- United States

- /

- Construction

- /

- NYSE:AMRC

Ameresco (AMRC): Exploring the Current Valuation After a Week of Renewed Share Price Momentum

Reviewed by Simply Wall St

See our latest analysis for Ameresco.

Ameresco’s 90-day share price return of 37.3% shows how quickly momentum can build following recent volatility. Its 1-year total shareholder return stands at 21.7%. Short-term swings hint at renewed optimism, but the longer view reminds us just how much ground there is to recover from past declines.

If recent volatility has you rethinking your portfolio, now is a great chance to widen your perspective and discover fast growing stocks with high insider ownership

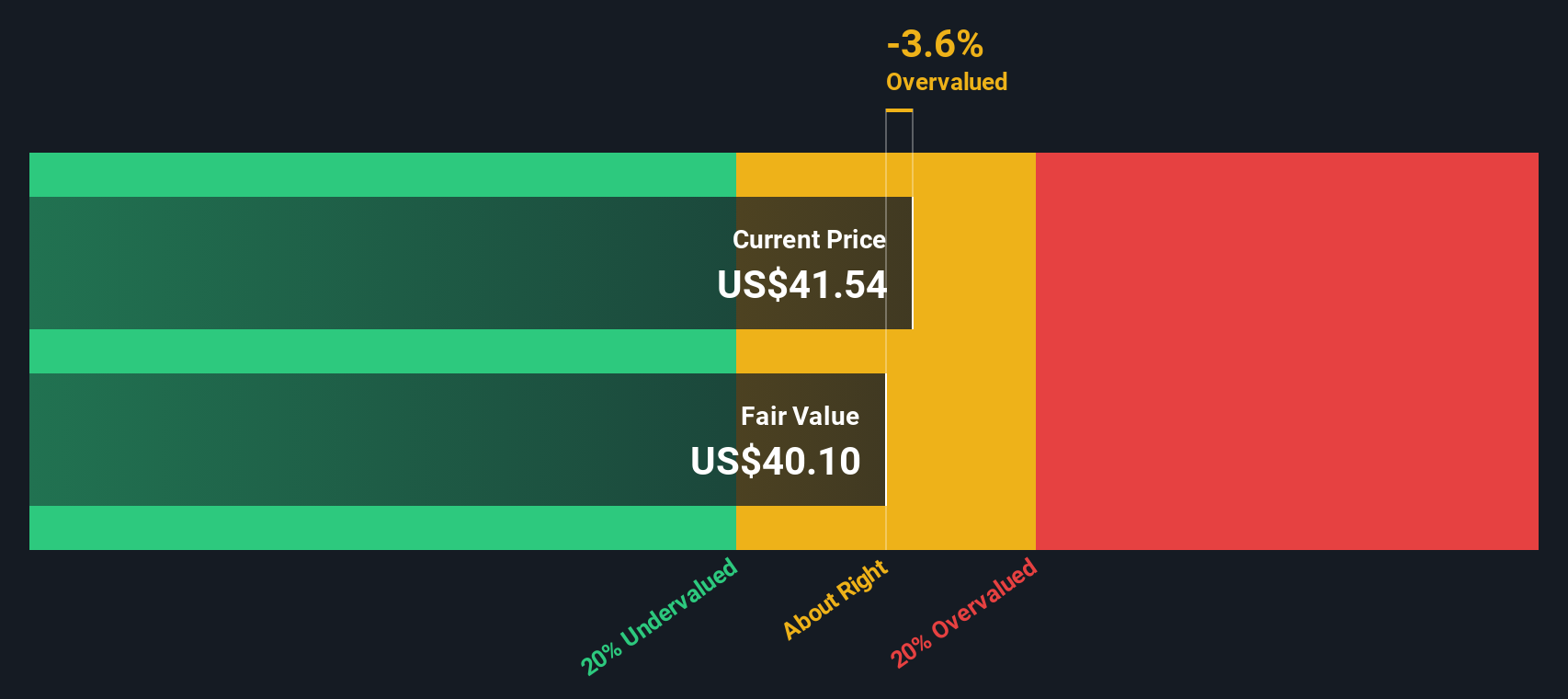

With shares still trading nearly 20% below consensus analyst targets and at a significant discount compared to estimated intrinsic value, is Ameresco offering a hidden bargain or are investors already factoring in all of its future growth potential?

Most Popular Narrative: 16.6% Undervalued

The widely followed narrative values Ameresco significantly above its recent closing price, suggesting the market may be underestimating its long-term earnings power. The stage is set for a story of growth fueled by federal projects and technological innovation.

Sharply rising utility rates and escalating grid instability are prompting more public and private clients to pursue long-term energy infrastructure, distributed generation, and microgrid projects. These are areas where Ameresco's project backlog and pipeline are rapidly growing, indicating upside for future revenues and gross margins as these higher-value projects convert.

Want to pull back the curtain on this bold fair value estimate? The narrative hints at aggressive expansion, ambitious profit targets, and a power move into markets many overlook. But what exactly is fueling analysts’ optimism about future revenue and margins? Some of the key assumptions might make you do a double-take. Dive in to uncover what’s really driving the valuation story.

Result: Fair Value of $41.89 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifting government funding priorities or prolonged supply chain challenges could quickly change the trajectory for Ameresco, which may make near-term outlooks more uncertain.

Find out about the key risks to this Ameresco narrative.

Another View: Discounted Cash Flow Perspective

While many investors rely on earnings multiples to gauge value, our DCF model provides a different lens. Based on future cash flow projections, the SWS DCF model puts Ameresco's fair value much higher at $83.84. This suggests the stock could be deeply undervalued. But which story should investors believe—the multiples or the long-term cash flow outlook?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Ameresco Narrative

If the analysis so far doesn’t match your view, or you want to dive deeper into the numbers yourself, you can build your own narrative with just a few clicks: Do it your way

A great starting point for your Ameresco research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Expand your strategy and unlock fresh opportunities. Don’t let the next winning stock pass you by. Power up your research with these targeted screeners:

- Tap into the explosive potential of artificial intelligence by checking out these 25 AI penny stocks, where companies are pushing boundaries in automation and smart technology.

- Boost your portfolio with steady cash flow by targeting consistent performers in these 14 dividend stocks with yields > 3%, featuring stocks offering yields above 3%.

- Stay ahead of tech’s next frontier by advancing into the future with these 27 quantum computing stocks, spotlighting businesses driving progress in quantum computing breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMRC

Ameresco

Provides energy solutions in the United States, Canada, and Europe.

Good value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "End-to-End" Space Prime – The Only Real Competitor to SpaceX

De-Risked Production Ramp with Exceptional Silver Price Leverage

The "Google Maps" of Cancer Biology – Data is the Moat

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026