- United States

- /

- Trade Distributors

- /

- NasdaqGM:WLFC

Willis Lease Finance (WLFC) Net Profit Margin Misses, Tests Bullish Narratives on Valuation

Reviewed by Simply Wall St

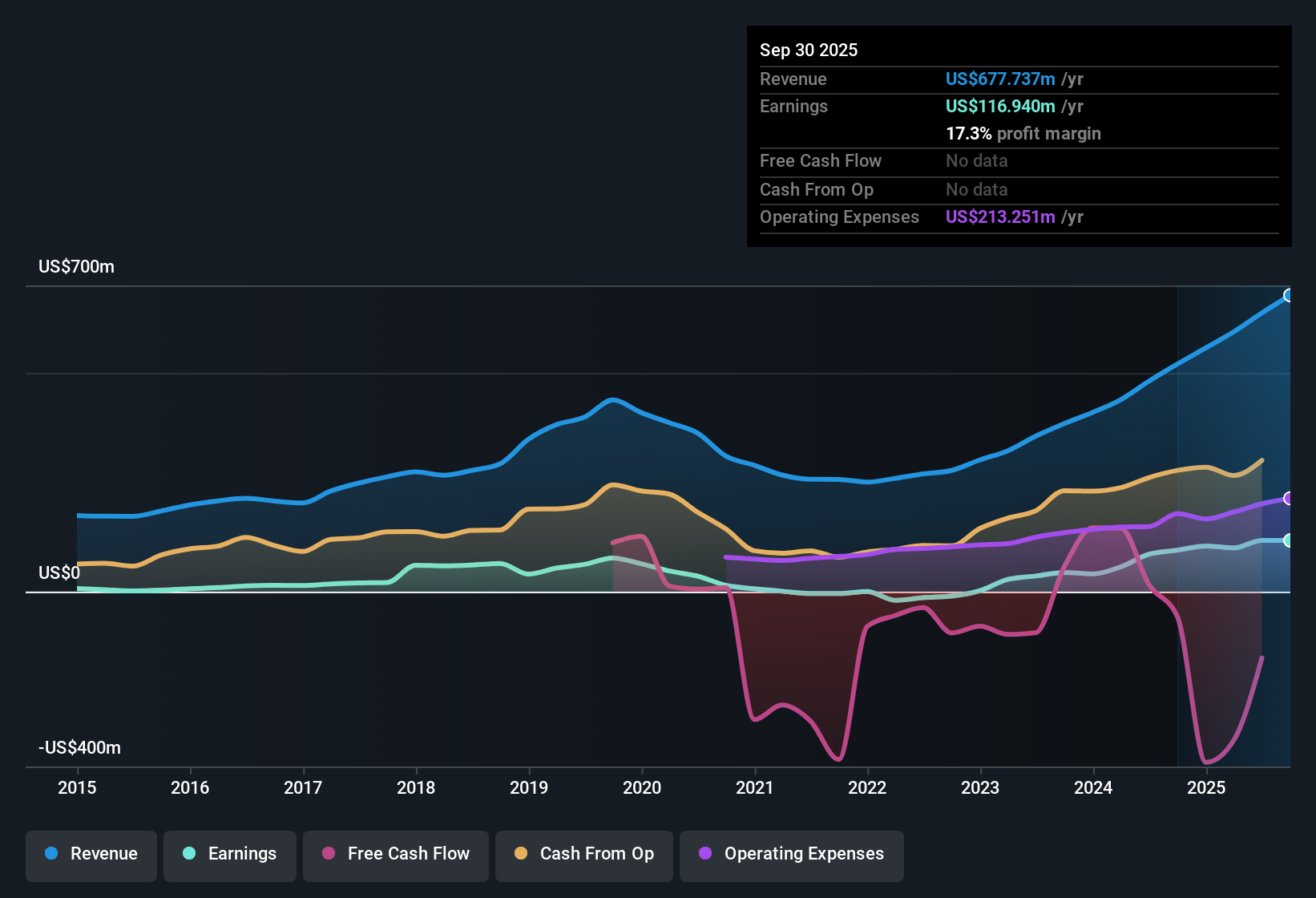

Willis Lease Finance (WLFC) reported a net profit margin of 17.3%, just below last year's 18.2%, with recent earnings growth of 23.4% that trails its robust five-year annual average of 63.2%. Over the longer term, the company has demonstrated impressive earnings power and maintains high-quality results, even as projected 3.8% annual revenue growth lags the broader US market forecast of 10.5%.

See our full analysis for Willis Lease Finance.Now, let's see how these numbers measure up against widely followed narratives in the market. Some perspectives will gain more support, while others may be up for debate.

See what the community is saying about Willis Lease Finance

Future Tech Engine Portfolio Nears 53% of Assets

- At year-end, 53% of Willis Lease Finance’s nearly $1 billion engine and aircraft portfolio consists of “future technology” assets like LEAP and GTF engines. This points to a major strategic tilt toward high-demand and higher-value assets.

- Consensus narrative notes this shift underpins growth opportunities and supports higher margins.

- The acquisition and integration of modern engines position the company for better lease rates and improved demand.

- However, analysts also flag that complex maintenance and regulatory changes could create earnings volatility as the asset mix evolves.

- Consensus narrative suggests balancing optimism over new-technology assets with vigilance on maintenance risks. The recent portfolio upgrades support the case for stronger future lease revenue, but investors should watch for expenses tied to servicing cutting-edge engines.

📊 Read the full Willis Lease Finance Consensus Narrative.

PE Ratio at 6.9x, a Major Discount to Peers

- Willis Lease Finance’s Price-To-Earnings ratio stands at 6.9x, far below both peer averages of 30.8x and the US Trade Distributors industry’s 21.7x. This emphasizes deep relative value by standard market measures.

- Analysts' consensus view highlights tension between low relative valuation and flagged financial risks.

- The discounted multiple makes Willis Lease Finance appear attractive, especially given its lengthy track record of high-quality earnings.

- Yet questions remain about whether the company’s weaker financial position justifies the low price or signals future headwinds.

Share Price Premium Over DCF Fair Value Raises Stakes

- Shares recently traded at $118.61, considerably higher than the company’s DCF fair value estimate of $17.81. This puts its market price at a steep premium versus long-term cash flow projections.

- Analysts' consensus narrative debates whether the market is pricing in more future growth than current models support.

- Despite the premium to estimated fair value, analysts’ price target of $190.00 suggests they see notable upside from current trading levels.

- However, this depends on achieving forecasted operating leverage and margin targets without unexpected setbacks from financial risks or slowing industry growth.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Willis Lease Finance on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Notice something others might not? In just a few minutes, you can craft your unique take and shape the Willis Lease Finance story yourself. Do it your way

A great starting point for your Willis Lease Finance research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite a strong earnings history, Willis Lease Finance faces concern over its stretched valuation and flagged financial risks highlighted by consensus analysts.

If you’re searching for stability and peace of mind, check out solid balance sheet and fundamentals stocks screener (1981 results) to discover companies with stronger financial positions and healthier balance sheets than Willis Lease Finance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Willis Lease Finance might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:WLFC

Willis Lease Finance

Operates as a lessor and servicer of commercial aircraft and aircraft engines worldwide.

Acceptable track record and slightly overvalued.

Similar Companies

Market Insights

Community Narratives