- United States

- /

- Building

- /

- NYSE:BLDR

Builders FirstSource (BLDR): Margin Decline Challenges Bullish Growth Narrative Despite Attractive Valuation

Reviewed by Simply Wall St

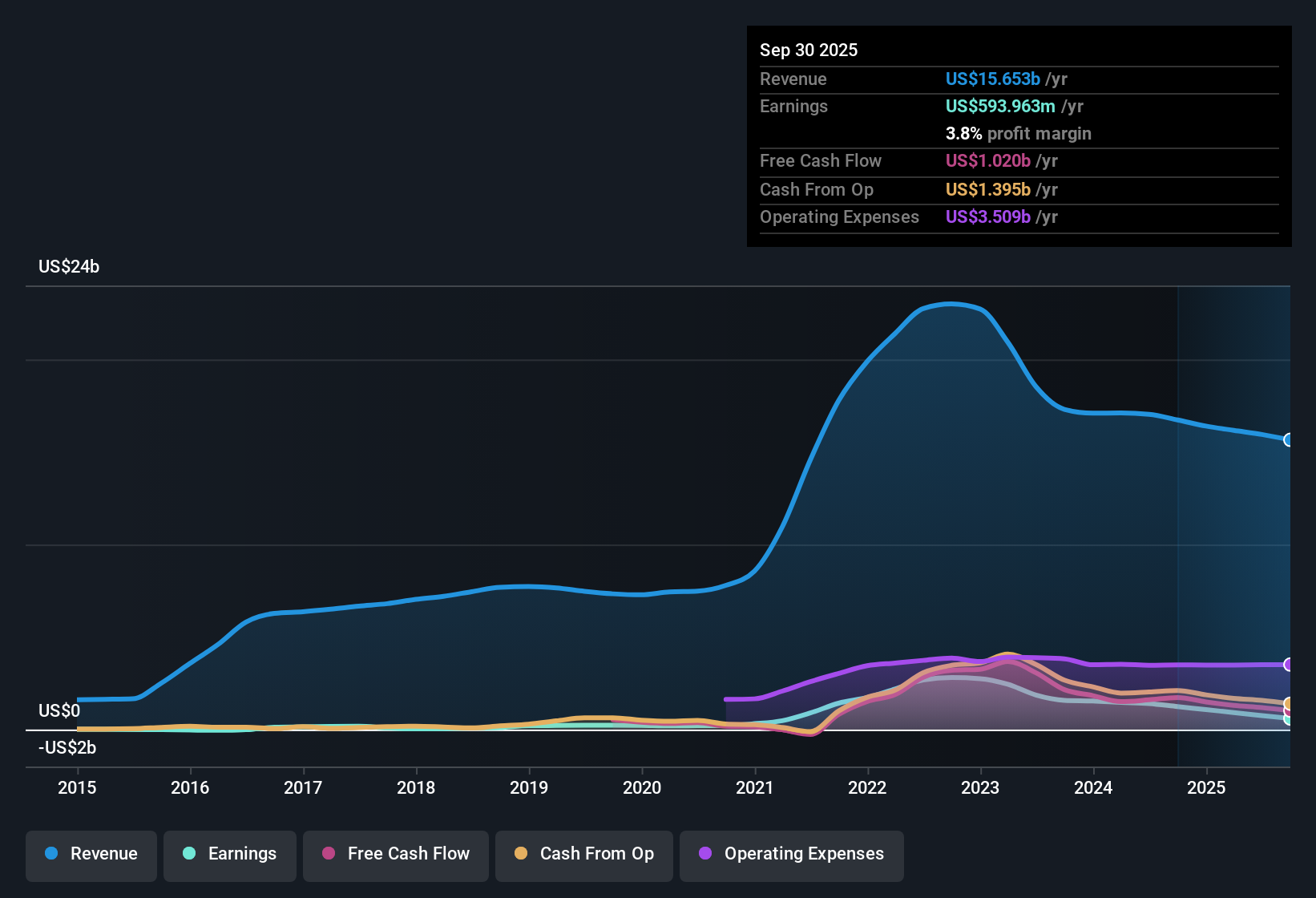

Builders FirstSource (BLDR) reported a net profit margin of 4.7%, down from 8.2% last year, reflecting negative earnings growth over the last twelve months. That said, the company’s earnings have grown by 3.7% per year on average over the past five years. Looking ahead, earnings are forecast to accelerate at a 23.7% annual pace, outpacing the broader US market. Although the company’s revenues are expected to rise only 3.1% per year, which trails the anticipated 10.3% market growth, its forward valuation looks compelling, with shares trading at a price-to-earnings ratio below peer and industry averages. Margins may be pressured for now, but investors are weighing these results against the substantial earnings growth projected in the years ahead.

See our full analysis for Builders FirstSource.With that backdrop, we are about to explore how these latest numbers measure up to the most prominent bull and bear narratives. Some long-held views may get a reality check, while others could be reinforced by the fresh data.

See what the community is saying about Builders FirstSource

Forecasts Diverge Despite Strong Past Growth

- Analysts expect Builders FirstSource’s earnings to drop from $756.4 million to $684.5 million by September 2028. This comes even though the company averaged 3.7% annual earnings growth over the last five years and is now forecasted for a 23.7% annual pace moving forward.

- Analysts’ consensus view highlights a sharp contrast between robust growth investments and a cautious outlook, noting:

- Despite heavy spending on digital transformation and automation to drive margins and efficiency, the near-term analyst outlook factors in revenue shrinking by 0.9% annually and profit margins slipping from 4.7% to 4.2%.

- This tension reflects skepticism around how quickly these initiatives will convert to earnings. A segment of analysts still project earnings to fall well below today’s level, while the most bullish believe profits could top $1.1 billion by 2028.

- The low analyst consensus price target of 137.21 sits just above the current share price of $111.69. This reinforces the sense that these estimates are already baked in for many investors. See what the community debate says about Builders FirstSource’s future in the full Consensus Narrative. 📊 Read the full Builders FirstSource Consensus Narrative.

Profit Margins Under Pressure Amid Industry Risks

- Profit margins are forecast to slip from 4.7% today to 4.2% within three years, with multi-family demand and commodity price swings cited as material pressures.

- Analysts’ consensus view flags:

- Weaker housing starts, volatile pricing for OSB and lumber, and slow adoption of digital solutions could all weigh on near-term operating margins. This is compounded by muted multi-family construction and persistent debt exposure.

- Analysts note that although the company has expanded its digital capabilities and product mix, prolonged housing market weakness and high leverage leave the business vulnerable to cyclical downturns and tightening financial conditions.

Attractive Valuation Versus Industry Averages

- Shares currently trade at a Price-To-Earnings ratio of 16.3x, below both the industry average of 19.1x and peer average of 20.4x. This pricing stands out against sector norms.

- Analysts’ consensus view underscores a nuanced outlook:

- Builders FirstSource’s valuation reflects both optimism about future margin expansion from digital initiatives and caution about whether forecasted profit growth will emerge as expected.

- With the current share price at $111.69 and the analyst price target at 137.21, the market seems to view the stock as fairly priced, absorbing both the upside from growth investments and the downside risks posed by the sector’s headwinds.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Builders FirstSource on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Want to interpret the data another way? Share your unique perspective and shape your own narrative in just a few minutes. Do it your way

A great starting point for your Builders FirstSource research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Builders FirstSource faces pressure from falling profit margins and cyclical risks that are amplified by its persistent debt and exposure to tough market conditions.

If you want to put financial strength first, solid balance sheet and fundamentals stocks screener ( results) helps you uncover companies with lower debt profiles and better balance sheets that are designed to weather economic ups and downs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Builders FirstSource might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BLDR

Builders FirstSource

Manufactures and supplies building materials, manufactured components, and construction services to professional homebuilders, sub-contractors, remodelers, and consumers in the United States.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives