- United States

- /

- Electrical

- /

- NYSE:AMPX

Will Amprius Technologies’ (AMPX) Korea Alliance Reinforce Its Global Manufacturing Ambitions?

Reviewed by Sasha Jovanovic

- Amprius Technologies, Inc. recently announced the formation of the Amprius Korea Battery Alliance, a collaborative initiative to expand global manufacturing, secure supply chain partners, and support over 2.0 GWh of worldwide contract manufacturing capacity by engaging multiple Korean battery industry leaders.

- The alliance aims to combine Amprius' silicon anode technology with Korea's manufacturing strengths and strengthen the supply network supporting the electric mobility and clean energy sectors.

- We'll examine how expanding Amprius' global manufacturing network through the Korea alliance could reshape its investment outlook and scale-up prospects.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

Amprius Technologies Investment Narrative Recap

At its core, being an Amprius shareholder means believing in the company's ability to turn its silicon anode battery technology into global commercial success, particularly by expanding beyond the aviation niche into broader electric mobility sectors. The formation of the Amprius Korea Battery Alliance could be a meaningful step toward geographic diversification and supply chain resilience; however, its short-term impact on the company’s biggest catalyst, scaling to mass production with reliable cost control, remains to be proven, while high customer concentration risk is unchanged for now.

The most relevant recent announcement is Amprius' third-quarter 2025 earnings report, which highlighted significant sales growth year-over-year but a continued net loss, mirroring the critical need for the company to ramp up commercial scale and operational efficiency, both areas potentially supported by the Korea partnership as Amprius builds out contract manufacturing capacity and aims for improved margin stability.

But despite progress overseas, investors should be aware that key challenges, such as revenue dependence on a few aviation and drone customers, still loom…

Read the full narrative on Amprius Technologies (it's free!)

Amprius Technologies' outlook anticipates $306.6 million in revenue and $13.4 million in earnings by 2028. Achieving these targets requires an 89.8% annual revenue growth rate and an increase in earnings of $52.1 million from the current level of -$38.7 million.

Uncover how Amprius Technologies' forecasts yield a $15.33 fair value, a 44% upside to its current price.

Exploring Other Perspectives

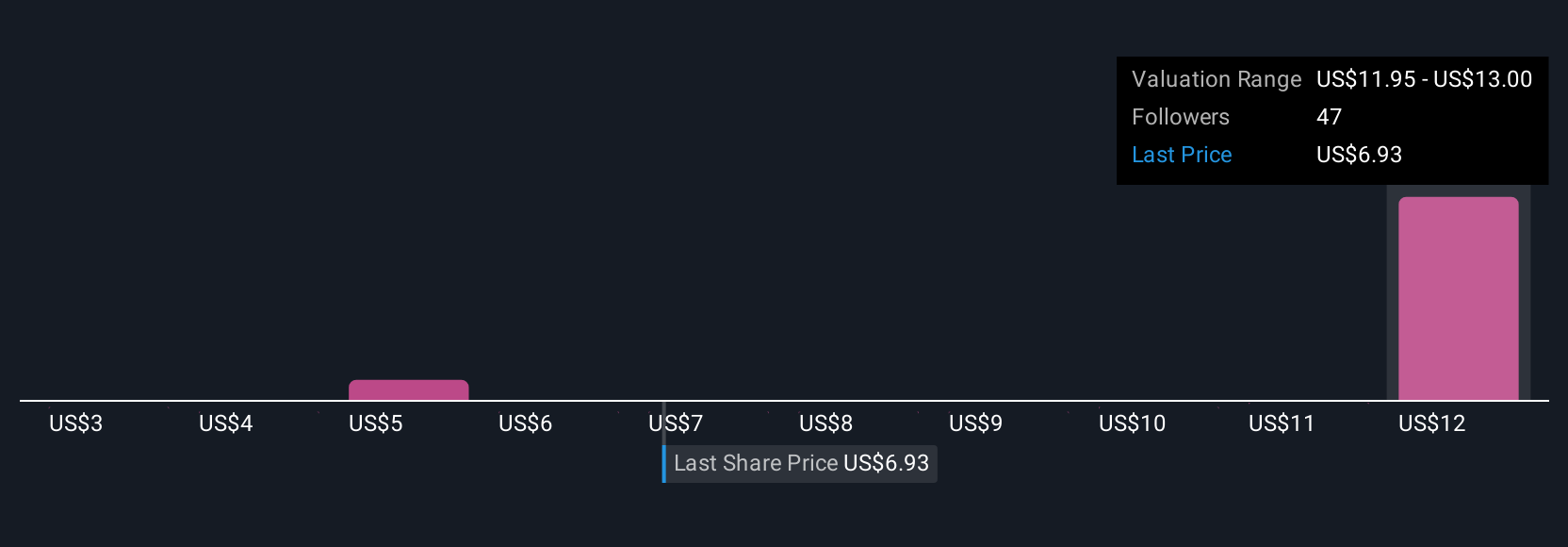

Simply Wall St Community members provided nine fair value estimates for Amprius Technologies, ranging widely from US$7.71 to US$28.91 per share. While many see upside potential, the ongoing challenge of scaling production efficiently may affect how quickly the company expands beyond its initial core markets, inviting you to review multiple viewpoints on its future.

Explore 9 other fair value estimates on Amprius Technologies - why the stock might be worth over 2x more than the current price!

Build Your Own Amprius Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Amprius Technologies research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Amprius Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Amprius Technologies' overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMPX

Amprius Technologies

Develops, manufactures, and markets lithium-ion batteries for mobility applications.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives