- United States

- /

- Construction

- /

- NYSE:AMRC

Why Ameresco (AMRC) Is Up 6.8% After Strong Q3 Earnings and New Data Center Deals

Reviewed by Sasha Jovanovic

- Ameresco recently presented at RENMAD Datacenters Italia 2025 and reported strong third-quarter 2025 earnings, reaffirming its full-year guidance and highlighting several new clean energy contracts, including an initiative with the City of Chandler.

- A key takeaway is that recurring revenue from energy assets and operations now exceeds 60% of EBITDA, supporting higher margins but also reflecting an increased reliance on leverage and capital spending.

- We'll now examine how Ameresco's strengthening contract pipeline, particularly in data centers, impacts its future investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Ameresco Investment Narrative Recap

To be a shareholder in Ameresco, you need to believe that rising utility rates, surging demand for energy efficiency, and supportive government incentives will drive the transition to clean, high-margin infrastructure, setting up recurring earnings from a robust pipeline of projects. While recent news of Ameresco’s strong Q3 earnings and contract wins supports near-term optimism, its ongoing dependence on capital-intensive development and high leverage remains the most important risk, especially in light of uncertain project financing costs. At this point, the news does not materially shift these key near-term considerations.

Among Ameresco’s recent contracts, the launch of a 50 MW battery storage system in Arizona directly supports the narrative that data center-related energy solutions are a catalyst for growth. This project illustrates how expanding partnerships in mission-critical sectors can elevate Ameresco's presence in high-value markets and potentially convert backlog into recurring, higher-margin revenue.

But amid these tailwinds, investors should also be aware of the company’s exposure to higher interest rates, which could significantly affect...

Read the full narrative on Ameresco (it's free!)

Ameresco's narrative projects $2.4 billion revenue and $87.4 million earnings by 2028. This requires 8.8% yearly revenue growth and a $25.4 million earnings increase from $62.0 million today.

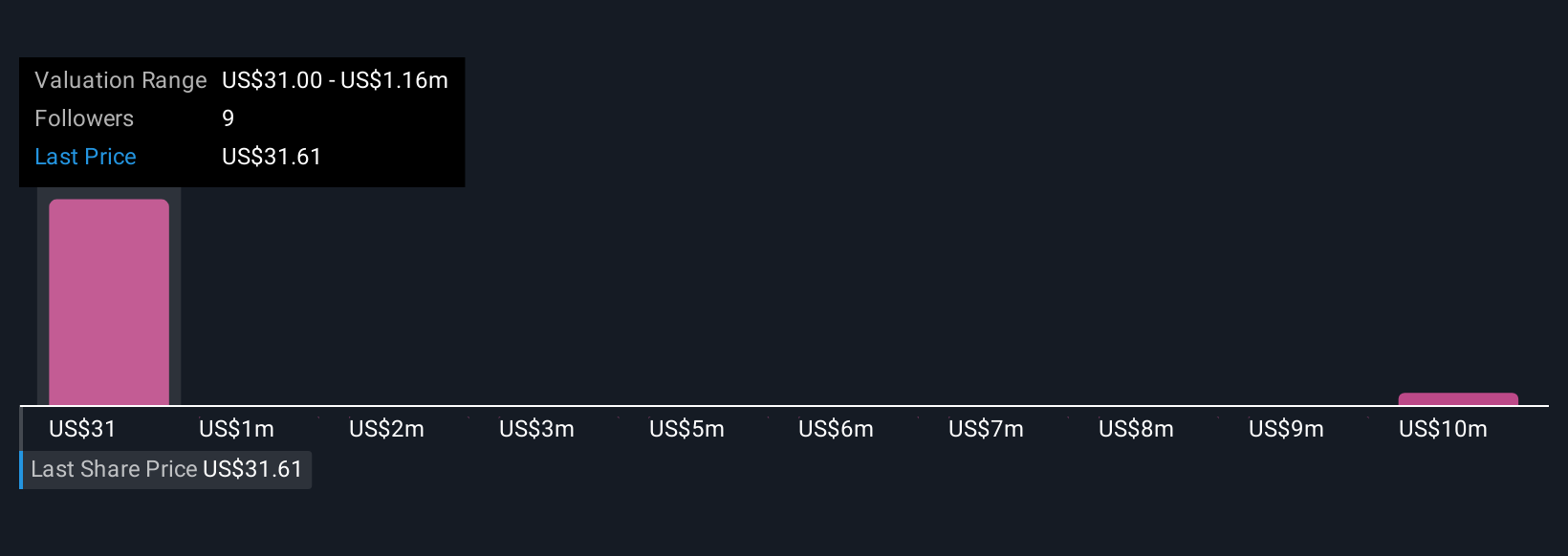

Uncover how Ameresco's forecasts yield a $41.22 fair value, a 24% upside to its current price.

Exploring Other Perspectives

Fair value estimates for Ameresco from the Simply Wall St Community span a wide US$36 to US$81.16 across three contributors. As recurring project and asset revenue builds, the potential impact of rising financing costs could shape how the story unfolds, so be sure to explore alternative views.

Explore 3 other fair value estimates on Ameresco - why the stock might be worth over 2x more than the current price!

Build Your Own Ameresco Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ameresco research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Ameresco research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ameresco's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMRC

Ameresco

Provides energy solutions in the United States, Canada, and Europe.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success