- United States

- /

- Aerospace & Defense

- /

- NYSE:ACHR

Is Archer Aviation’s Stock Pullback in 2025 a Chance After News on Air Taxi Partnerships?

Reviewed by Bailey Pemberton

- Wondering if Archer Aviation is a hidden gem or flying too close to the sun? You are not alone. With all the recent buzz, it's natural to ask if the stock is truly worth its current price.

- After soaring an incredible 198.1% over the last year and posting a massive 284.3% gain in three years, the stock has pulled back significantly in the past month, dropping 29.8%.

- These price swings have been fueled by headlines about Archer Aviation's partnerships in the electric air taxi sector and high-profile backing from strategic investors. News of expanded test flights and new regulatory steps have both heightened excitement and caused investors to revisit the company's risk profile.

- When it comes to valuation, Archer Aviation scores a 3 out of 6 on our checklist for undervaluation. We will dive into what this means using classic valuation methods, but stick around for an alternative view that could change how you think about the stock entirely.

Approach 1: Archer Aviation Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and then discounting those amounts back to today’s dollars. This approach helps investors focus less on short-term swings and more on the company’s fundamental ability to generate money over time.

For Archer Aviation, the latest reported Free Cash Flow is negative $472.3 million, highlighting that the company is currently burning cash as it invests in growth and development. Analyst projections expect this to shift dramatically. By 2029, Archer’s Free Cash Flow is estimated to reach $286 million, with further growth potentially leading to over $1.5 billion annually by 2035, according to extended forecasts. Notably, these later numbers are extrapolated estimates rather than direct analyst predictions.

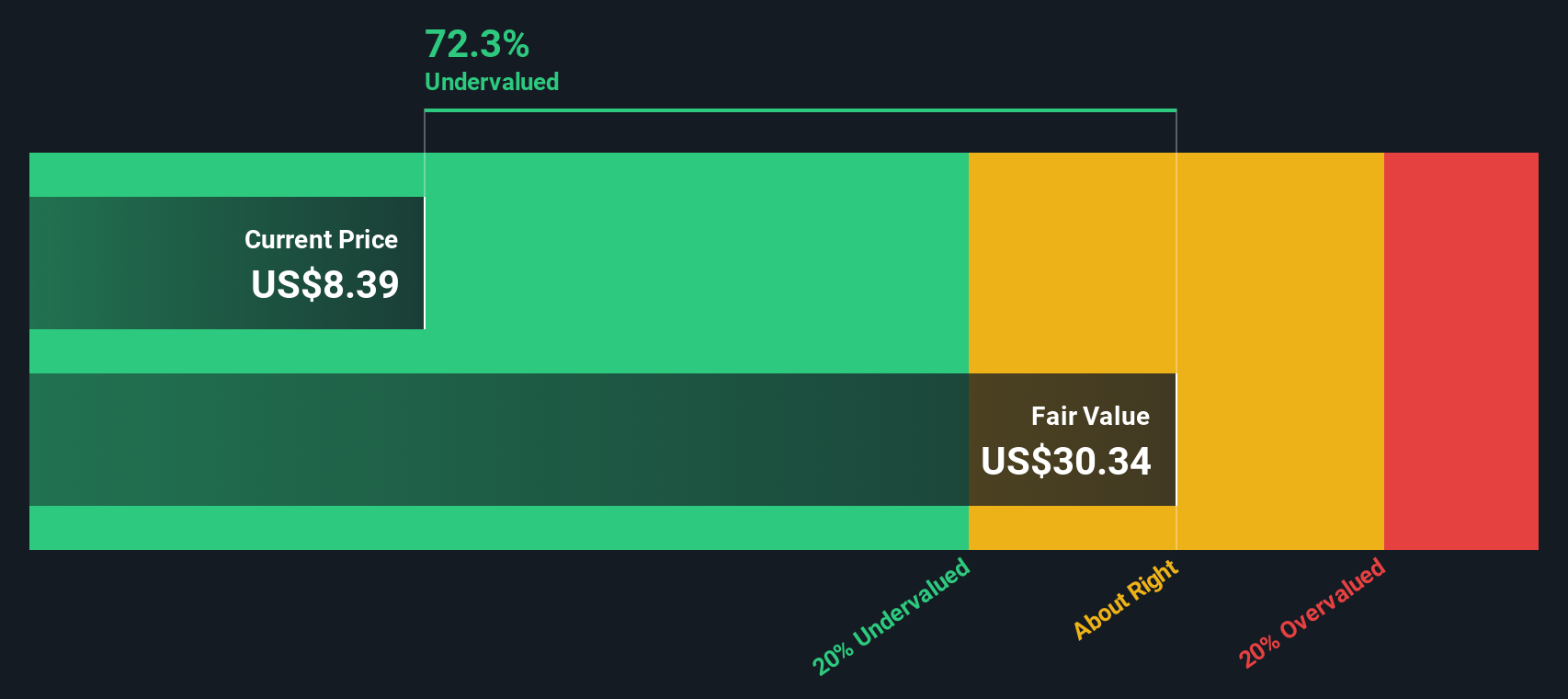

With the DCF model’s two-stage analysis, the fair value for Archer Aviation stock is calculated at $32.47 per share. This figure sits a substantial 70.5 percent above the current market price, implying that based on these aggressive growth assumptions, Archer shares are significantly undervalued right now.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Archer Aviation is undervalued by 70.5%. Track this in your watchlist or portfolio, or discover 838 more undervalued stocks based on cash flows.

Approach 2: Archer Aviation Price vs Book

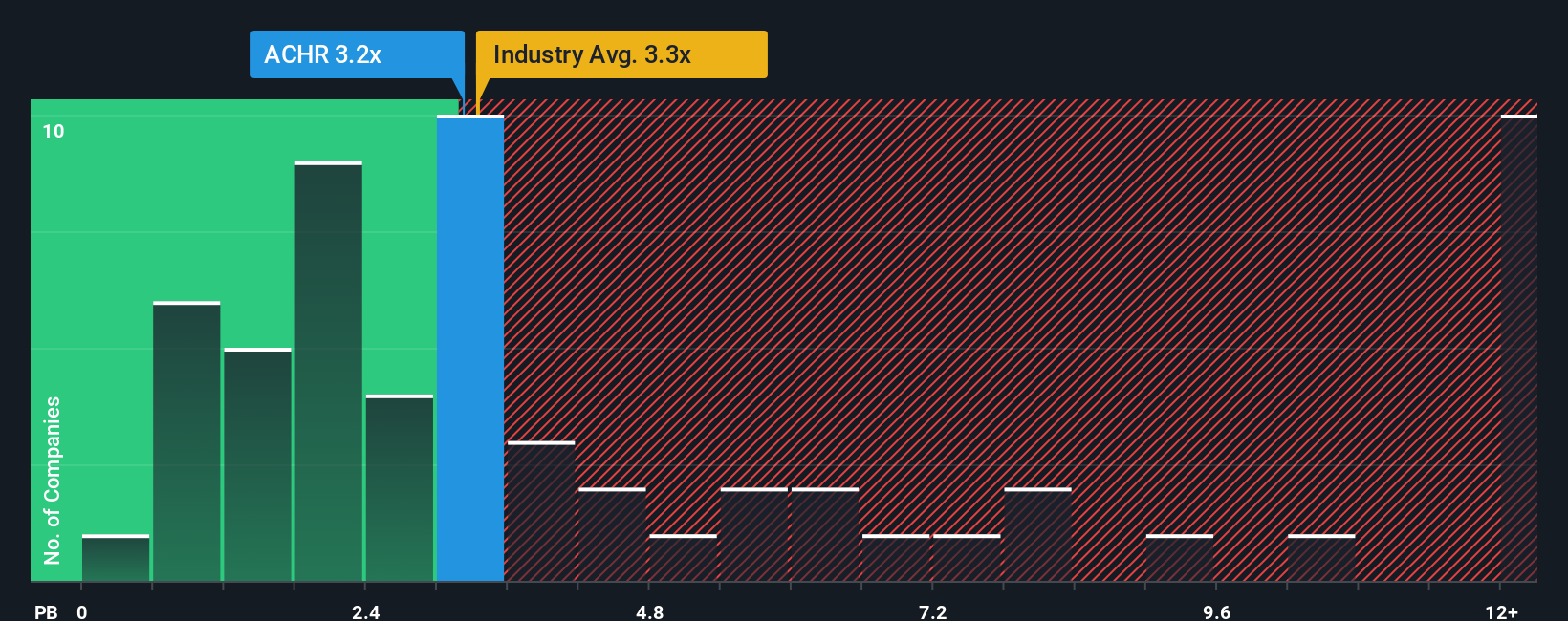

The Price-to-Book (P/B) ratio is a commonly used valuation metric, especially for companies that are not yet profitable or are in the early stages of development. It compares a company’s market price to its net asset value, offering investors a sense of how much they are paying for what the company actually owns.

Growth potential and risk are two key factors that influence what a fair P/B ratio should be. If investors expect rapid growth or believe the company owns valuable intangible assets, they may be comfortable paying a higher P/B ratio. In contrast, higher risks can justify a lower multiple, as they increase the chance that book value may not materialize into shareholder returns.

Archer Aviation currently trades at a P/B ratio of 3.67x. This aligns closely with the Aerospace & Defense industry average of 3.60x, but is lower than its peer group’s average of 4.17x. To provide deeper insight, Simply Wall St calculates a “Fair Ratio” that incorporates Archer’s unique mix of growth potential, risk, profit margins, and industry context. This approach is more holistic than a simple comparison against peers or industry averages, as it adapts to the company’s individual circumstances, including its market cap and financial health.

Comparing Archer’s actual P/B ratio with its Fair Ratio shows that the stock is valued right in line with where the fundamentals suggest it should be.

Result: ABOUT RIGHT

PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1403 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Archer Aviation Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your own story about a company, connecting your beliefs about its future growth, profitability, and business risks to real financial forecasts and a calculated fair value.

Narratives link Archer Aviation’s potential, challenges, and opportunities to concrete numbers, making it easier to see how different views about its future shape what the stock is worth. Available right on Simply Wall St's Community page, Narratives are an easy-to-use tool trusted by millions of investors to bring context to the numbers.

By using Narratives, you can decide when to buy or sell by quickly seeing whether your estimated Fair Value is above or below today’s share price. Best of all, Narratives update automatically as new information such as news headlines or quarterly results comes in, keeping your outlook current and relevant.

For example, some investors might believe Archer’s rapid expansion could lead to a much higher fair value, while others focus on cash burn risks and estimate a far lower value. Both scenarios are visible and trackable with Narratives.

Do you think there's more to the story for Archer Aviation? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ACHR

Archer Aviation

Designs and develops aircraft and related technologies and services in the United States and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives