- United States

- /

- Construction

- /

- NYSE:AMRC

Could Ameresco's (AMRC) New Maryland EV Contract Hint at Deeper Competitive Strengths?

Reviewed by Sasha Jovanovic

- In late October 2025, The Resilience Authority of Annapolis and Anne Arundel County, Maryland announced a design-build contract with Ameresco, Inc. to install electric-vehicle charging infrastructure at 10 county-owned facilities following a competitive selection process.

- This project highlights Ameresco's capacity to deliver managed EV charging solutions that optimize utility savings, reduce electrical capacity needs, and offer scalable infrastructure for public sector fleet electrification.

- We'll examine how Ameresco's new public sector EV charging contract showcases its expertise in scalable, cost-saving energy infrastructure.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Ameresco Investment Narrative Recap

To be a shareholder in Ameresco, you’d want to believe in the long-term rise of public and private investment in energy infrastructure, driven by sustainability goals and public sector demand. The recent Maryland contract for EV charging infrastructure showcases Ameresco’s ability to secure competitive projects, but its impact on the immediate project backlog and the most pressing risk, persistent supply chain constraints for batteries and electrical equipment, does not appear to be material in the short term.

An especially relevant recent announcement is the $197 million Energy Savings Performance Contract (ESPC) with the U.S. Naval Research Laboratory in October, which, like the Maryland deal, highlights Ameresco’s strength in delivering complex, cost-saving solutions for major public sector clients, an area considered a core catalyst for future revenue and margin growth.

However, there’s a less visible risk that could reduce cash flow if supply chain volatility for key project inputs worsens...

Read the full narrative on Ameresco (it's free!)

Ameresco's outlook anticipates $2.4 billion in revenue and $87.4 million in earnings by 2028. This scenario assumes an annual revenue growth rate of 8.8% and an earnings increase of $25.4 million from the current $62.0 million.

Uncover how Ameresco's forecasts yield a $37.11 fair value, a 6% downside to its current price.

Exploring Other Perspectives

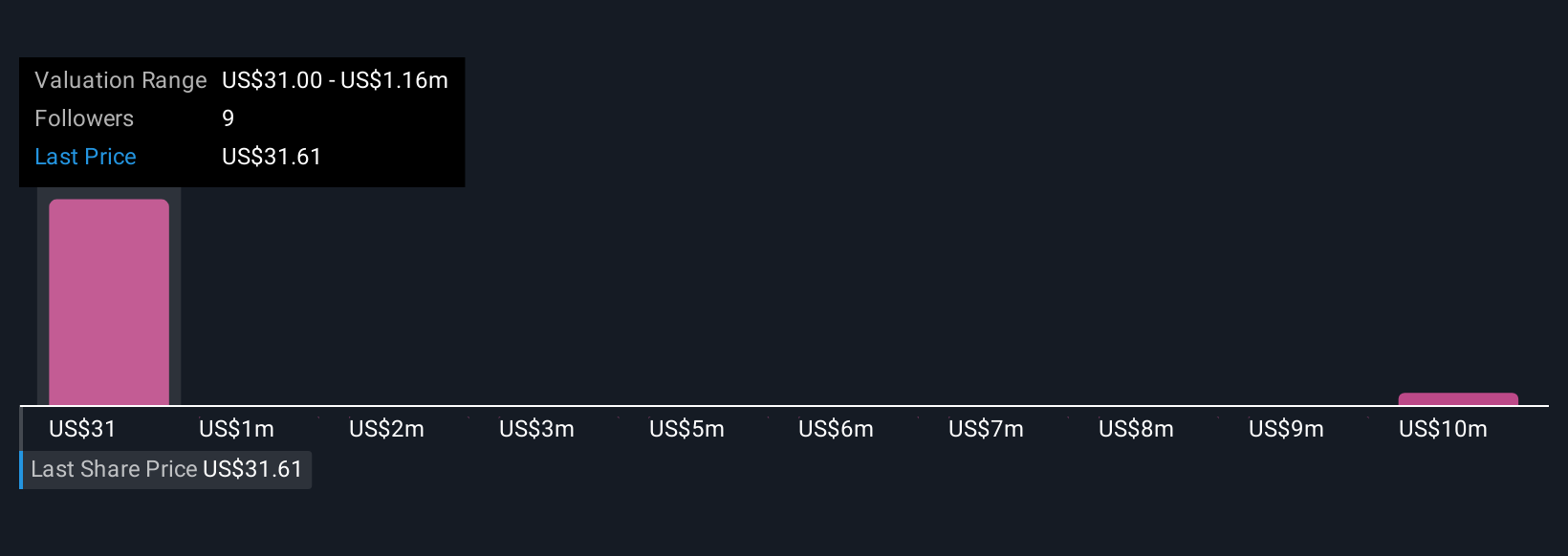

Simply Wall St Community members recently placed Ameresco’s fair value in a narrow US$36 to US$38.82 range across three different estimates. Yet with ongoing supply chain risks, you’ll find a wide variety of opinions about future profitability, review several perspectives to broaden your view.

Explore 3 other fair value estimates on Ameresco - why the stock might be worth 9% less than the current price!

Build Your Own Ameresco Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ameresco research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Ameresco research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ameresco's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMRC

Ameresco

Provides energy solutions in the United States, Canada, and Europe.

Low risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives