- United States

- /

- Construction

- /

- NYSE:AMRC

Ameresco (AMRC): Valuation Insights Following Strong Q3 Earnings, 2025 Outlook, and Major Contract Wins

Reviewed by Simply Wall St

Ameresco (AMRC) delivered solid third-quarter results, showing gains in revenue and net income from the previous year. With reaffirmed 2025 guidance, the company also highlighted recent contract wins in clean energy infrastructure.

See our latest analysis for Ameresco.

Ameresco’s latest contract wins and solid earnings have given its share price remarkable momentum, with a 61% gain over the past 90 days and a year-to-date rise of 59%. Despite some volatility, the stock’s 19% total shareholder return over the past year suggests renewed optimism. However, longer-term total returns remain negative, which hints at a potential turnaround in sentiment.

If these moves in clean energy infrastructure have your attention, this could be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

Given Ameresco’s sharp rally, strong operational performance, and upbeat analyst sentiment, investors are now left weighing a key question: is the stock still undervalued, or is the recent surge simply pricing in all the expected future growth?

Most Popular Narrative: 7.8% Overvalued

Ameresco’s narrative fair value trails the latest market close, raising questions about what assumptions might be driving the current stock price. Here is how the story is unfolding, according to the most followed sources.

Sharply rising utility rates and escalating grid instability are prompting more public and private clients to pursue long-term energy infrastructure, distributed generation, and microgrid projects. These are areas where Ameresco's project backlog and pipeline are rapidly growing, indicating upside for future revenues and gross margins as these higher-value projects convert.

What is pushing the fair value below the market price? The narrative expects this pipeline boom to drive future revenue and margin expansion, but it is based on some bold earnings and profit assumptions. Curious what rhythm of growth and profitability is priced into Ameresco’s future? The details inside this narrative will surprise even longtime followers.

Result: Fair Value of $37.11 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing supply chain disruptions and regulatory unpredictability could slow project execution and dampen Ameresco’s earnings momentum in the coming quarters.

Find out about the key risks to this Ameresco narrative.

Another View: What Does Our DCF Model Suggest?

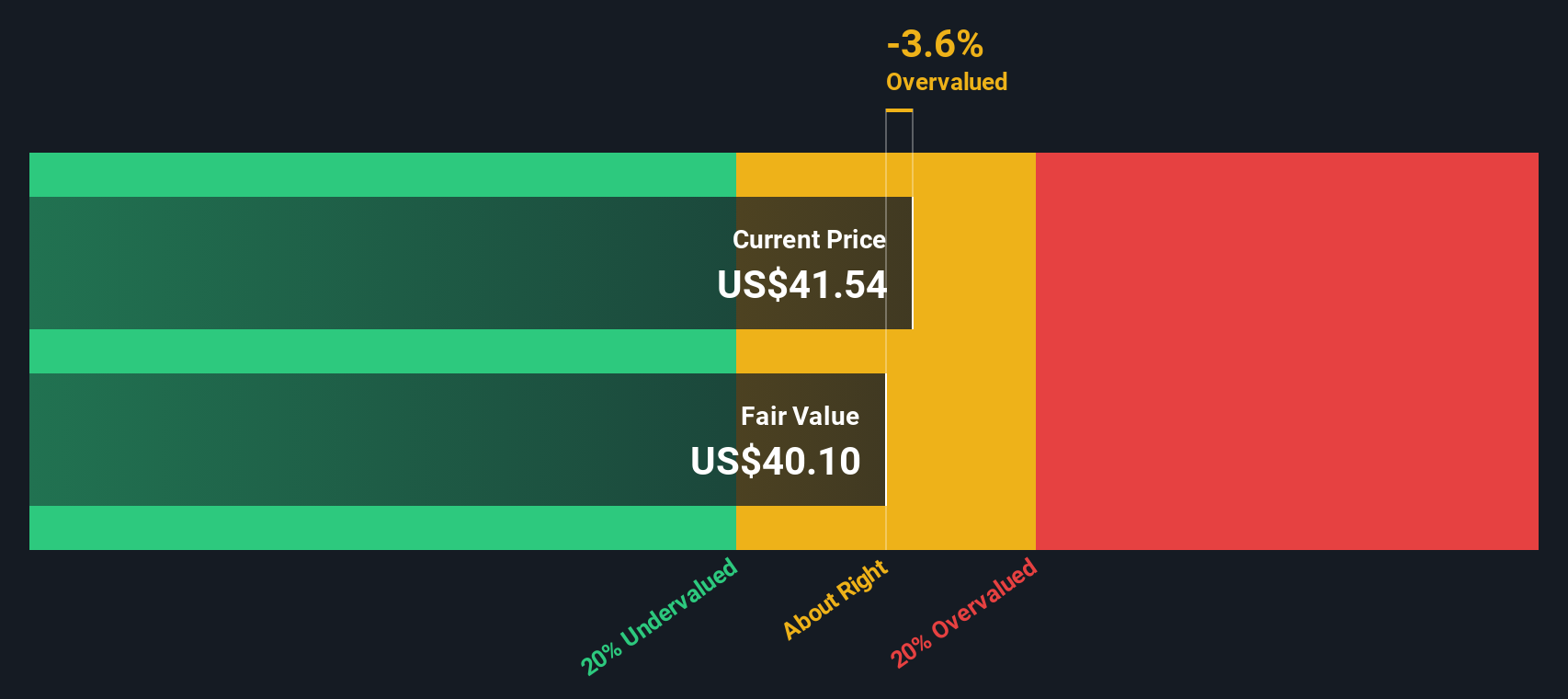

While recent valuations based on price-to-earnings by peers and analysts put Ameresco above its estimated fair value, our SWS DCF model offers a second perspective. According to this approach, Ameresco’s shares are also trading slightly above their calculated fair value. Could these methods both be underestimating future catalysts, or is the market running ahead of itself?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Ameresco Narrative

If the current narrative does not fully reflect your perspective or you prefer to dig into the numbers personally, you can analyze the data and develop your own viewpoint in just a few minutes. Do it your way.

A great starting point for your Ameresco research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let opportunities slip by when the next innovative stock could be right around the corner. Use these powerful tools to find your edge today:

- Capture growth potential early and seize your place among up-and-coming market leaders with these 3598 penny stocks with strong financials.

- Boost your strategy by focusing on long-term value and unearth tomorrow’s winners with these 843 undervalued stocks based on cash flows.

- Ride the rise of cutting-edge medical technology by tapping into breakthroughs behind these 33 healthcare AI stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMRC

Ameresco

Provides energy solutions in the United States, Canada, and Europe.

Low risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives