- United States

- /

- Industrials

- /

- NYSE:BBUC

Brookfield Business (NYSE:BBUC) Is Due To Pay A Dividend Of $0.0625

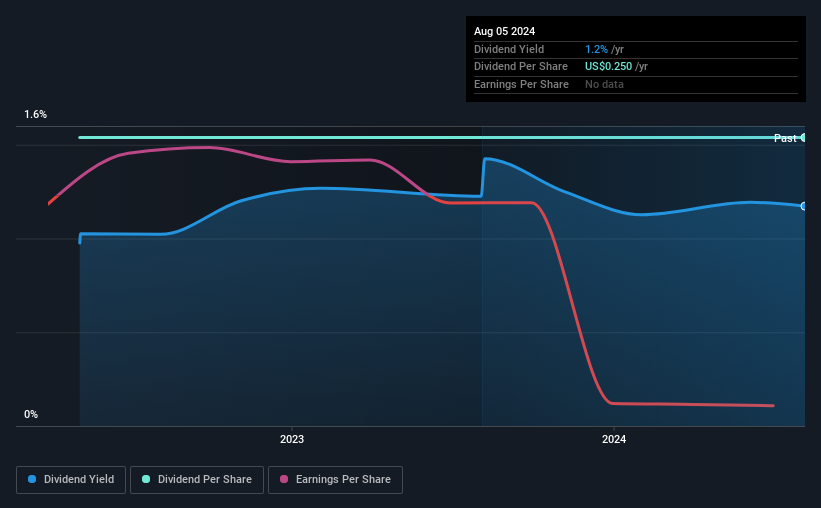

Brookfield Business Corporation's (NYSE:BBUC) investors are due to receive a payment of $0.0625 per share on 27th of September. This means the annual payment will be 1.2% of the current stock price, which is lower than the industry average.

Check out our latest analysis for Brookfield Business

Brookfield Business' Distributions May Be Difficult To Sustain

The dividend yield is a little bit low, but sustainability of the payments is also an important part of evaluating an income stock. Even in the absence of profits, Brookfield Business is paying a dividend. Along with this, it is also not generating free cash flows, which raises concerns about the sustainability of the dividend.

If nothing changes, EPS could fall just as dramatically this year as it has recently. This could force the company to make difficult decisions around continuing payouts to shareholders or putting additional pressure on the balance sheet.

Brookfield Business Is Still Building Its Track Record

The dividend has been pretty stable looking back, but the company hasn't been paying one for very long. This makes it tough to judge how it would fare through a full economic cycle. The most recent annual payment of $0.25 is about the same as the annual payment 2 years ago. Brookfield Business hasn't been paying a dividend for very long, so we wouldn't get to excited about its record of growth just yet.

The Dividend Has Limited Growth Potential

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. Let's not jump to conclusions as things might not be as good as they appear on the surface. Brookfield Business has seen EPS fall by 2,605% over the last 12 months. Reduced dividend payments are a common consequence of declining earnings. However, we would never make any decisions based on only a single year of data, especially when assessing long term dividend potential.

We're Not Big Fans Of Brookfield Business' Dividend

In summary, while it is good to see that the dividend hasn't been cut, we think that at current levels the payment isn't particularly sustainable. The company isn't making enough to be paying as much as it is, and the other factors don't look particularly promising either. Considering all of these factors, we wouldn't rely on this dividend if we wanted to live on the income.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. However, there are other things to consider for investors when analysing stock performance. For example, we've picked out 1 warning sign for Brookfield Business that investors should know about before committing capital to this stock. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Valuation is complex, but we're here to simplify it.

Discover if Brookfield Business might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BBUC

Brookfield Business

Owns and operates services and industrials operations in the United States, Australia, Brazil, the United Kingdom, and internationally.

Slightly overvalued with very low risk.

Similar Companies

Market Insights

Community Narratives