- United States

- /

- Trade Distributors

- /

- NYSE:BXC

BlueLinx Holdings Inc.'s (NYSE:BXC) 27% Share Price Plunge Could Signal Some Risk

Unfortunately for some shareholders, the BlueLinx Holdings Inc. (NYSE:BXC) share price has dived 27% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 57% loss during that time.

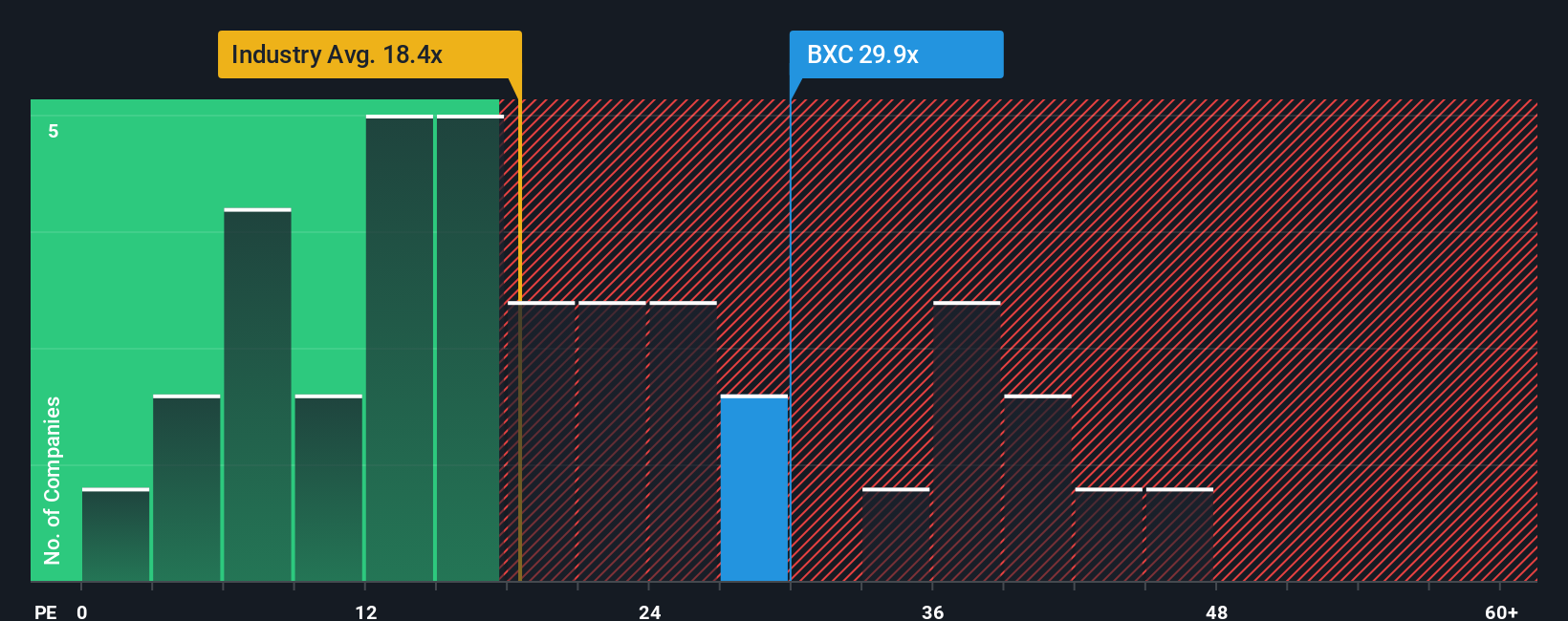

In spite of the heavy fall in price, given close to half the companies in the United States have price-to-earnings ratios (or "P/E's") below 17x, you may still consider BlueLinx Holdings as a stock to avoid entirely with its 29.9x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

While the market has experienced earnings growth lately, BlueLinx Holdings' earnings have gone into reverse gear, which is not great. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

View our latest analysis for BlueLinx Holdings

Is There Enough Growth For BlueLinx Holdings?

In order to justify its P/E ratio, BlueLinx Holdings would need to produce outstanding growth well in excess of the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 49%. The last three years don't look nice either as the company has shrunk EPS by 95% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Turning to the outlook, the next year should bring diminished returns, with earnings decreasing 73% as estimated by the four analysts watching the company. Meanwhile, the broader market is forecast to expand by 16%, which paints a poor picture.

In light of this, it's alarming that BlueLinx Holdings' P/E sits above the majority of other companies. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as these declining earnings are likely to weigh heavily on the share price eventually.

The Key Takeaway

A significant share price dive has done very little to deflate BlueLinx Holdings' very lofty P/E. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that BlueLinx Holdings currently trades on a much higher than expected P/E for a company whose earnings are forecast to decline. When we see a poor outlook with earnings heading backwards, we suspect the share price is at risk of declining, sending the high P/E lower. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with BlueLinx Holdings, and understanding them should be part of your investment process.

If these risks are making you reconsider your opinion on BlueLinx Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if BlueLinx Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:BXC

BlueLinx Holdings

Engages in the distribution of residential and commercial building products in the United States.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives