- United States

- /

- Building

- /

- NYSE:BLDR

Will Builders FirstSource (BLDR) Prioritize Acquisitions or Shareholder Returns for Long-Term Value Creation?

Reviewed by Sasha Jovanovic

- On October 30, 2025, Builders FirstSource announced third-quarter results that exceeded analyst expectations, reaffirmed its full-year sales outlook of US$15.1 billion to US$15.4 billion, and signaled ongoing interest in acquisitions to support future growth.

- An important detail from the announcement is the CEO’s emphasis on using strong free cash flow to invest in value-added offerings, organic expansion, and shareholder returns, highlighting the company’s focus on long-term value creation.

- We’ll assess how Builders FirstSource’s strong earnings and continued acquisition strategy influence its investment narrative amid changing market conditions.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

Builders FirstSource Investment Narrative Recap

To be a shareholder in Builders FirstSource, you need confidence in the company's ability to deliver growth through industry cycles by expanding its value-added solutions and successfully acquiring and integrating new businesses. The latest results reinforce this long-term vision, but the short-term catalyst of improved housing demand remains largely unchanged as revenue and profit weakened year-over-year; the biggest risk continues to be prolonged softness and volatility in single-family housing starts, which was not materially altered by this quarter's news.

Among the recent announcements, the reaffirmation of full-year sales guidance between US$15.1 billion and US$15.4 billion stands out. This steady outlook suggests management remains constructive about the company’s near-term prospects, even as broader demand and margin pressures persist, and links directly to the importance of stability amid ongoing market uncertainty.

Yet in sharp contrast, ongoing unpredictability in single-family housing starts could still affect the company’s growth prospects and represents an area investors need to watch closely as...

Read the full narrative on Builders FirstSource (it's free!)

Builders FirstSource's outlook anticipates $16.4 billion in revenue and $684.5 million in earnings by 2028. This scenario implies a -0.9% annual revenue decline and a $71.9 million decrease in earnings from the current $756.4 million level.

Uncover how Builders FirstSource's forecasts yield a $139.02 fair value, a 20% upside to its current price.

Exploring Other Perspectives

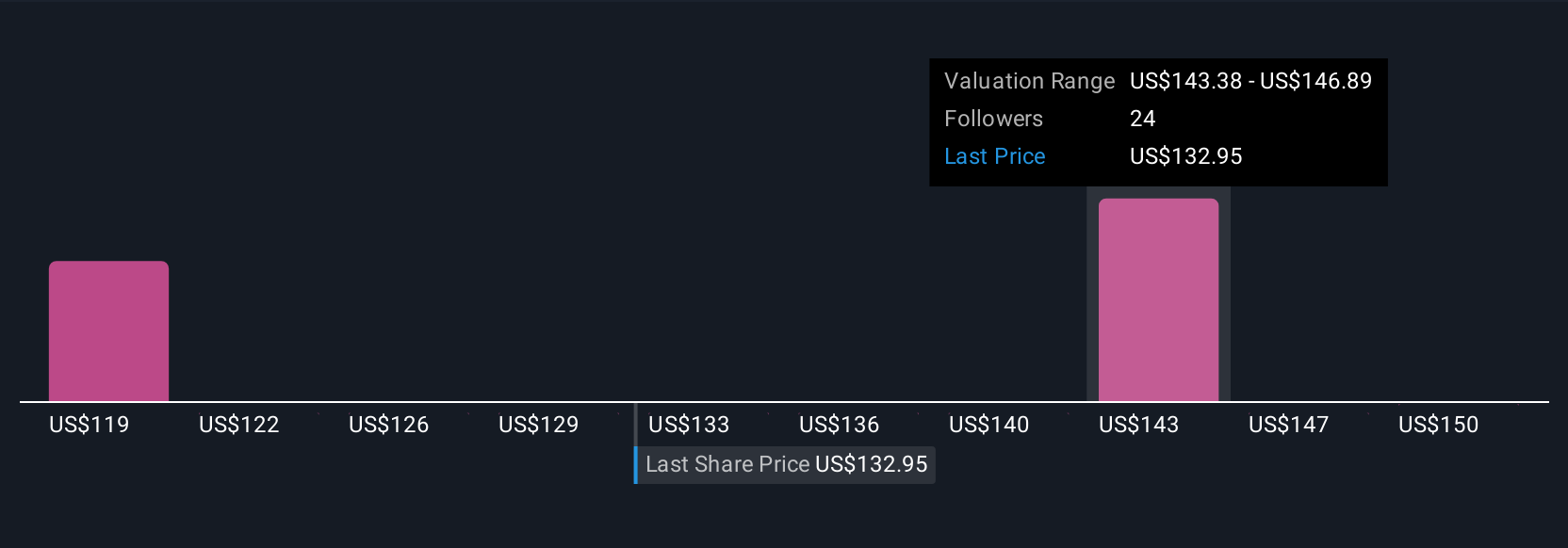

The Simply Wall St Community has submitted two fair value estimates for Builders FirstSource ranging from US$125.93 to US$139.02 per share. While views among these individual investors vary, many continue to weigh the potential for higher-margin growth from expanded products and digital investments as a key driver for longer-term performance.

Explore 2 other fair value estimates on Builders FirstSource - why the stock might be worth as much as 20% more than the current price!

Build Your Own Builders FirstSource Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Builders FirstSource research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Builders FirstSource research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Builders FirstSource's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Builders FirstSource might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BLDR

Builders FirstSource

Manufactures and supplies building materials, manufactured components, and construction services to professional homebuilders, sub-contractors, remodelers, and consumers in the United States.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives