- United States

- /

- Machinery

- /

- NYSE:CR

Crane (CR): Valuation Perspectives Following Strong Q3 Earnings and Positive Analyst Sentiment

Reviewed by Simply Wall St

Crane (CR) just reported its third quarter earnings, revealing stronger sales and profit growth compared to last year. Alongside steady analyst sentiment, the company’s performance this quarter is attracting attention from investors.

See our latest analysis for Crane.

After a robust earnings report and solid dividend announcement, Crane's momentum has been on investors’ radar. The stock’s 1-month share price return was a healthy 8%, reflecting growing confidence, while its 1-year total shareholder return of just over 8% and a remarkable 3-year total return above 187% point to substantial long-term value creation. The impressive price move this past month hints at renewed optimism, even though some insider selling has been observed lately.

If this surge in Crane’s performance has you curious about where else steady growth and leadership matter, it could be the right moment to broaden your search and discover fast growing stocks with high insider ownership.

After such a strong recent run and continued analyst support, is there still upside potential for Crane, or is the market already looking ahead and fully pricing in future growth?

Most Popular Narrative: 10.6% Undervalued

With Crane’s last close price well below the most widely followed narrative’s fair value, this view sees notable upside still ahead. The valuation hinges on sector tailwinds and expectations for sustained financial gains.

Crane's recent acquisition of PSI (Druck, Panametrics, Reuter-Stokes) positions the company to capture rising demand for advanced sensing and fluid control in both aerospace and process industries. This directly benefits from infrastructure modernization and growing automation, supporting sustained revenue and future margin expansion.

Want to know the bold drivers behind this call? This narrative is built on growth signals, new market frontiers, and expansion plans. The secret lies in a future profit mix and upward earnings assumptions you’ll want to see for yourself.

Result: Fair Value of $211.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, potential setbacks from weaker demand in Europe or integration risks with recent acquisitions could quickly challenge this optimistic growth story.

Find out about the key risks to this Crane narrative.

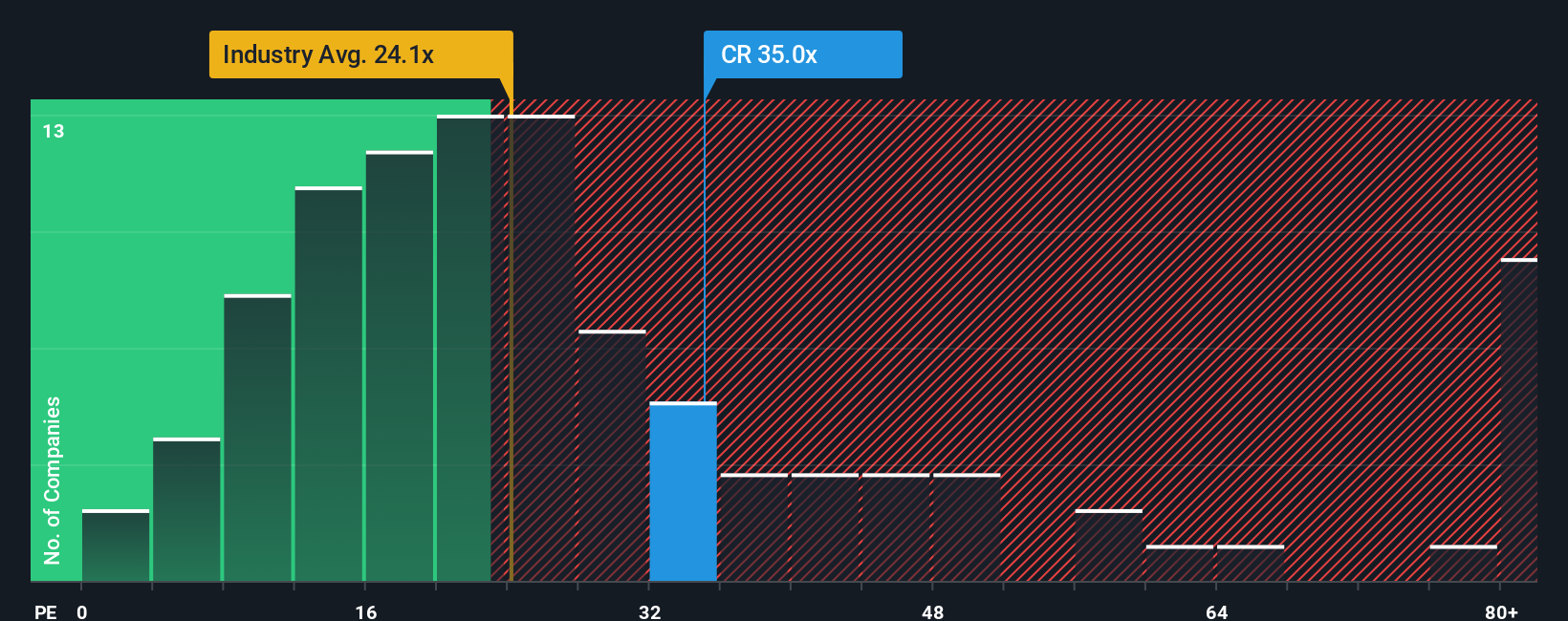

Another View: High Price Relative to Industry

Looking at Crane's valuation through its price-to-earnings ratio, the story shifts. The company is trading at 34.1 times earnings, which is far above both its industry peers at 24.1x and also above the fair ratio of 25.8x. This rich valuation could expose investors to downside risk if expectations prove too optimistic. Is this premium justified, or is the stock getting ahead of itself?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Crane Narrative

If you have your own perspective or want to dig into the numbers firsthand, it’s quick and easy to craft your own view of Crane. Do it your way.

A great starting point for your Crane research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Stop waiting for the next opportunity to knock. Simply Wall Street’s unique screeners make it easy to target stocks that fit your strategy, so you never miss a chance to invest smarter.

- Capture unstoppable income streams by reviewing these 16 dividend stocks with yields > 3% offering yields above 3% from established market winners.

- Ride the wave of technological disruption by researching these 25 AI penny stocks at the forefront of artificial intelligence innovation and smart automation.

- Target value with confidence and uncover these 874 undervalued stocks based on cash flows that trade below their intrinsic worth, putting the odds in your favor.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CR

Crane

Manufactures and sells engineered industrial products in the United States, Canada, the United Kingdom, Continental Europe, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives