafTech International's shares means its P/S is now sitting at a pretty low level. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of GrafTech International's analyst forecasts revealed that its outlook for shrinking revenue is contributing to its low P/S. As other companies in the industry are forecasting revenue growth, GrafTech International's poor outlook justifies its low P/S ratio. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

Plus, you should also learn about these 2 warning signs we've spotted with GrafTech International (including 1 which makes us a bit uncomfortable).

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:EAF

GrafTech International

Research, develops, manufactures, and sells graphite and carbon-based solutions worldwide.

Fair value with low risk.

Similar Companies

Market Insights

Community Narratives