- United States

- /

- Aerospace & Defense

- /

- NYSE:DCO

Ducommun (DCO): How the Latest Valuation Compares After Recent Share Price Momentum

Reviewed by Simply Wall St

Ducommun (DCO) stock has experienced some movement lately, sparking interest from investors who track trends over the past month and 3 months. Let’s take a look at what could be influencing the share price right now.

See our latest analysis for Ducommun.

While Ducommun’s share price has slipped slightly over the past month, the bigger story is its impressive longer-term run. The company has posted a year-to-date share price return of 43.64% and a one-year total shareholder return of 48.09%. Momentum is clearly building as investors size up its growth prospects alongside recent earnings strength and sector demand.

Curious to uncover other aerospace and defense stocks with similar potential? Check out the latest opportunities with our See the full list for free.

But with shares trading around $91, still about 18% below analyst targets, investors may be wondering if the market is offering a window for new buyers or if Ducommun’s recent success has already been fully factored into the price.

Most Popular Narrative: 14% Undervalued

Ducommun’s most popular narrative puts its fair value at $106.25, a notable premium over the last close of $91.34. This signals a potential opportunity as the market weighs the durability of Ducommun’s growth levers against future profit expectations.

Ongoing mix shift toward higher-margin engineered products and aftermarket (maintained at 23% of revenues, moving toward 25%+), together with value-driven pricing and restructuring actions, is increasing gross margins (recorded at 26.6% in Q2). This supports sustained improvements in net margins and earnings.

Want to know what is powering this bullish forecast? One key assumption is a sharp jump in profitability—with much higher margins and stronger cash flow than the company has delivered before. Ready to see the bold financial expectations and analyst math behind this target? Don’t miss what drives this headline number.

Result: Fair Value of $106.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks such as shifting defense spending and potential production delays remain. Either could quickly challenge even the most optimistic outlook for Ducommun.

Find out about the key risks to this Ducommun narrative.

Another View: Valuation by Comparison

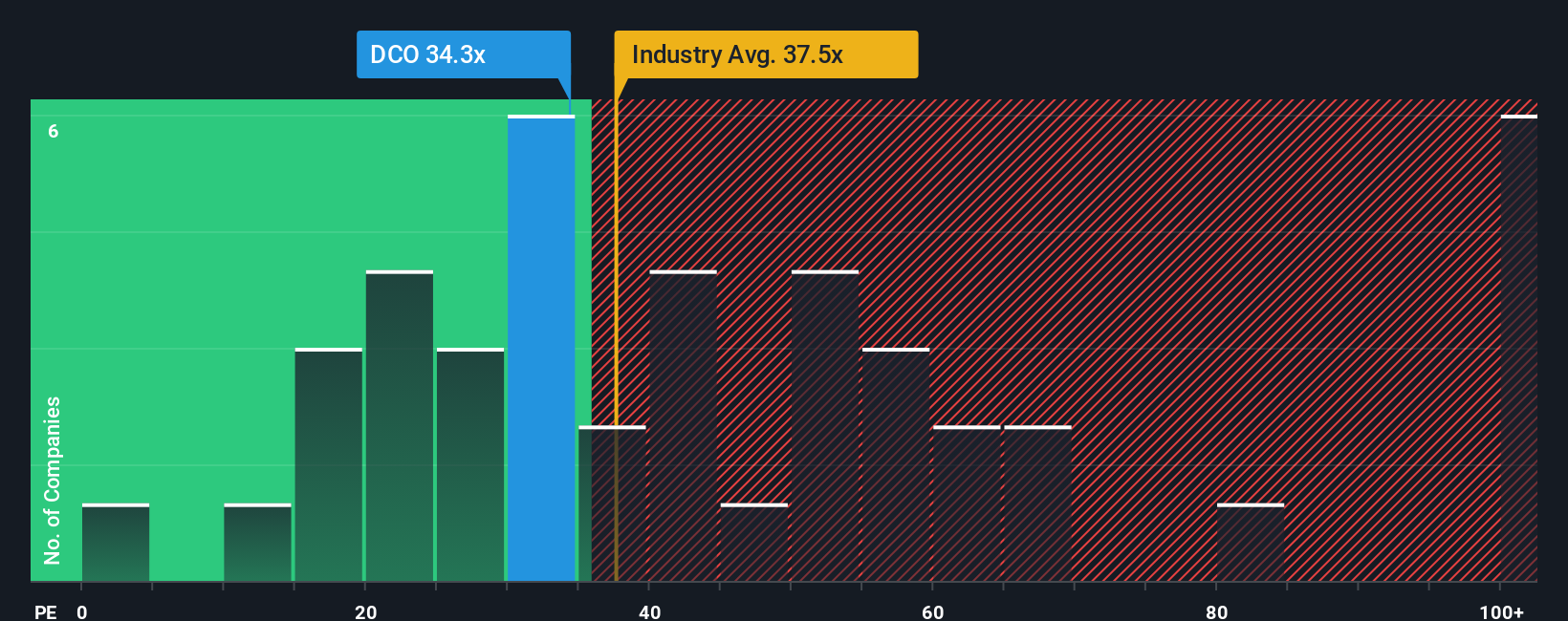

Looking at how Ducommun is valued compared to similar companies, it trades at a price-to-earnings ratio of 34.1x. This is lower than the industry average of 38.5x and much lower than the peer average of 50.4x. However, it is above its fair ratio of 24.8x, suggesting it is attractively valued next to competitors but still carries the risk of a market correction if growth falters. Does the market recognize untapped potential or is it already pricing in the upside?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ducommun Narrative

If you would rather take a different perspective, you can review the data for yourself and build your own investment case in just a few minutes. Simply Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Ducommun.

Looking for more investment ideas?

Give yourself an edge by checking out investment opportunities where others might not be looking. Don’t wait. Your next portfolio winner could be just a click away.

- Tap into wealth-building potential by reviewing these 20 dividend stocks with yields > 3% that deliver sustainable income and robust yields above 3%.

- Fast-track your search for undervalued opportunities with these 842 undervalued stocks based on cash flows identified as trading below cash flow-driven fair value.

- Cement your stake in tomorrow’s innovation with these 26 AI penny stocks making waves in artificial intelligence breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DCO

Ducommun

Provides engineering and manufacturing services for products and applications used in the aerospace and defense, industrial, medical, and other industries in the United States.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives