- United States

- /

- Machinery

- /

- NYSE:DCI

Is Donaldson Company Fairly Priced After Product Innovation and 30% Rally in 2025?

Reviewed by Bailey Pemberton

- Thinking about buying Donaldson Company stock, but wondering if it’s actually a good deal? You’re not alone. Figuring out whether a stock is genuinely undervalued is at the heart of smart investing.

- The stock has seen some noteworthy moves lately, climbing 2.5% in the last week, 5.3% over the past month, and a robust 30.3% so far this year.

- Recent headlines about Donaldson’s ongoing product innovation and strategic acquisitions have caught the attention of investors, sparking fresh interest in the stock. With this kind of news, it is no surprise that price momentum has picked up as market sentiment shifts.

- By our checks, Donaldson Company currently scores a 0/6 on undervaluation, so there is plenty to unpack here. Let’s dive into how different valuation approaches stack up. At the end, we will share a perspective that could help you see value in a whole new light.

Donaldson Company scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Donaldson Company Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what a company’s shares are really worth by projecting its future cash flows and then discounting those numbers back to today’s value. This process helps investors get a sense of a stock’s intrinsic worth. For Donaldson Company, this means taking what the company is expected to earn in the future and translating that into a present value.

Currently, Donaldson Company generates Free Cash Flow of $321.25 million. Analyst estimates project steady growth, with free cash flows expected to reach $437.5 million by 2026 and continue rising through 2029. Beyond 2029, these numbers are extrapolated, arriving at about $713.13 million in 2035. All figures are provided in US dollars and represent the company’s ongoing cash generation potential.

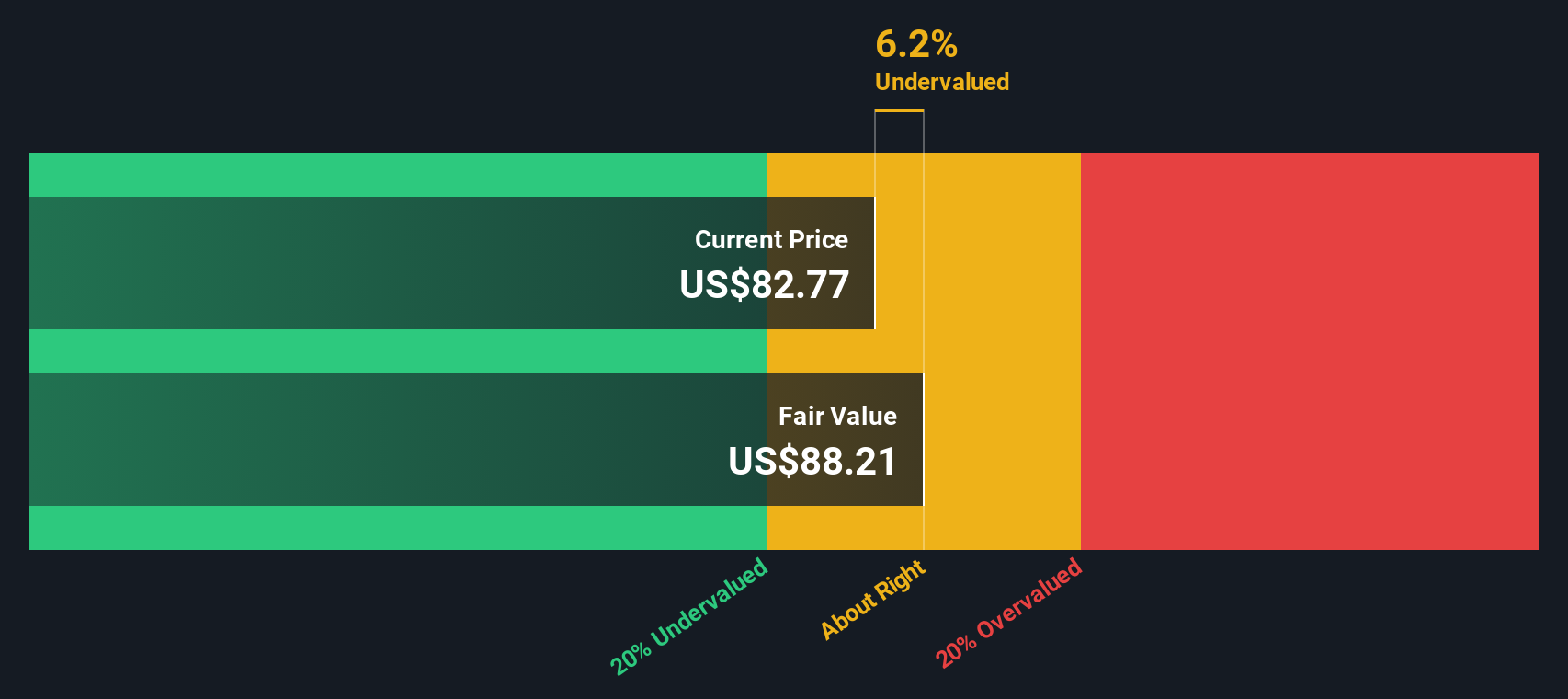

According to the DCF analysis, the fair value per share is calculated at $87.50. When compared against the current price, this points to a negligible intrinsic discount of 0.2 percent, meaning the stock is just slightly overvalued.

In short, Donaldson Company’s share price aligns closely with its actual business fundamentals right now. Investors are not getting a notable bargain or overpaying.

Result: ABOUT RIGHT

Donaldson Company is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

Approach 2: Donaldson Company Price vs Earnings

The Price-to-Earnings (PE) ratio is the preferred multiple for evaluating profitable companies like Donaldson Company, as it directly measures how much investors are willing to pay for each dollar of current earnings. This metric is especially relevant when a business has consistent profits, offering a straightforward comparison with peers and the broader industry.

Growth expectations and perceived risk can significantly influence what is considered a "normal" or "fair" PE ratio. Companies with strong future earnings potential often trade at higher multiples, while those with greater risks or slower growth typically have lower valuations.

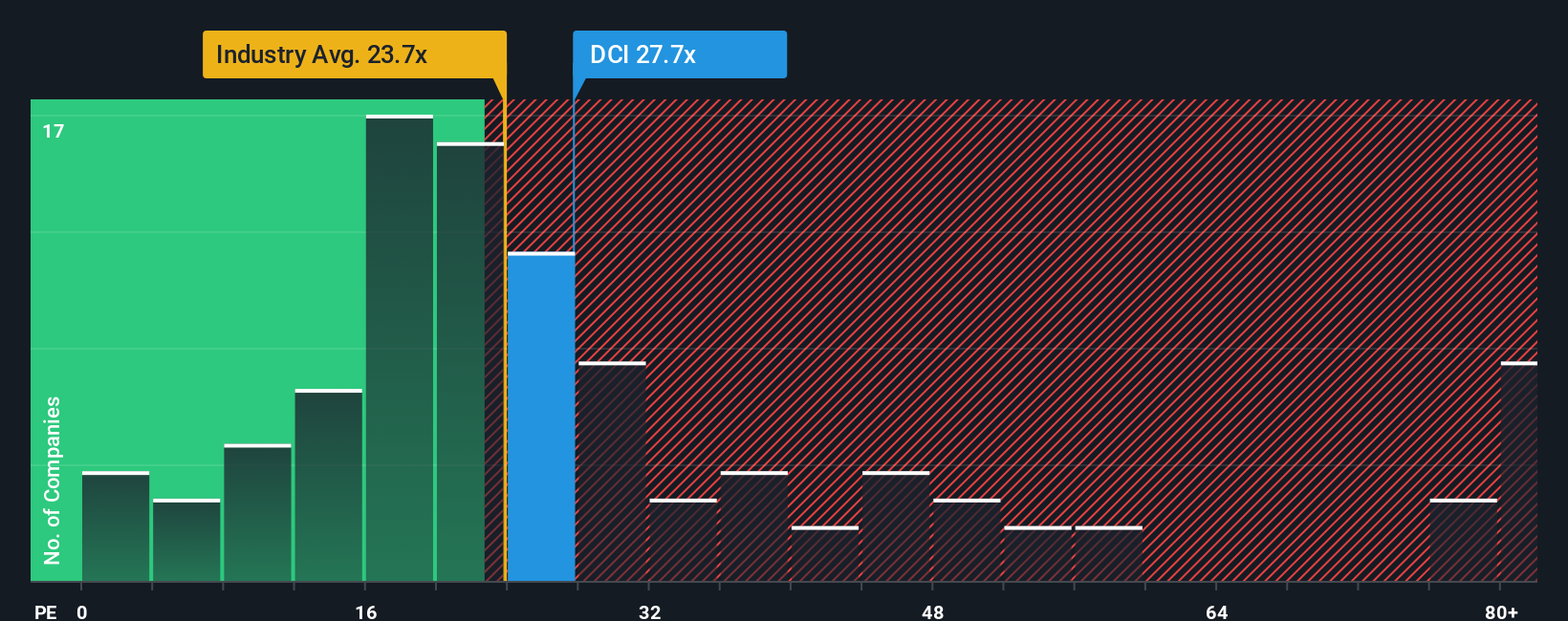

Donaldson Company currently trades at a PE ratio of 27.7x. In comparison, peers in the Machinery industry average around 24.8x, and the industry’s overall average is 23.7x. This suggests Donaldson is trading at a premium to both its industry and its peers.

Simply Wall St's proprietary "Fair Ratio" for Donaldson is 21.1x. The Fair Ratio is designed to be more comprehensive than simple peer or industry comparisons, as it factors in the company’s growth prospects, risk profile, profit margin, industry trends, and market size, providing a more nuanced picture of value.

Comparing Donaldson’s current PE of 27.7x to its Fair Ratio of 21.1x, the stock appears to be priced above what is justified by its fundamentals.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1430 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Donaldson Company Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives, a dynamic, accessible way to make smarter investment decisions that goes beyond traditional ratios and forecasts.

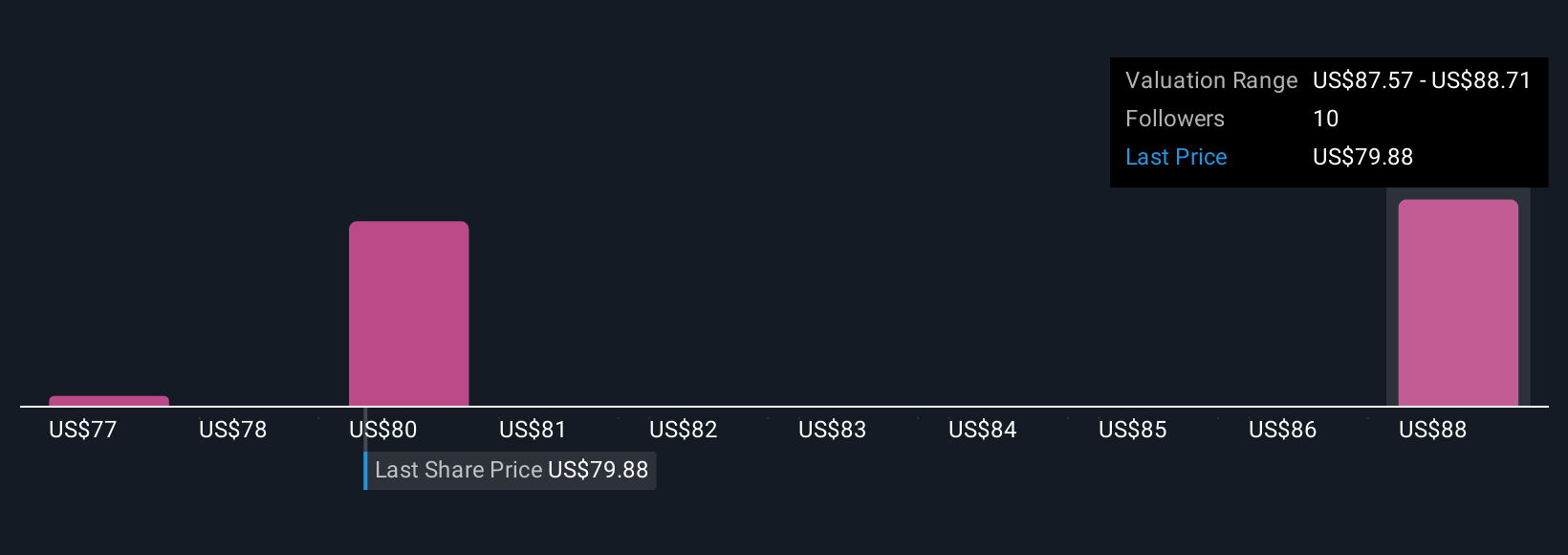

A Narrative is your investment story about a company, built around your specific expectations for its future revenue, earnings, margins, and ultimately, its fair value. Rather than relying solely on generic analyst targets or rigid valuation models, Narratives allow you to connect the company’s real story, what you believe drives its prospects, to numbers and a fair value that reflect your view. This approach links your personal outlook to actual financial forecasts, helping you see and justify your own version of value.

Narratives are easy to create and post on Simply Wall St's Community page, where millions of investors contribute their perspectives and scenarios. They help you decide whether to buy or sell by comparing your Fair Value to the current Price. Plus, as soon as earnings or news updates come in, Narratives auto-update so you always stay aligned with the latest information.

For example, one Donaldson Company Narrative uses rapid growth in filtration demand to project a fair value of $80 per share. Another, more cautious narrative emphasizes risks from legacy product reliance and sees fair value much lower, showing how the "right" price can depend on your unique viewpoint.

Do you think there's more to the story for Donaldson Company? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DCI

Donaldson Company

Manufactures and sells filtration systems and replacement parts worldwide.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives