- United States

- /

- Electrical

- /

- NYSE:BE

Did Bloom Energy’s (BE) $2.2 Billion Convertible Bond Issuance Just Shift Its Investment Narrative?

Reviewed by Sasha Jovanovic

- In recent days, Bloom Energy completed a significant upsized fixed-income offering, issuing US$2.2 billion in zero-coupon convertible senior unsecured notes due 2030 to fund business initiatives and optimize its capital structure.

- This major capital raise comes on the heels of strong quarterly earnings and highlights Bloom's accelerating demand from hyperscale data centers and its growing industry influence.

- We'll explore how Bloom's successful bond issuance and capital restructuring could influence its investment narrative and long-term growth outlook.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Bloom Energy Investment Narrative Recap

To own Bloom Energy stock, you need a conviction in its ability to lead in powering data centers through fuel cell technology, amid rapid AI and cloud adoption. The recent upsized US$2.2 billion convertible note offering strengthens Bloom's balance sheet but doesn’t materially alter the core catalyst: hyperscaler demand for grid-independent solutions. The primary risk remains intense competition from zero-emissions alternatives, which could undermine the company's long-term differentiation and pricing power.

Among recent announcements, the $5 billion AI infrastructure partnership with Brookfield stands out, underscoring Bloom’s focus on data center opportunities, the most important driver for revenue growth today. This deal aligns with the short-term narrative around surging mission-critical demand, supporting optimism in Bloom's future earnings potential. Yet, linking such high-profile collaborations to sustained customer adoption remains a key uncertainty for shareholders watching near-term project execution.

By contrast, investors should be aware that rapid capacity expansion could leave Bloom exposed if data center demand fails to materialize as forecasted...

Read the full narrative on Bloom Energy (it's free!)

Bloom Energy's outlook calls for $2.7 billion in revenue and $395.4 million in earnings by 2028. This scenario relies on a 19.0% annual revenue growth rate and an increase in earnings of about $371.7 million from the current $23.7 million.

Uncover how Bloom Energy's forecasts yield a $104.29 fair value, a 23% downside to its current price.

Exploring Other Perspectives

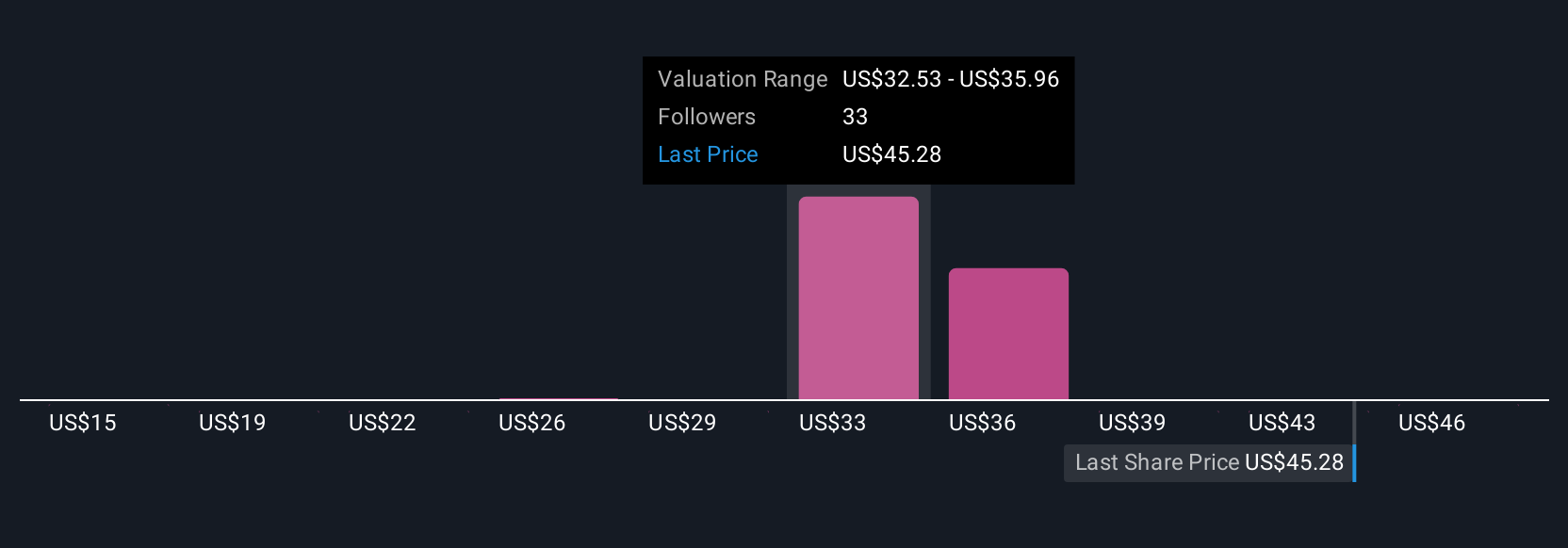

Nine members of the Simply Wall St Community value Bloom Energy between US$15 and US$230 per share. While data center catalysts are fueling enthusiasm, sharp valuation multiples reflect how much future execution matters to your outlook.

Explore 9 other fair value estimates on Bloom Energy - why the stock might be worth as much as 70% more than the current price!

Build Your Own Bloom Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bloom Energy research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Bloom Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bloom Energy's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bloom Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BE

Bloom Energy

Designs, manufactures, sells, and installs solid-oxide fuel cell systems for on-site power generation in the United States and internationally.

Exceptional growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives