- United States

- /

- Industrials

- /

- NYSE:BBU

A Fresh Look at Brookfield Business Partners (NYSE:BBU) Valuation Following Recent Share Price Momentum

Reviewed by Simply Wall St

Brookfield Business Partners (NYSE:BBU) shares have been on the move recently. This has prompted investors to revisit the stock’s performance and underlying fundamentals. With a track record of pursuing global acquisitions, BBU often attracts attention when markets shift.

See our latest analysis for Brookfield Business Partners.

After surging nearly 46% year-to-date, Brookfield Business Partners has captured significant investor interest. The company’s recent rally, highlighted by a 26% share price return over the past 90 days, signals that buyers are attracted to both its global acquisition activity and renewed confidence in its long-term value. Even so, the one-year total shareholder return of 34% and a substantial 94% over three years underscore that momentum has largely held up, connecting short-term price gains and long-term wealth creation for shareholders.

If you’re scanning for other standout opportunities right now, it is a great moment to broaden your search and discover fast growing stocks with high insider ownership

With shares climbing and the stock trading just below its latest analyst price target, the question comes into focus: Is Brookfield Business Partners offering a bargain, or is the market already reflecting its future potential?

Price-to-Sales Ratio of 0.3x: Is it justified?

Brookfield Business Partners trades at a price-to-sales ratio of just 0.3x, meaning shares are priced well below the value typically assigned to similar companies in both its peer group and the wider industry. With the most recent close at $34.49, the current market price remains notably lower than what the sales multiple implies among comparable firms.

The price-to-sales ratio measures what investors are willing to pay per dollar of annual sales, and is especially relevant for businesses like BBU that may be investing for growth or showing volatile earnings. A lower ratio often signals the market is ignoring future growth or discounting profitability risk, especially in capital-intensive and acquisition-driven sectors such as industrials or infrastructure services.

Compared to its direct peers, which trade at an average price-to-sales ratio of 1.2x, BBU looks attractively valued. Taking a broader view, the global industrials industry landscape shows an average of 0.8x, still well above BBU’s current valuation. This gap suggests that investors might be overlooking potential upside in BBU’s business model or undervaluing the company's ability to translate acquisitions into future sales growth.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Sales of 0.3x (UNDERVALUED)

However, investors should remember that sustained negative net income and the lack of recent revenue growth could present challenges to the case for further upside.

Find out about the key risks to this Brookfield Business Partners narrative.

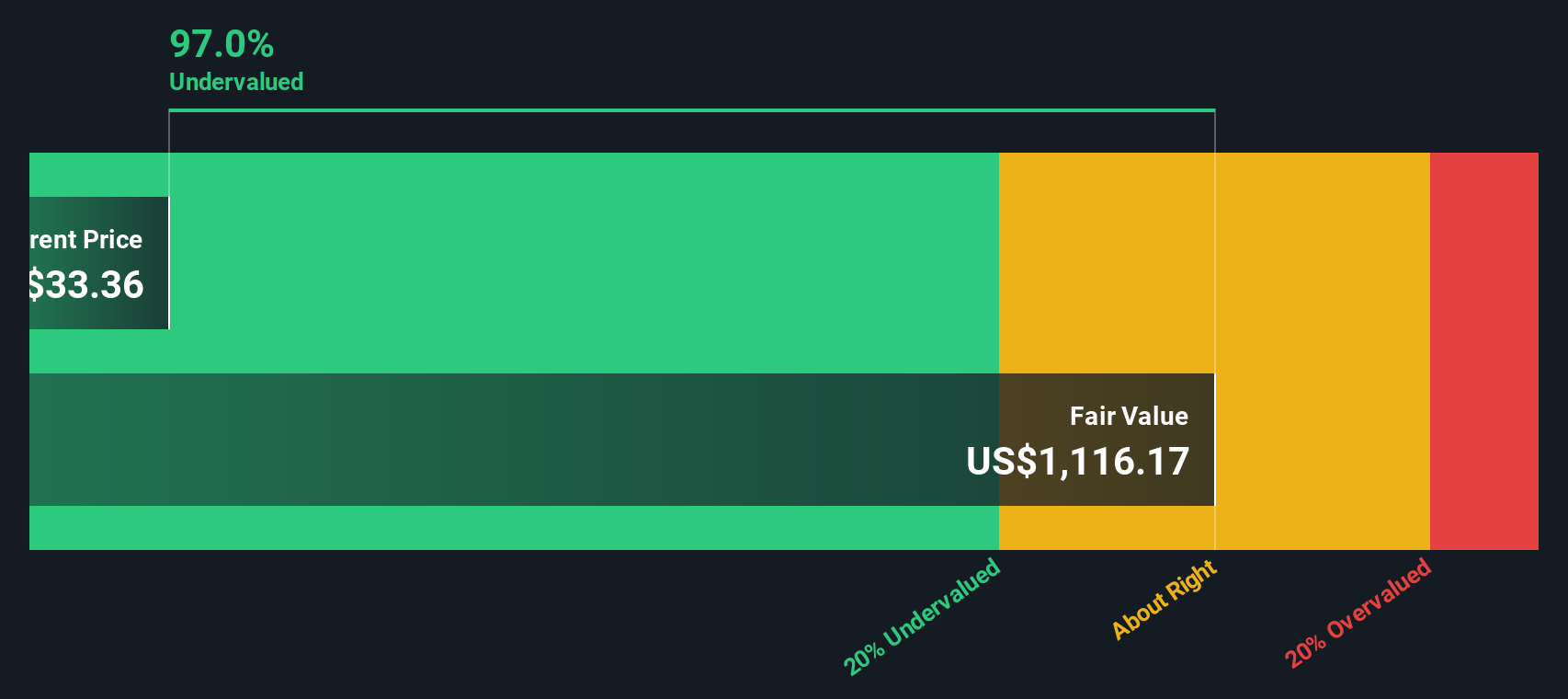

Another View: SWS DCF Model Shows Big Divergence

While the price-to-sales ratio makes Brookfield Business Partners seem attractively valued compared to peers, our DCF model gives a surprising result. The SWS DCF model estimates fair value at $891.75 per share, which is significantly above the current price of $34.49. Does this large gap reflect market caution or an overlooked opportunity in the stock?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Brookfield Business Partners for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 930 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Brookfield Business Partners Narrative

If you wish to chart your own perspective or prefer hands-on analysis, you can quickly assemble and personalize your own narrative in just a few minutes, and Do it your way.

A great starting point for your Brookfield Business Partners research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors always keep their radar up for the next great stock. Don’t miss the chance to spot untapped opportunities. These handpicked ideas could be what your portfolio needs right now.

- Boost your prospects with these 14 dividend stocks with yields > 3% offering attractive yields exceeding 3% and the potential for steady income in any market climate.

- Stay ahead of market trends by checking out these 25 AI penny stocks fueling innovation across artificial intelligence and setting the pace for future growth.

- Target hidden gems with these 930 undervalued stocks based on cash flows that are trading well below their intrinsic value, giving you a head start toward strong returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brookfield Business Partners might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BBU

Brookfield Business Partners

A private equity firm specializing in growth capital, divestitures, and acquisitions.

Good value with worrying balance sheet.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026