- United States

- /

- Electrical

- /

- NYSE:BE

Bloom Energy (BE): Assessing Valuation After a 60% Share Price Surge

Reviewed by Simply Wall St

Bloom Energy (BE) shares have rallied 60% over the past month, catching the attention of investors interested in the clean energy space. The company’s recent performance points to renewed optimism about its fuel cell technology and future prospects.

See our latest analysis for Bloom Energy.

This surge follows months of broader gains, with Bloom Energy’s 1-year total shareholder return sitting at an impressive 922%. Clearly, momentum has been building as investors warm to the company’s growth outlook and clean technology focus. This is underscored by its recent share price rally.

If you’re interested in spotting more dynamic moves like this, it’s a great moment to broaden your search and discover fast growing stocks with high insider ownership

With such remarkable gains in recent months, the key question is whether Bloom Energy's impressive run leaves room for further upside or if the current share price already reflects optimism about its future growth. Could there still be a buying opportunity here?

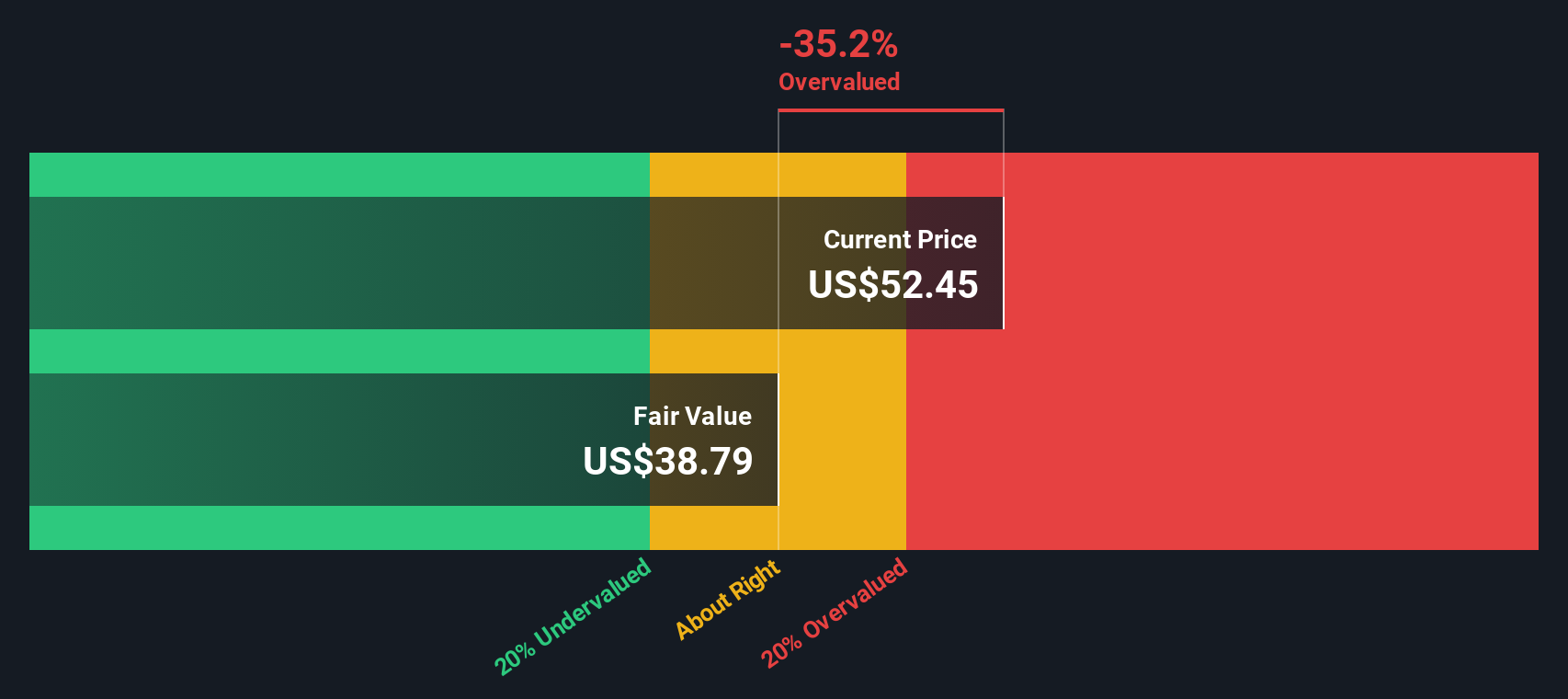

Most Popular Narrative: 33.5% Overvalued

Bloom Energy’s widely followed valuation narrative sets the company’s fair value at $104.29, which is materially below the last close of $139.23. This difference hints at elevated expectations and places the share price well above the consensus fair value.

Ongoing product cost reductions and digital twin enabled operational improvements, fueled by AI driven analytics from a large installed base, are lowering cost per watt and raising manufacturing efficiency. These factors are poised to drive continued operating margin and net margin expansion.

Want to know the secret recipe behind this lofty price? The most popular narrative relies on rapid margin expansion and something even more bullish that only a deep dive will reveal. Could these bold projections really support today’s premium? Click through if you want to uncover the shock factor that could move the market.

Result: Fair Value of $104.29 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, surging advances in battery storage and Bloom's ongoing reliance on natural gas could both threaten the company's competitive edge and future growth prospects.

Find out about the key risks to this Bloom Energy narrative.

Another View: Is the DCF Model Telling a Different Story?

While the most-watched valuation suggests Bloom Energy is overvalued, our SWS DCF model offers a different take. According to this model, Bloom Energy trades about 5% below its fair value estimate, suggesting the market may not be pricing in all of the company’s long-term growth potential. Which perspective is closer to the truth? Does opportunity still exist here, or is caution warranted?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Bloom Energy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 872 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Bloom Energy Narrative

If you think there’s more to the story, or you’d rather dig into the numbers yourself, it only takes a few minutes to shape your own view. Do it your way

A great starting point for your Bloom Energy research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Smart Investing Ideas?

Seize your next opportunity by expanding your search beyond just Bloom Energy. These screens help pinpoint standout stocks so you never miss what’s next.

- Strengthen your portfolio with stocks that generate reliable income and gain an edge with these 16 dividend stocks with yields > 3% offering impressive yields surpassing 3%.

- Jump ahead of the market by checking out these 24 AI penny stocks featuring companies at the forefront of artificial intelligence innovation.

- Unearth potential bargains and sharpen your strategy using these 872 undervalued stocks based on cash flows driven by strong underlying cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bloom Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BE

Bloom Energy

Designs, manufactures, sells, and installs solid-oxide fuel cell systems for on-site power generation in the United States and internationally.

Exceptional growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives