- United States

- /

- Machinery

- /

- NYSE:DDD

3D Systems (DDD) Losses Worsen 41.6% Annually, Reinforcing Bearish Profitability Narratives

Reviewed by Simply Wall St

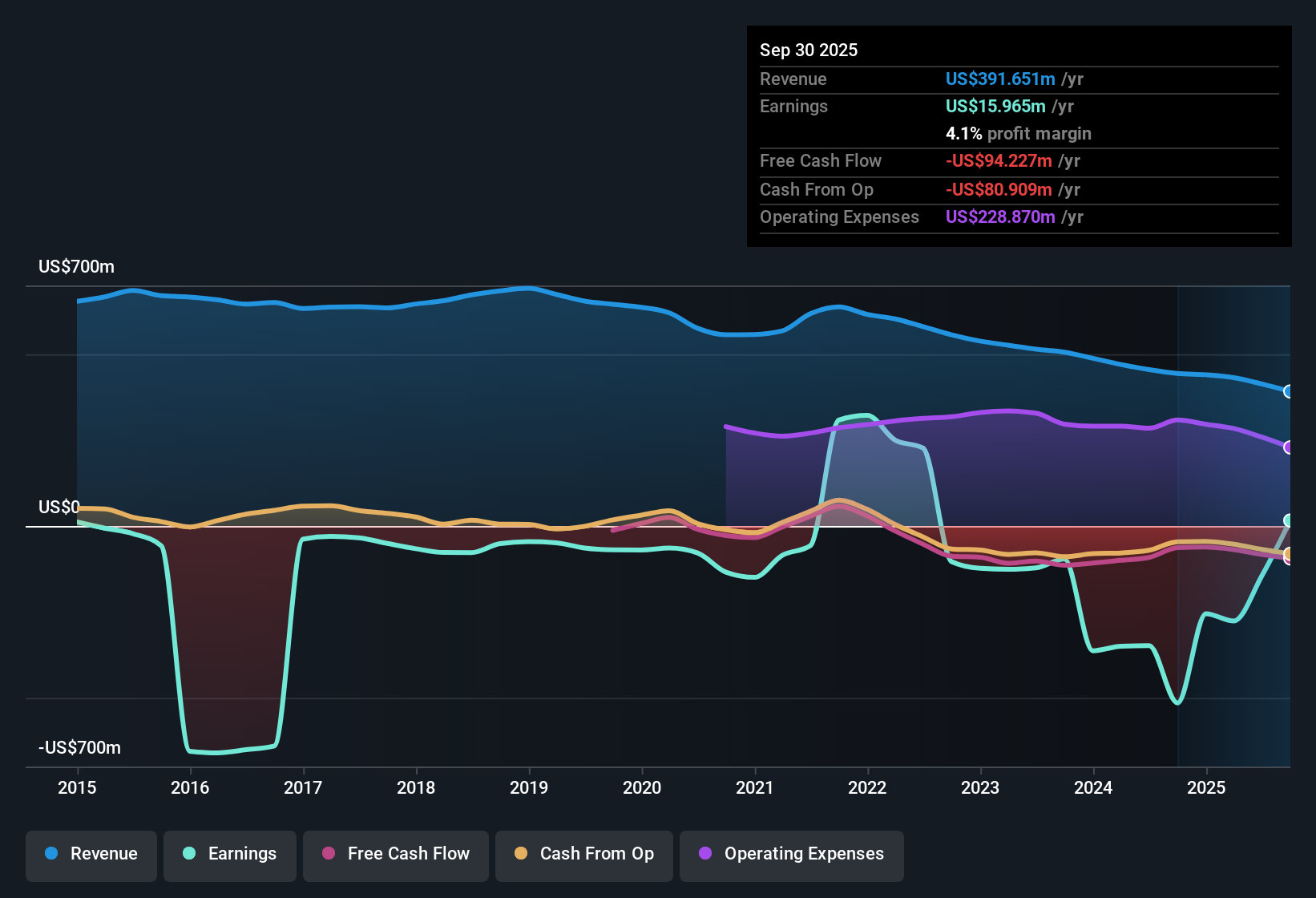

3D Systems (DDD) has reported increasing losses at an annual rate of 41.6% over the past five years, and net profit margins have not shown improvement. The company’s Price-to-Sales Ratio is 0.8x, making its sales more attractively valued compared to the US Machinery industry average of 1.9x and the peer group average of 1.2x. Persistent unprofitability and share price instability continue to present challenges for investors, with further growth in revenue and earnings not expected in the near term. This makes the path to sustainable improvement key to watch in upcoming quarters.

See our full analysis for 3D Systems.The next section dives into how these numbers compare with the market’s most widely-followed narratives and reveals which beliefs hold up and which might need a reality check.

See what the community is saying about 3D Systems

Recurring Revenue: Healthcare and Dental in Focus

- Consensus narrative spotlights 3D Systems' growth in healthcare and dental solutions, expecting these high-margin offerings to create steadier, recurring revenues amid an overall sector shift toward digital and customized care.

- According to the analysts' consensus view, the company’s push into MedTech (custom implants and trauma solutions) and NextDent dentures is poised to boost both top-line and profit margins as regulatory approvals and global adoption expand.

- What’s notable is that, despite recent revenue headwinds, consensus expects the combination of recurring healthcare demand and expanding digital dental markets to diversify sales beyond traditional cyclical manufacturing contracts.

- However, bears will watch for execution risk, as volatile order trends in dental and the need for commercialization discipline could undermine these growth ambitions if market uptake falls short.

Consensus views the latest results as a critical test for the long-term transformation story. Read the full narrative for deeper context. 📊 Read the full 3D Systems Consensus Narrative.

Aggressive Cost Cuts Versus Innovation Capacity

- With operating losses widening at a 41.6% annual rate over five years, 3D Systems is balancing cost reduction through in-sourcing, consolidation, and automation against the risk of undercutting its R&D engine.

- The consensus narrative frames this as a high-stakes efficiency drive, touting lower cost of goods and expanded gross margins as keys for turning profitable by 2026.

- Consensus emphasizes that shifting R&D toward commercialization, rather than pure research, could boost product launch frequency and improve returns on investment.

- Still, critics highlight that slashing R&D and restructuring, while controlling costs, may erode the company’s innovation pace, enabling competitors to leap ahead in fast-evolving additive manufacturing spaces.

Valuation Discount: Peer and Analyst Comparison

- 3D Systems’ current Price-to-Sales Ratio of 0.8x stands well below the US Machinery industry average of 1.9x and the peer average of 1.2x, marking a market discount on its sales relative to both industry and direct competitors.

- Within the consensus narrative, analysts set a $3.25 price target for 3D Systems, which is 25% higher than the current share price of $2.60 and hinges on a turnaround driving revenues to $359.5 million and profits to $2.6 million by 2028.

- Consensus suggests achieving this target would require the company to deliver a dramatic recovery in margins and earnings, trading at a hefty 178.1x forward P/E, far above the current industry multiple of 24.0x, highlighting the market’s skepticism in pricing.

- The discount to peers reflects persistent doubts about near-term growth and profitability, signaling the valuation upside is only likely if management’s execution matches these ambitious profit and margin milestones.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for 3D Systems on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Notice something new in the data? Take a moment to add your perspective and shape your own market narrative in just a few minutes. Do it your way

A great starting point for your 3D Systems research is our analysis highlighting 3 important warning signs that could impact your investment decision.

See What Else Is Out There

3D Systems faces inconsistent profitability, weak near-term growth, and persistent doubts about achieving sustainable revenue and earnings momentum.

If you want to focus on businesses delivering reliable expansion and less volatility, check out stable growth stocks screener (2074 results) to discover companies known for steady growth and consistent results.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if 3D Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DDD

3D Systems

Provides 3D printing and digital manufacturing solutions in North and South America, Europe, the Middle East, Africa, the Asia Pacific, and Oceania.

Mediocre balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives