- United States

- /

- Building

- /

- NYSE:AOS

How Will Cautious Guidance and Acquisition Focus Shape A. O. Smith’s (AOS) Growth Trajectory?

Reviewed by Sasha Jovanovic

- A. O. Smith Corporation recently reported its third quarter 2025 financial results, updated its full-year earnings guidance with a more cautious outlook, announced continued share repurchases, and reaffirmed its active search for acquisitions aligned with its strategic goals.

- Management highlighted their strong balance sheet and ongoing capital allocation efforts, including buybacks and a focus on deals that could expand their core business or develop new growth platforms.

- We'll examine how management's emphasis on disciplined capital allocation and strategic acquisitions may reshape A. O. Smith's investment narrative and growth outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

A. O. Smith Investment Narrative Recap

To be a shareholder in A. O. Smith, you need confidence in the company's strategy to drive steady growth through disciplined capital allocation, product innovation, and long-term operational execution. The cautious full-year guidance and ongoing M&A search have not materially changed the biggest short-term catalyst, which remains the shift toward high-efficiency, smart products and margin expansion in North America. However, the largest present risk continues to be persistent weakness in China and global macro uncertainty, which challenge predictable earnings growth and segment margins.

Among recent announcements, the updated earnings guidance for 2025 stands out, bringing attention to management’s more cautious outlook. While it signals near-term headwinds such as competitive pressure in China, it also reinforces the company’s emphasis on cost discipline and product mix improvements, factors that remain central to margin expansion and future growth.

In contrast, it is important for investors to be aware of how China market volatility could still...

Read the full narrative on A. O. Smith (it's free!)

A. O. Smith's outlook anticipates $4.3 billion in revenue and $634.5 million in earnings by 2028. This implies a 4.6% annual revenue growth rate and a $115.9 million earnings increase from the current $518.6 million.

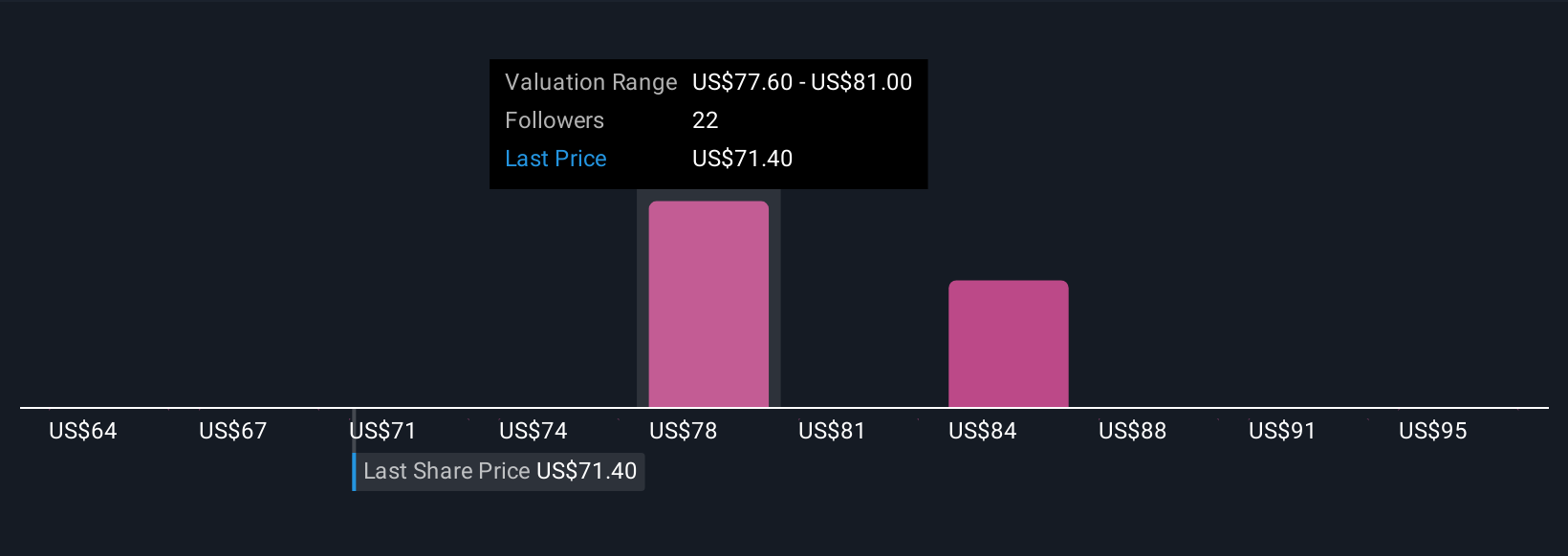

Uncover how A. O. Smith's forecasts yield a $78.18 fair value, a 18% upside to its current price.

Exploring Other Perspectives

Six members of the Simply Wall St Community put forward A. O. Smith fair values ranging from US$70 to over US$41,380. These opinions span far beyond consensus and invite you to consider how macro headwinds and North American market saturation might shape future performance.

Explore 6 other fair value estimates on A. O. Smith - why the stock might be a potential multi-bagger!

Build Your Own A. O. Smith Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your A. O. Smith research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free A. O. Smith research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate A. O. Smith's overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AOS

A. O. Smith

Manufactures and markets residential and commercial gas and electric water heaters, boilers, heat pumps, tanks, and water treatment products in North America, China, Europe, and India.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives