- United States

- /

- Building

- /

- NYSE:CSW

Does CSW Industrials’ (CSW) Strong Quarter Signal Enduring Resilience Amid HVACR Market Pressures?

Reviewed by Sasha Jovanovic

- CSW Industrials reported higher sales and net income for the second quarter and first half of fiscal 2025, with quarterly revenue reaching US$276.95 million and net income totaling US$40.66 million, both up from last year.

- Despite disruptions in the U.S. residential HVACR market, the company continued its share buyback program and received mixed but shifting analyst sentiment, with recognition for recent earnings growth and upward estimate revisions.

- We will explore how CSW Industrials' strong quarterly earnings in the face of end-market challenges may impact its investment narrative.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

CSW Industrials Investment Narrative Recap

Shareholders in CSW Industrials typically believe the company can harness regulatory and infrastructure trends to drive steady earnings, supported by a diversified specialty building products portfolio and ongoing acquisitions. The latest quarterly earnings growth, despite residential HVACR headwinds, offers reassurance to those focused on operational resilience, but the underlying organic revenue decline remains the biggest risk, especially if acquisition momentum falters. Recent results do little to materially shift this short-term risk profile, but near-term catalysts stay intact for now.

One of the most relevant recent announcements is the company’s continued share buyback program, which saw 72,911 shares repurchased for US$18.32 million in the last quarter. While buybacks can signal confidence in long-term prospects and potentially support per-share metrics, their impact may be overshadowed if persistent organic revenue weakness continues to challenge topline growth, particularly in the core Contractor Solutions business.

In contrast, investors should also be aware of how organic revenue declines beneath positive headline numbers could indicate deeper end-market softness if...

Read the full narrative on CSW Industrials (it's free!)

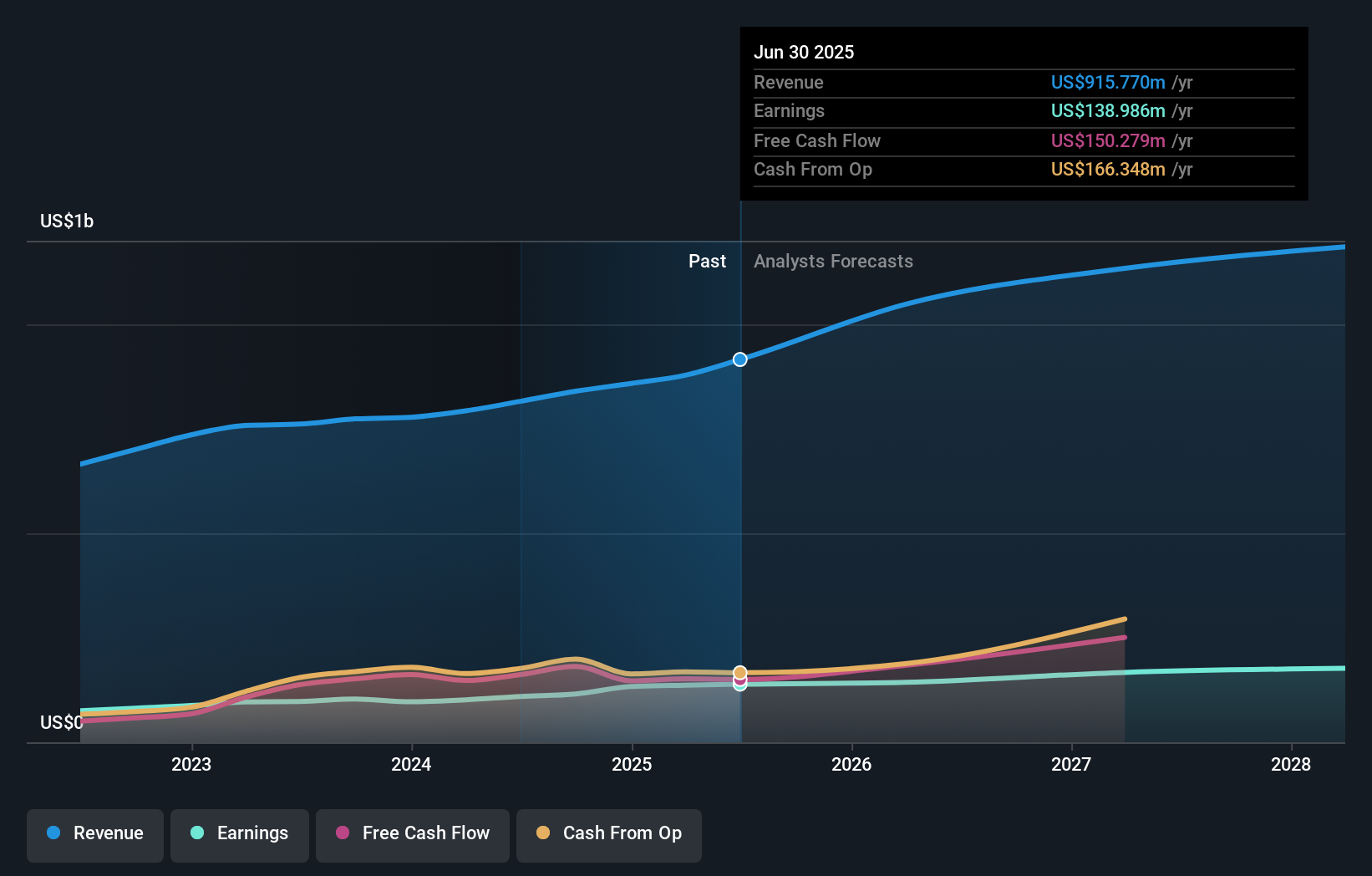

CSW Industrials' narrative projects $1.3 billion revenue and $186.5 million earnings by 2028. This requires 11.0% yearly revenue growth and a $47.5 million earnings increase from $139.0 million.

Uncover how CSW Industrials' forecasts yield a $287.83 fair value, a 18% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members offered three distinct fair value estimates for CSW Industrials, ranging from US$215 to US$287.83 per share. Given recent earnings data alongside concerns about organic revenue contraction, you may want to consider differing viewpoints on CSW's future performance, as opinions vary widely.

Explore 3 other fair value estimates on CSW Industrials - why the stock might be worth 12% less than the current price!

Build Your Own CSW Industrials Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CSW Industrials research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free CSW Industrials research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CSW Industrials' overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CSW

CSW Industrials

Provides various industrial products in the United States and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives