- United States

- /

- Machinery

- /

- NYSE:DOV

Does Dover’s (DOV) 2025 Earnings Guidance Shift the Long-Term Investment Narrative?

Reviewed by Sasha Jovanovic

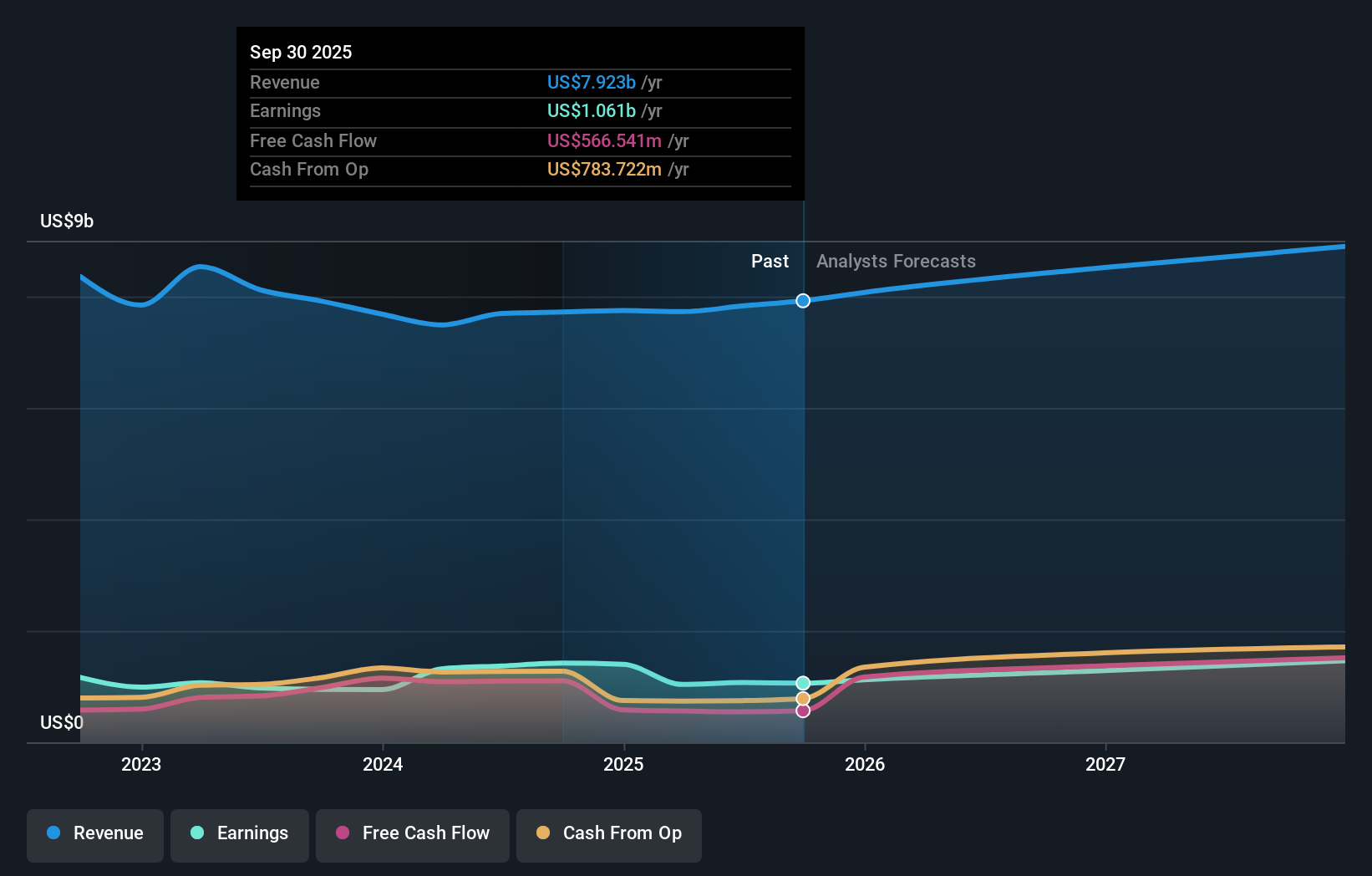

- Dover Corporation recently reported its third-quarter 2025 results, showing sales of US$2,077.84 million and net income of US$302 million, while also issuing full-year 2025 earnings guidance with GAAP EPS expected between US$8.06 and US$8.16 and revenue growth of 4% to 6%.

- Amid ongoing buyback activity earlier in the year, Dover reported higher sales but lower net income versus the previous year, offering investors fresh insight into both operational performance and forward expectations.

- We'll now explore how Dover's updated 2025 earnings guidance could influence the company's longer-term investment narrative and market positioning.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Dover Investment Narrative Recap

To be a Dover shareholder, you need to believe in the company's ability to drive long-term earnings growth through operational excellence, exposure to secular growth markets, and ongoing portfolio optimization, even as cyclical and macroeconomic headwinds create earnings volatility. The latest earnings and guidance suggest sales are on track, but margin pressure and lower net income highlight the importance of margin improvements as the most important short-term catalyst; risks from demand volatility and supply chain disruptions remain material to the narrative.

The most relevant recent announcement is Dover’s confirmation of its full-year 2025 earnings guidance, projecting GAAP EPS between US$8.06 and US$8.16 with 4 to 6 percent revenue growth. This update, following higher sales but lower earnings in the third quarter, reinforces the centrality of margin management and operating leverage as key catalysts for the near future.

In contrast, investors should be aware that ongoing exposure to cyclical end-markets leaves long-term profit margins vulnerable if growth drivers...

Read the full narrative on Dover (it's free!)

Dover's narrative projects $9.1 billion revenue and $1.1 billion earnings by 2028. This requires 5.2% yearly revenue growth and no change in earnings from the current level of $1.1 billion.

Uncover how Dover's forecasts yield a $214.44 fair value, a 20% upside to its current price.

Exploring Other Perspectives

Fair value estimates from the Simply Wall St Community span US$214.44 to US$242.02 based on two independent analyses. With margin pressure and lower net income highlighted in recent results, the range of values reflects the different ways market participants assess Dover's exposure to cyclical risks.

Explore 2 other fair value estimates on Dover - why the stock might be worth as much as 36% more than the current price!

Build Your Own Dover Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dover research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Dover research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dover's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DOV

Dover

Provides equipment and components, consumable supplies, aftermarket parts, software and digital solutions, and support services worldwide.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives