- United States

- /

- Aerospace & Defense

- /

- NYSE:ACHR

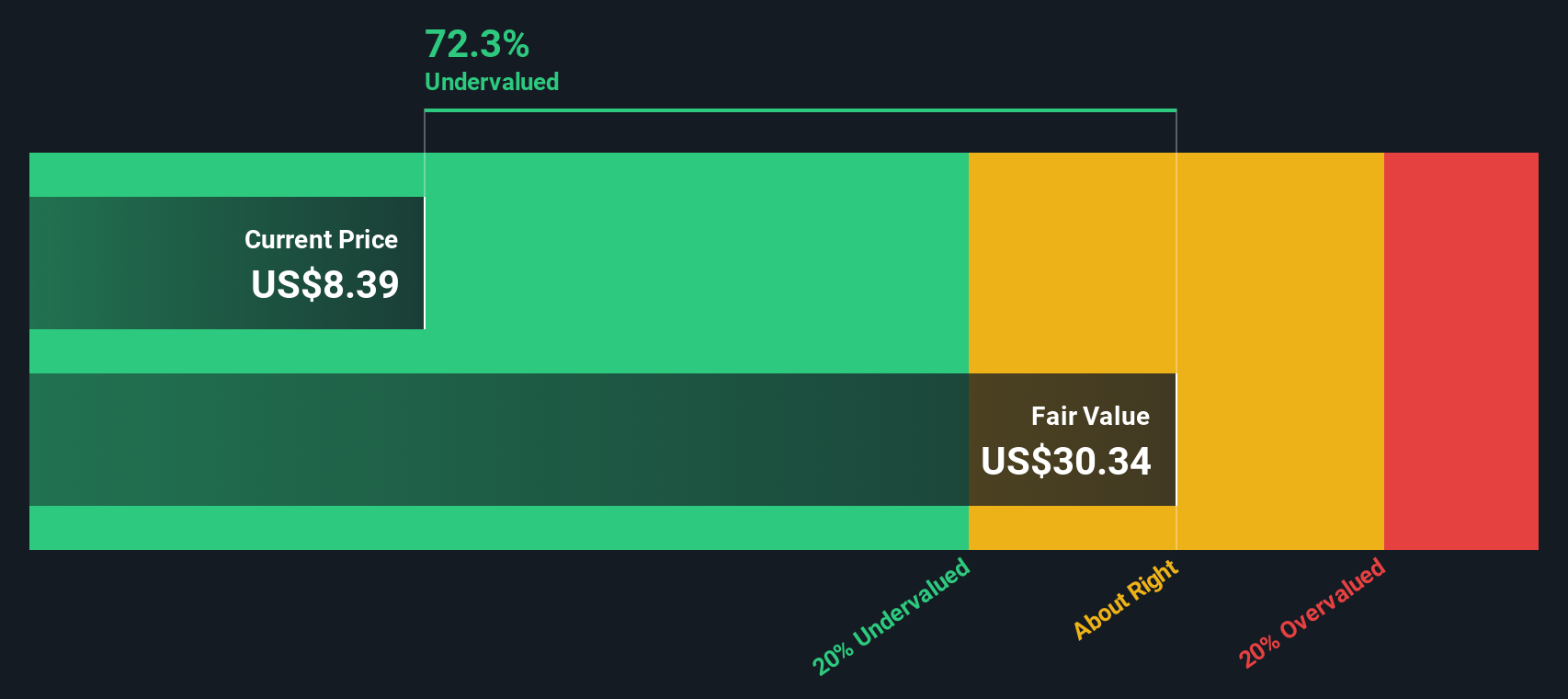

Assessing Archer Aviation (ACHR) Valuation After Recent Share Price Volatility

Reviewed by Simply Wall St

See our latest analysis for Archer Aviation.

Archer Aviation’s share price saw a steep dip over the past month, falling more than 36%, which has put a spotlight on how sentiment can quickly shift for innovative early-stage companies. While momentum has faded recently, the longer-term story is still compelling. The stock’s three-year total shareholder return stands at an impressive 186%.

If Archer’s rapid shifts have you curious about other players shaping the future of travel, it’s worth taking a look at the aerospace and defense space. See the full list for free.

With shares now trading at a substantial discount to analyst targets, the big question is whether Archer is undervalued based on its future potential, or if the market has already factored in all the expected growth.

Price-to-Book of 3.2x: Is it justified?

Archer Aviation’s current price-to-book ratio stands at 3.2x, sitting slightly below the peer group average of 3.8x and matching the broader US Aerospace & Defense industry average. With a last close price of $7.18 and substantial recent share price volatility, the valuation appears to reflect both the company’s ambitious growth prospects and the uncertainty that comes with them.

The price-to-book ratio compares a company’s market value to its net assets. This makes it a useful lens for early-stage, pre-revenue businesses like Archer. For innovative players focused on technological disruption, investors often look to this multiple as a reality check versus more traditional companies in the same sector.

Archer’s ratio at industry parity but below the typical peer suggests the market is cautiously optimistic but not overly exuberant about near-term asset value creation. If the fair ratio, or the level the market could move toward, becomes clearer as Archer matures, the current pricing leaves room for re-rating, either higher or lower.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book Ratio of 3.2x (UNDERVALUED)

However, investors should remember that ongoing revenue losses and rapid share price swings could quickly challenge even the strongest bull case for Archer.

Find out about the key risks to this Archer Aviation narrative.

Another View: Discounted Cash Flow Perspective

While the price-to-book ratio suggests Archer Aviation is undervalued against peers, our DCF model provides an even more striking perspective. According to this method, Archer’s current share price is trading at a substantial 68% discount to an estimated fair value of $22.57. This presents a much wider gap than the multiples approach indicates. However, it raises the question of whether such a discount truly reflects the risks ahead, or if the market is underestimating future potential.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Archer Aviation for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 926 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Archer Aviation Narrative

Keep in mind, if these numbers or perspectives don’t align with your view, you can dive into the data yourself and create a personalized story in just a few minutes. Do it your way

A great starting point for your Archer Aviation research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Smart Opportunities?

Don't wait on the sidelines while others spot hidden winners in the market. Broaden your investing playbook and take action with ideas tailored to what could move next.

- Seize the potential for strong yields by checking out these 16 dividend stocks with yields > 3% for standout income and stability.

- Uncover breakthrough innovations in medical technology and patient care by exploring these 30 healthcare AI stocks that are shaping tomorrow’s healthcare landscape.

- Catch the next big growth story ahead of the crowd with these 3598 penny stocks with strong financials positioned by robust financials and momentum.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ACHR

Archer Aviation

Designs and develops aircraft and related technologies and services in the United States and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives