- United States

- /

- Machinery

- /

- NYSE:DDD

Benign Growth For 3D Systems Corporation (NYSE:DDD) Underpins Stock's 31% Plummet

The 3D Systems Corporation (NYSE:DDD) share price has softened a substantial 31% over the previous 30 days, handing back much of the gains the stock has made lately. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 34% in that time.

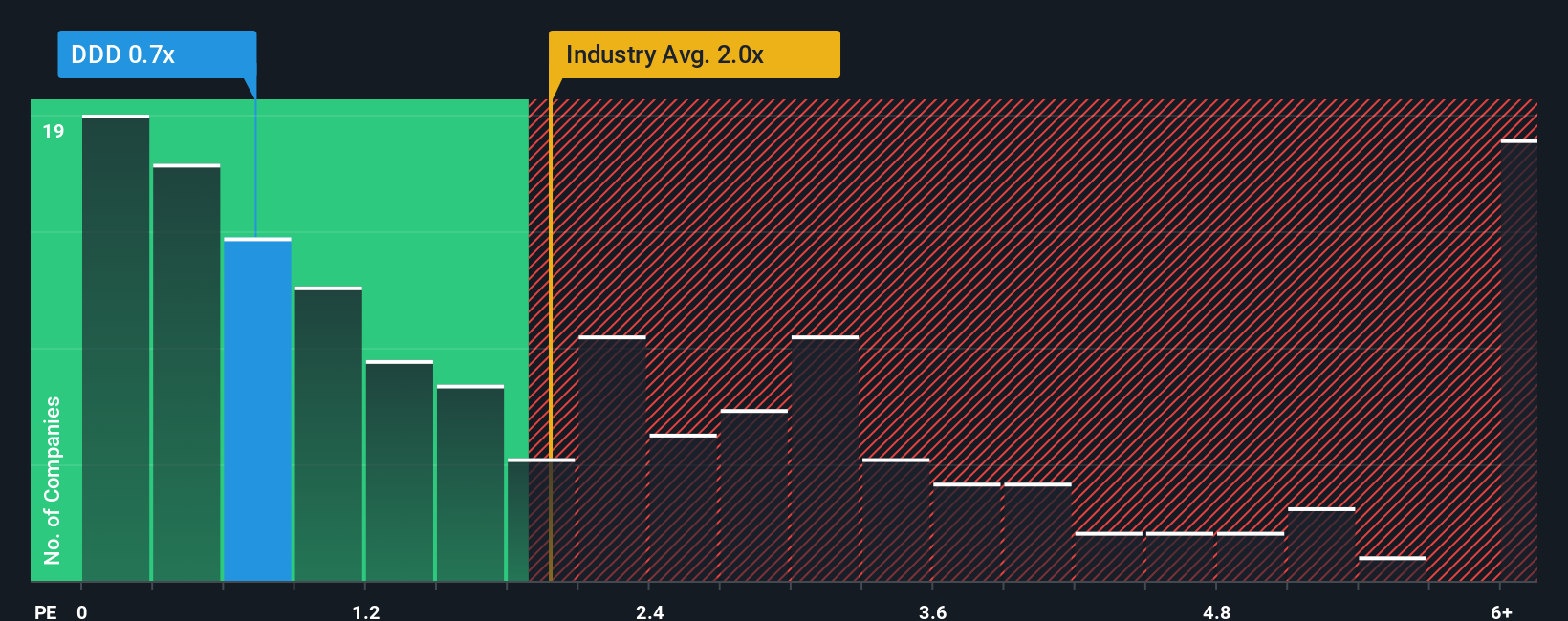

Although its price has dipped substantially, 3D Systems may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.7x, considering almost half of all companies in the Machinery industry in the United States have P/S ratios greater than 2x and even P/S higher than 4x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for 3D Systems

What Does 3D Systems' P/S Mean For Shareholders?

3D Systems hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on 3D Systems.How Is 3D Systems' Revenue Growth Trending?

In order to justify its P/S ratio, 3D Systems would need to produce sluggish growth that's trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 12%. This means it has also seen a slide in revenue over the longer-term as revenue is down 30% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the four analysts covering the company suggest revenue growth is heading into negative territory, declining 1.5% over the next year. Meanwhile, the broader industry is forecast to expand by 15%, which paints a poor picture.

With this in consideration, we find it intriguing that 3D Systems' P/S is closely matching its industry peers. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Final Word

3D Systems' P/S has taken a dip along with its share price. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of 3D Systems' analyst forecasts revealed that its outlook for shrinking revenue is contributing to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

We don't want to rain on the parade too much, but we did also find 3 warning signs for 3D Systems (2 are a bit unpleasant!) that you need to be mindful of.

If you're unsure about the strength of 3D Systems' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if 3D Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:DDD

3D Systems

Provides 3D printing and digital manufacturing solutions in North and South America, Europe, the Middle East, Africa, the Asia Pacific, and Oceania.

Mediocre balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives