- United States

- /

- Building

- /

- NYSE:CSW

CSW Industrials (CSWI): Evaluating Valuation After Earnings Beat and Lowered Growth Outlook

Reviewed by Simply Wall St

CSW Industrials (CSW) just posted higher quarterly revenue and net profit compared to last year, signaling solid performance. However, analysts pointed out a drop in organic revenue because of headwinds in the U.S. residential HVACR segment.

See our latest analysis for CSW Industrials.

Despite recent earnings growth and an accelerating buyback program, CSW Industrials' share price has yet to rebound. After a jump this week, it is still down nearly 29% year-to-date. Meanwhile, the 1-year total shareholder return sits at -40%, underscoring how sentiment has shifted even with long-term holders still having enjoyed impressive gains of 115% and 124% over the past three and five years. Momentum appears to be stabilizing after a tough stretch, as the latest uptick hints at renewed investor interest following the company's results and strategic initiatives.

If you're curious what other companies with strong leadership are up to, now's an interesting moment to broaden your perspective and discover fast growing stocks with high insider ownership

With strong headline numbers but wavering analyst confidence, investors are left to wonder if CSW Industrials is trading at a bargain following this year’s drop, or if the current price accurately reflects future challenges and growth potential.

Most Popular Narrative: 11.9% Undervalued

CSW Industrials' most widely followed valuation puts its fair value notably above yesterday’s close, hinting at significant upside according to the narrative. This sets up an intriguing debate about what is driving analysts' higher expectations against a backdrop of volatile market sentiment and recent share buybacks.

Operational efficiencies and labor-saving innovations are driving margin improvement, pricing power, and long-term organic and inorganic growth.

What bold financial forecast underpins this optimistic price? There is a pivotal assumption in play, one that leans on future margins and sustained growth. Curious how sharply forward estimates differ from market trends? The answer lies in the full breakdown behind this fair value.

Result: Fair Value of $283.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent margin pressures from recent acquisitions and a slowdown in organic growth could quickly challenge even the most bullish forecasts for CSW Industrials.

Find out about the key risks to this CSW Industrials narrative.

Another View: What Do the Numbers Say?

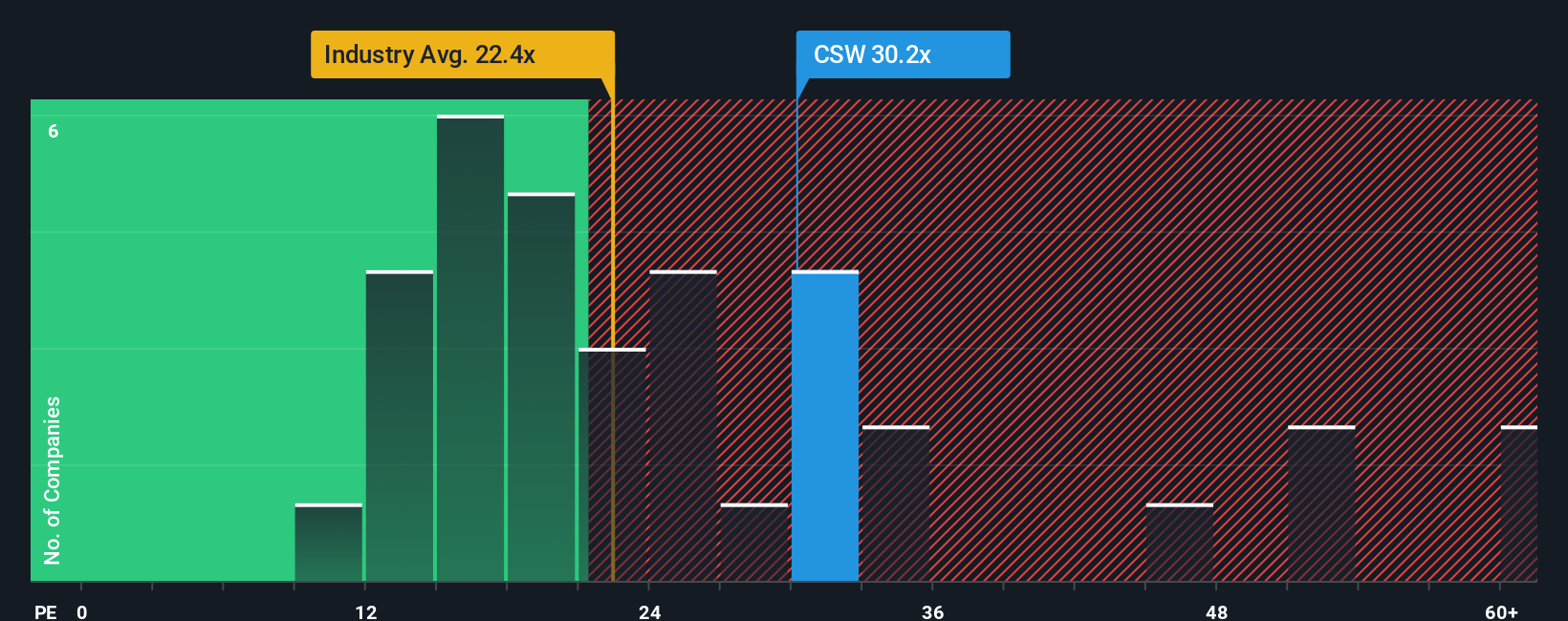

While the fair value narrative suggests CSW Industrials is undervalued, a look at its price-to-earnings ratio tells a different story. CSW trades at 29x earnings, which is well above both the industry average of 19.1x and the peer average of 23.3x. Even compared to its fair ratio of 25.1x, the stock appears expensive. Could this premium signal strong future growth, or is the market already pricing in too much?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CSW Industrials Narrative

Keep in mind, if you want to dig deeper or think another story stands out, you can craft your own viewpoint in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding CSW Industrials.

Looking for Fresh Investment Opportunities?

Smart investors know the real edge comes from staying one step ahead. Don’t let these standout investment ideas pass you by. Expand your portfolio with handpicked stocks built for the next wave of growth.

- Unlock the potential of market underdogs by uncovering these 3564 penny stocks with strong financials showing positive momentum and strong fundamentals that are unlikely to stay under the radar much longer.

- Capture powerful dividend streams when you assess these 15 dividend stocks with yields > 3%, which deliver attractive yields for those seeking reliable income alongside growth.

- Jump on groundbreaking innovations in healthcare with these 32 healthcare AI stocks, spotlighting companies transforming patient care and diagnostics through artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CSW

CSW Industrials

Provides various industrial products in the United States and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives