- United States

- /

- Construction

- /

- NYSE:ACA

Assessing Arcosa’s Value After 7% Stock Jump Driven by Infrastructure Bill News

Reviewed by Bailey Pemberton

- Wondering if Arcosa's current share price is a steal or too good to be true? You are not alone in wanting to get to the bottom of its real value.

- In just the last week, Arcosa's stock climbed 7.1%, adding to an 8.6% gain over the past month and bringing its five-year return to an impressive 86.6%.

- Much of this momentum follows recent headlines about new infrastructure spending bills and Arcosa's strategic position to benefit from heightened demand in the construction industry. Investors are paying close attention to how these developments could reshape the company's growth outlook and risk profile.

- With a valuation score of 1 out of 6, Arcosa passes just one of our undervalued checks. Next, we will break down what goes into this valuation score, explore how different methods compare, and finish with an approach that takes a deeper view of Arcosa's true worth beyond the numbers.

Arcosa scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Arcosa Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and discounting them back to today's value. This approach aims to capture the present worth of what Arcosa is expected to generate for shareholders over the coming years.

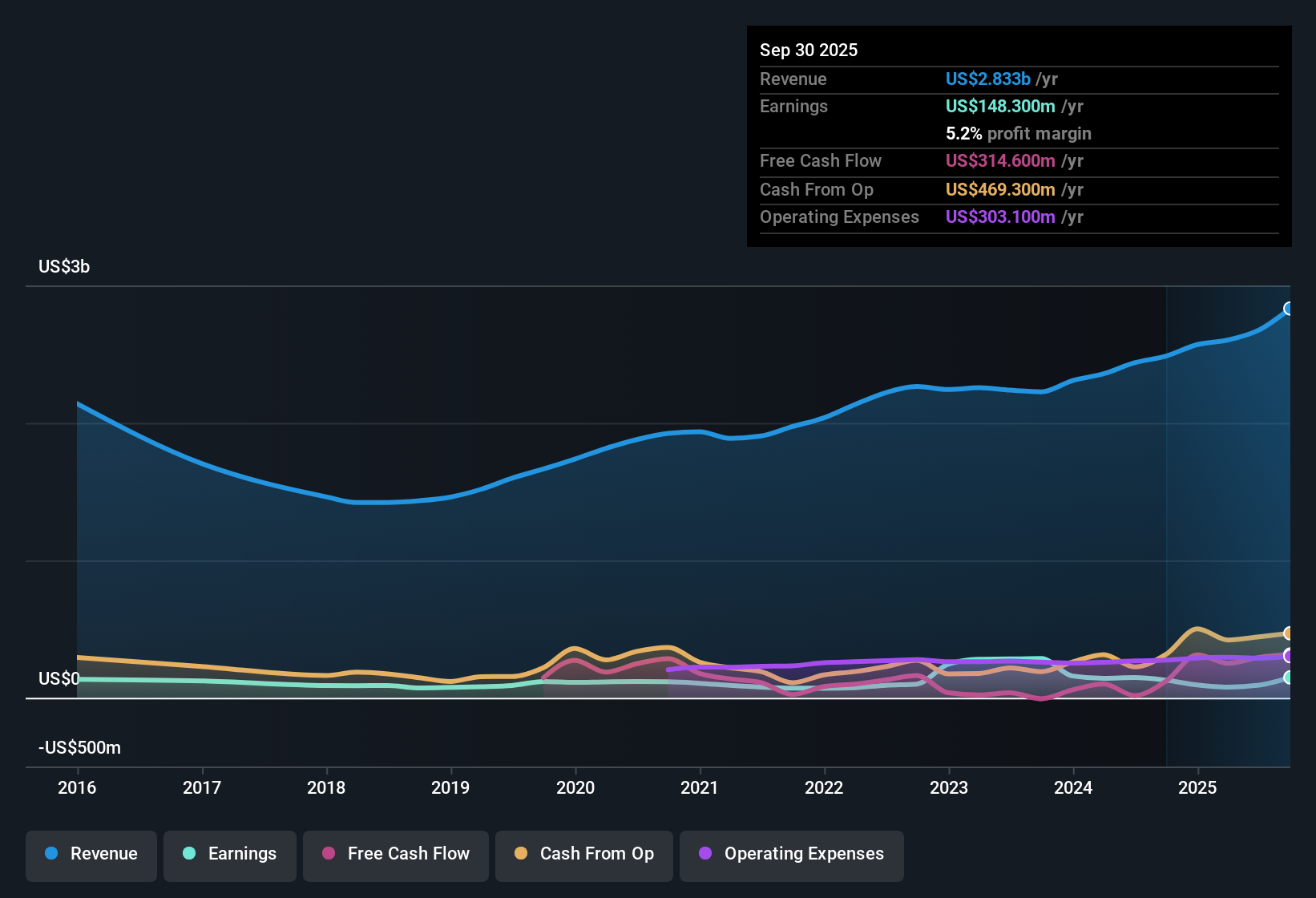

Currently, Arcosa's Free Cash Flow (FCF) stands at $264 million. Analyst estimates, which reliably cover the next several years, project FCF to reach $237.8 million by 2027. Beyond those years, projections are extrapolated to estimate the company's cash generation up to 2035. According to Simply Wall St's calculations, this results in a range close to $251 million in that year. All cash flows are reported in US dollars.

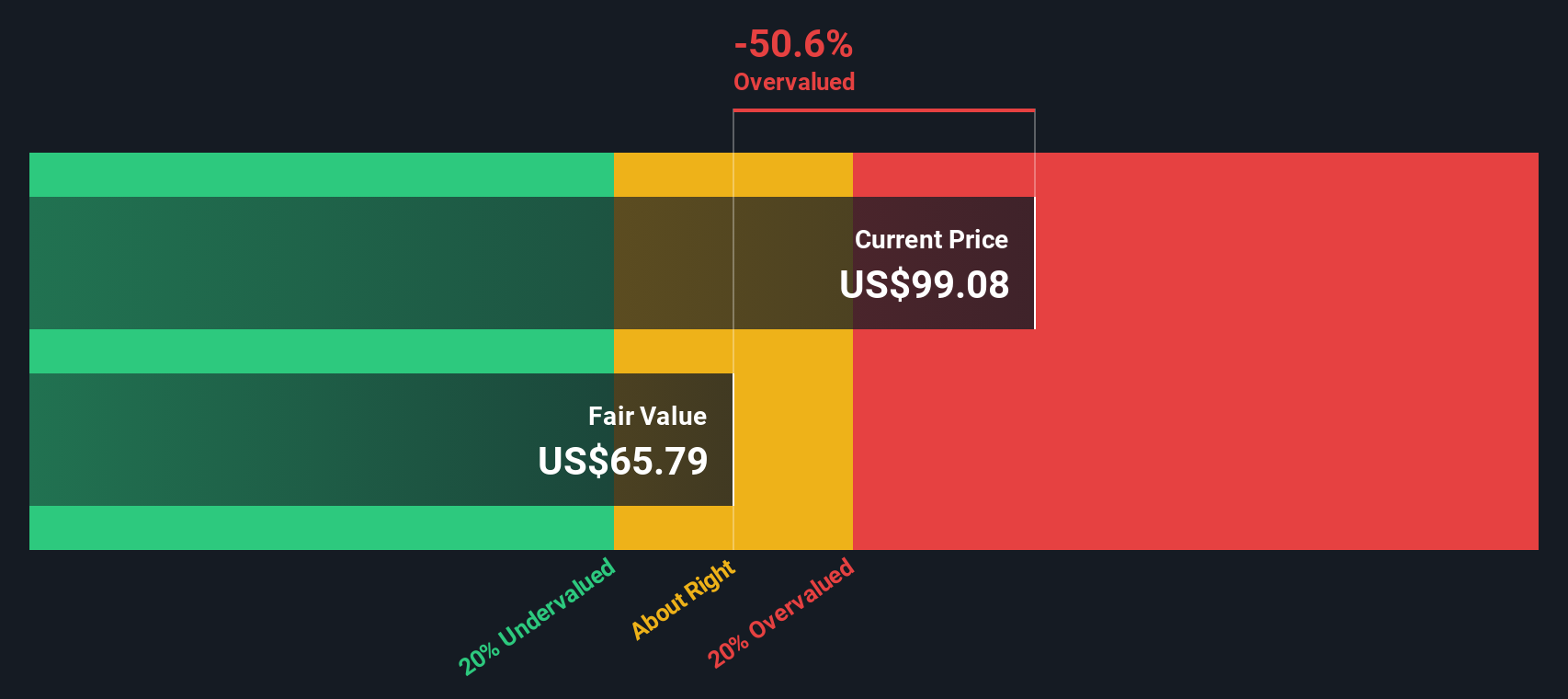

Taking these cash flows and applying the DCF model, the intrinsic value per share for Arcosa is estimated at $66.24. Compared to the current share price, this implies the stock trades at a 51.4% premium, suggesting substantial overvaluation when assessed through this lens.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Arcosa may be overvalued by 51.4%. Discover 840 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Arcosa Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used metric for valuing profitable companies like Arcosa. This ratio shows how much investors are willing to pay today for a dollar of the company's earnings, making it especially relevant when a company is steadily generating profits.

It is important to remember that what counts as a “normal” or reasonable PE ratio is influenced by factors such as growth expectations, industry risk, and market sentiment. Faster-growing or less risky companies typically command higher PE ratios, while slower growth or greater uncertainty can justify lower ones.

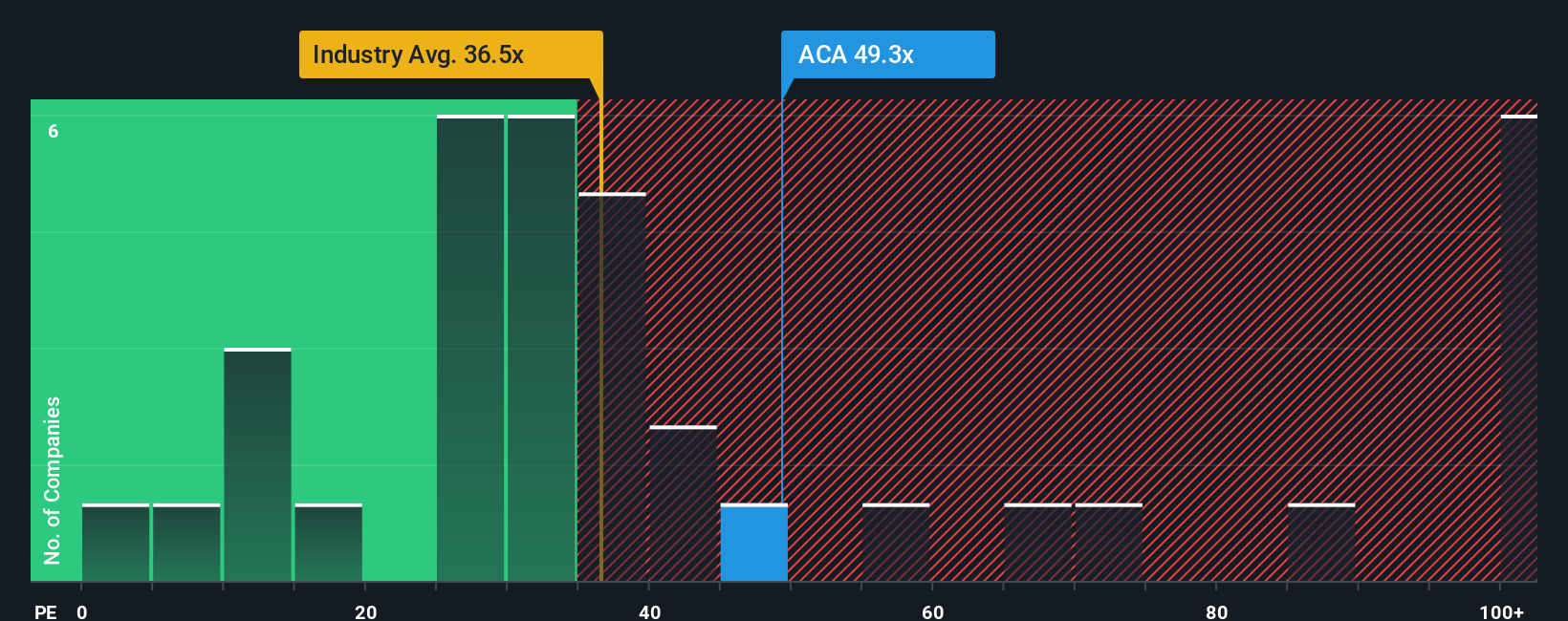

Arcosa currently trades at a PE ratio of 33.2x. For context, the average PE ratio among peer companies is 31.5x, and the broader construction industry average is 34.2x. While these comparisons provide a helpful reference, they may not capture Arcosa’s unique qualities.

This is where Simply Wall St’s proprietary “Fair Ratio” comes in. The Fair Ratio for Arcosa is 28.7x. Unlike a simple industry or peer comparison, this metric factors in Arcosa’s specific earnings growth outlook, profit margins, industry dynamics, company size, and risk profile to arrive at a more nuanced benchmark for what Arcosa’s PE ought to be.

Arcosa’s actual PE is mildly above its Fair Ratio, but the difference is modest. The valuation is therefore about in line with fundamental expectations.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Arcosa Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is a clear, personalized way to frame your investment thesis. It connects your perspective on Arcosa's opportunities and risks with your own forecast for its future revenue, earnings, and margins, ultimately arriving at what you believe is a fair value for the stock.

Unlike traditional methods that just crunch numbers, Narratives empower you to tie the company's real-world story, its catalysts, challenges, and outlook, to dynamic financial estimates and a concrete fair value. Available to everyone through the Simply Wall St Community page, Narratives are straightforward to use and regularly updated as new news or results come in, so your view stays relevant in fast-changing markets.

By making your Narrative, you can see in real time how your fair value compares to the current price, helping you decide if Arcosa is a buy, hold, or sell for your strategy. For example, some investors see Arcosa’s growing backlog and expanding margins as reasons to set a bullish target of $130 per share, while others concerned about government funding risks lean toward a more cautious $106. This demonstrates how Narratives let you capture your unique perspective and adjust as events unfold.

Do you think there's more to the story for Arcosa? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ACA

Arcosa

Provides infrastructure-related products and solutions for the construction, engineered structures, and transportation markets in the United States.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives