- United States

- /

- Construction

- /

- NYSE:AMRC

Ameresco (AMRC) Earnings Rebound Supported by One-Off Gain Challenges Quality Narrative

Reviewed by Simply Wall St

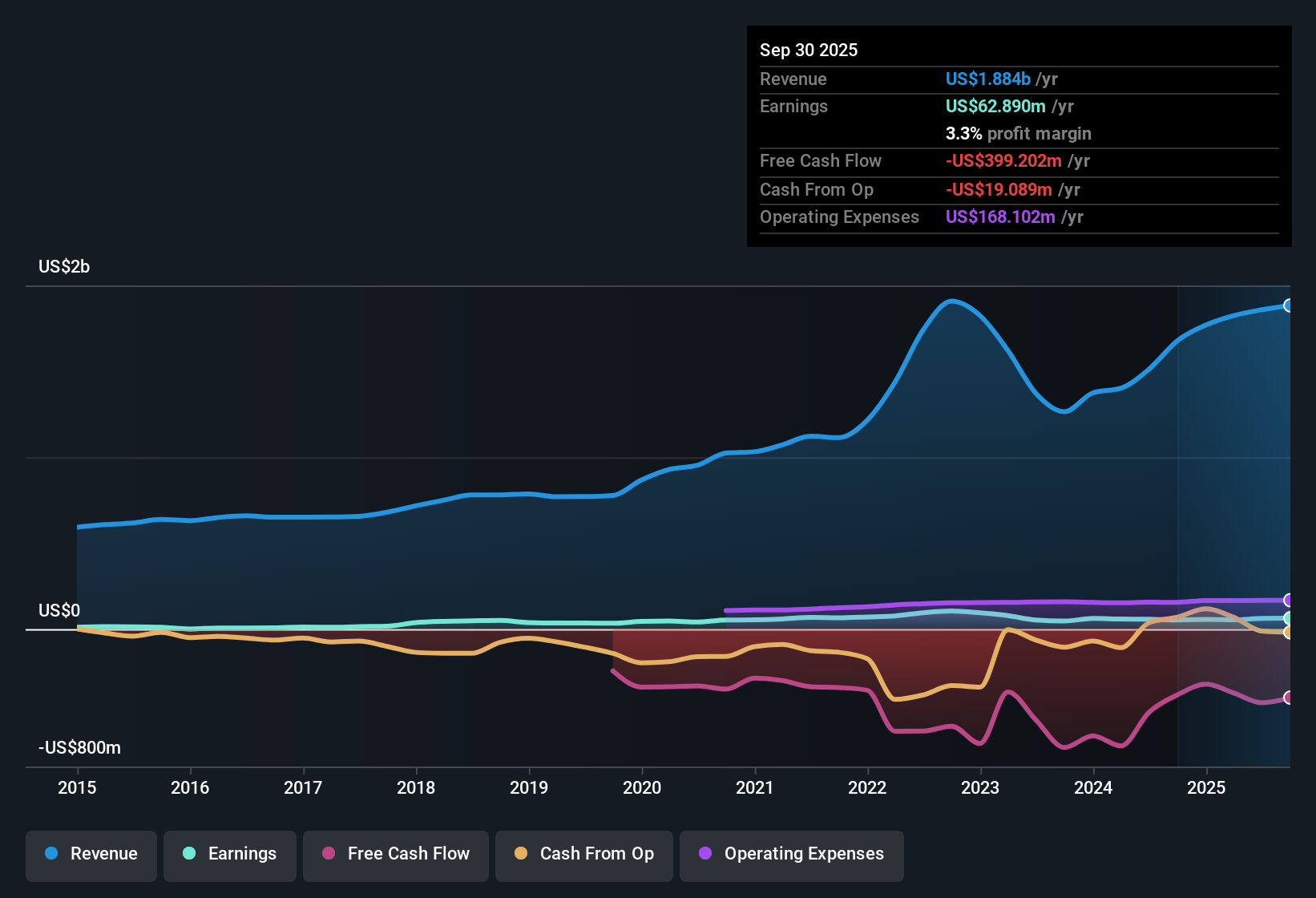

Ameresco (AMRC) delivered 18% earnings growth over the past year, reversing a five-year trend that saw average annual declines of 3.3%. Net profit margins ticked up slightly to 3.3% compared to last year's 3.2%, while a $25.5 million one-off gain factored into the most recent results and forward estimates see earnings outpacing the broader US market at 17.45% per year. Investors may weigh Ameresco's increased profits, slightly improving margins, and a price-to-earnings ratio of 30.4x that is less than key industry benchmarks, against the impact of non-recurring gains on earnings quality and a projected revenue growth that lags the US average.

See our full analysis for Ameresco.The real test is how these headline figures compare to the prevailing narratives. Let’s see where the consensus stacks up and where it gets challenged in the next section.

See what the community is saying about Ameresco

Recurring Contracts Drive Predictability

- Recurring operations and maintenance revenue, plus a base of 750MW in operating energy assets, now deliver a more stable and higher-margin income stream for Ameresco.

- Analysts' consensus view sees rising contract income and project screening as key to improved earnings quality.

- Strong pipeline growth from advanced energy infrastructure and supportive government policies is expanding both margins and revenue predictability.

- Market diversification and investment in new technologies provide higher-margin opportunities and help Ameresco better handle execution risks.

- What stands out is that recurring revenue via long-term contracts is increasingly offsetting the lumpiness seen in prior years. This shift sharply supports the consensus confidence in greater financial stability for earnings and cash flow.

- Consensus narrative expects that as the contracted revenue base grows, Ameresco will see more visible and predictable margin gains.

- This claim is notable given that net profit margins have already ticked up to 3.3% and analysts forecast further progression to 3.6% within three years, despite ongoing supply chain pressures.

Europe’s Backlog Grows Faster

- Europe accounts for 20% of Ameresco’s project backlog and is projected to expand even more rapidly than the U.S., driven by aggressive decarbonization mandates and increasing demand for advanced assets like battery storage.

- Consensus narrative points to the strategic importance of European momentum.

- Heightened government incentives (such as ITCs and the Inflation Reduction Act) and accelerated timelines are helping Ameresco monetize new projects faster and boost margins.

- Diversification across geographies is expected to reduce risk and enhance visibility over multi-year project flows, supporting both topline and margin expansion through the shift to higher-value markets.

Valuation: Discount to Industry Despite Growth

- Ameresco’s price-to-earnings ratio sits at 30.4x, which is lower than both the US Construction industry average of 34.6x and the peer group average of 31.9x, indicating relative value; the company’s current share price of $36.28 also trades beneath the DCF fair value of $38.49.

- Analysts' consensus view finds this valuation attractive by sector standards even as it weighs ongoing risks.

- Persistent supply chain and financing headwinds still threaten margin expansion and earnings stability, potentially explaining why the market continues to apply a discount to price targets.

- Consensus narrative calls out the firm’s strong projected earnings growth rate of 17.45% per year, which outpaces the US market average and amplifies the case for a higher valuation if these assumptions hold.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Ameresco on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on these figures? Share your unique outlook and create a personal narrative in just minutes: Do it your way.

A great starting point for your Ameresco research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Ameresco’s promising earnings growth is balanced by revenue expansion that still trails the wider market and ongoing supply chain and financing challenges that impact profit stability.

If you want to focus on businesses with more consistent financial performance and visible revenue growth, check out stable growth stocks screener (2080 results) to discover companies delivering steady results year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMRC

Ameresco

Provides energy solutions in the United States, Canada, and Europe.

Good value with low risk.

Similar Companies

Market Insights

Community Narratives