- United States

- /

- Machinery

- /

- NYSE:ALSN

Did Allison Transmission's (ALSN) Weaker Guidance and Defense Expansion Just Shift Its Investment Narrative?

Reviewed by Sasha Jovanovic

- Allison Transmission Holdings recently released its third-quarter results, reporting sales of US$693 million and net income of US$137 million, both down from a year earlier, and updated its 2025 full-year guidance with expected net sales between US$2.98 billion and US$3.03 billion and net income of US$620 million to US$650 million.

- Alongside its earnings announcement, the company expanded its global defense network, naming a new authorized channel partner in Poland to strengthen support for defense customers and localize service offerings.

- We’ll explore how Allison’s revised sales outlook and international service expansion may shape its broader investment narrative and future growth expectations.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Allison Transmission Holdings Investment Narrative Recap

To be an Allison Transmission shareholder, you need to believe in the company's ability to offset cyclical declines in its core North America On-Highway market with growth from global expansion and new product initiatives. The news of lower third-quarter results and trimmed 2025 guidance does not significantly alter the most important near-term catalyst, successful execution of the Dana Off-Highway acquisition, while the biggest risk remains sustained weakness in North America OEM demand.

The most relevant recent announcement here is Allison’s expansion of its authorized defense service provider network into Poland. This move strengthens the company’s presence in durable, higher-margin international segments, potentially helping to buffer against softness in its traditional truck and bus markets as it aims for a more resilient earnings profile.

By contrast, investors should be aware that persistent OEM production cuts and high inventories in North America could signal...

Read the full narrative on Allison Transmission Holdings (it's free!)

Allison Transmission Holdings' outlook anticipates $5.1 billion in revenue and $983.8 million in earnings by 2028. This scenario assumes a 16.9% annual revenue growth rate and an earnings increase of $221.8 million from the current $762.0 million.

Uncover how Allison Transmission Holdings' forecasts yield a $101.89 fair value, a 24% upside to its current price.

Exploring Other Perspectives

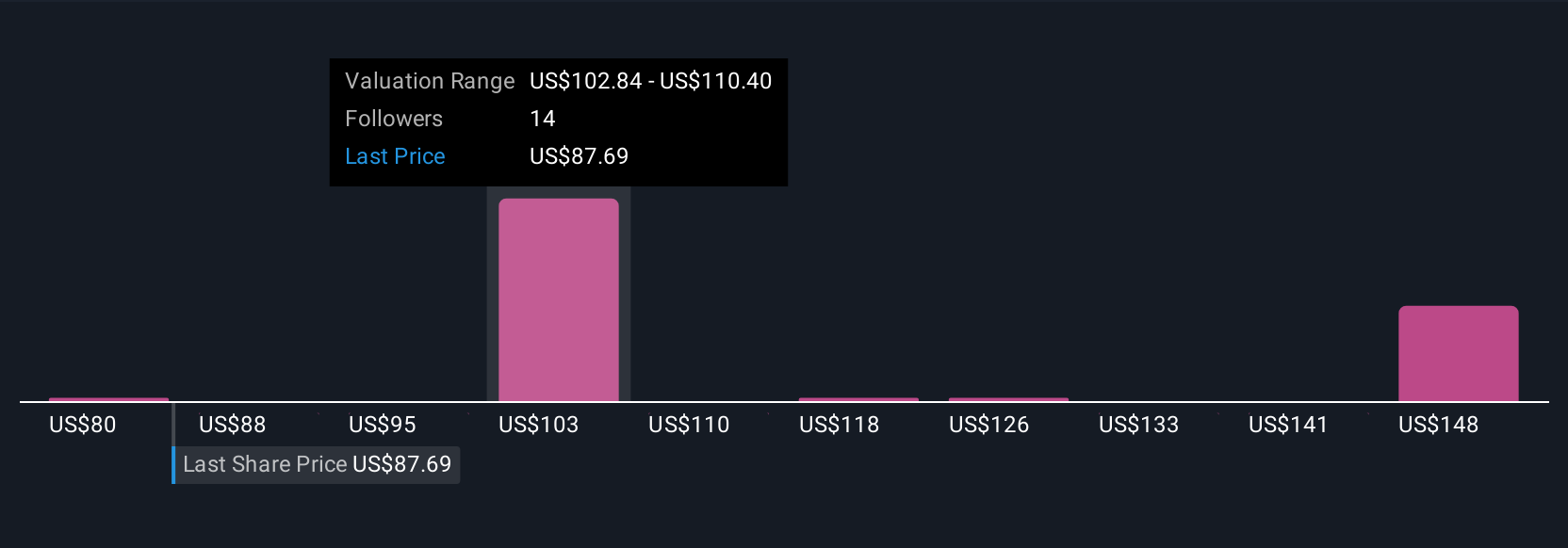

Six members of the Simply Wall St Community estimate Allison’s fair value ranges widely from US$84 to US$222.39 per share. As you weigh these diverse viewpoints, keep in mind how ongoing North America market softness could influence future results and consider exploring several alternative perspectives.

Explore 6 other fair value estimates on Allison Transmission Holdings - why the stock might be worth over 2x more than the current price!

Build Your Own Allison Transmission Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Allison Transmission Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Allison Transmission Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Allison Transmission Holdings' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ALSN

Allison Transmission Holdings

Designs, manufactures, and sells fully automatic transmissions for medium- and heavy-duty commercial vehicles and medium- and heavy-tactical U.S.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives