- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:VSEC

Assessing VSE (VSEC) Valuation After Recent Share Price Momentum

Reviewed by Simply Wall St

See our latest analysis for VSE.

VSE’s share price may have slipped slightly over the last month, but its 80.8% year-to-date share price return stands out as momentum continues to build following a strong run. Over the longer term, VSE has rewarded investors handsomely, with a 44% total shareholder return over the past year and an impressive 250% return over three years. This reflects improving fundamentals and shifting growth expectations.

If you’re curious about where else leadership and outperformance might be taking shape, it’s a perfect moment to discover fast growing stocks with high insider ownership

With VSE’s stock up significantly this year, investors are weighing whether today’s prices leave room for further upside or if the market has already factored in all of the company’s future growth potential. Is this a new buying opportunity, or is the momentum already reflected in the share price?

Most Popular Narrative: 18.9% Undervalued

VSE’s most widely-followed valuation narrative assigns a notably higher fair value than its last close, highlighting expected growth and transformation-driven optimism. The gap between market price and narrative fair value sets the stage for a fundamental debate around future potential.

Significant investments and recent strategic acquisitions (TCI, Kellstrom, Turbine Weld) are expanding VSE's capacity and footprint in higher-growth, higher-margin aftermarket aviation distribution and MRO services. These developments are supporting robust future revenue growth and diversification of the customer base.

Want to unlock the secrets behind this bullish valuation? There is a bold call here on future margins, a bet on acquisitions, and profit projections few competitors can rival. See what numbers the narrative is relying on to make the case for double-digit returns and a premium price target.

Result: Fair Value of $207.07 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, especially if VSE encounters challenges with integrating new acquisitions or if changes in aviation market demand undermine growth assumptions.

Find out about the key risks to this VSE narrative.

Another View: Market Multiples Perspective

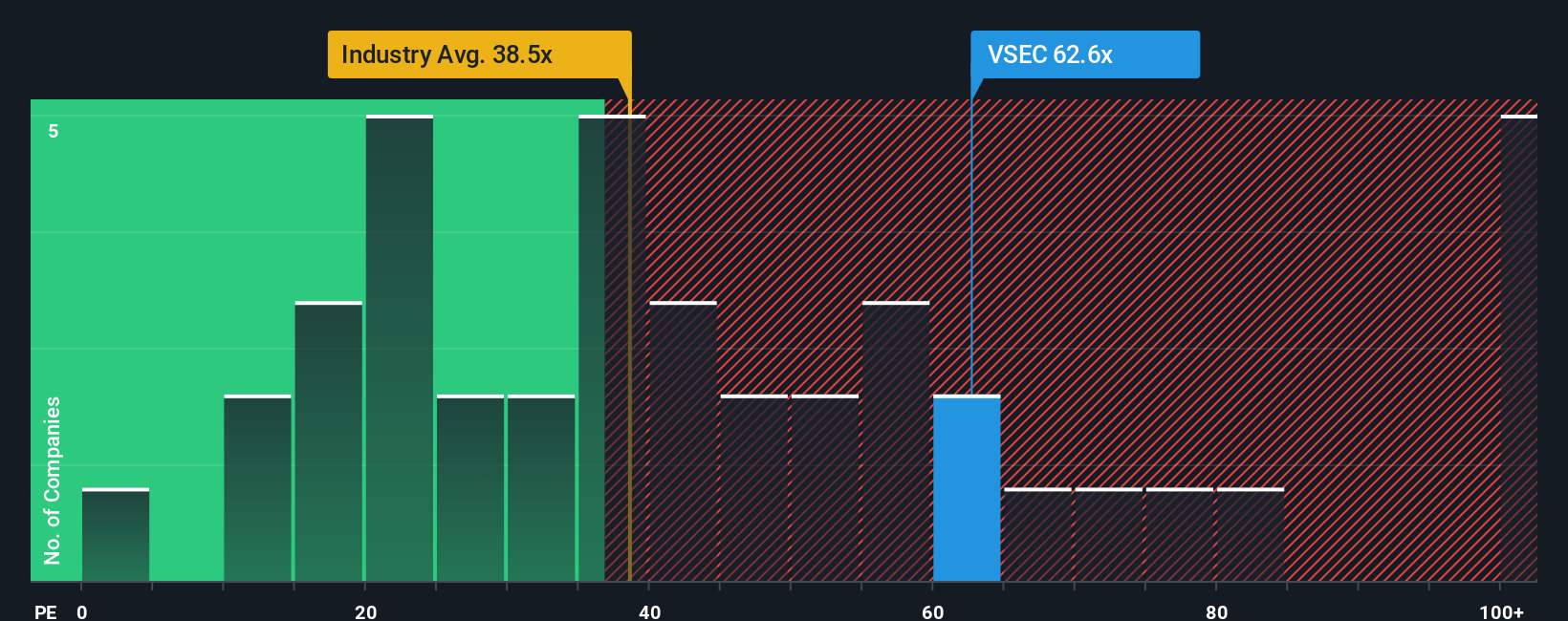

Taking a look at valuation through the lens of price-to-earnings ratios, VSEC currently trades at 66.9x. This is noticeably higher than the US Aerospace & Defense industry average of 35.4x and its own fair ratio of 40.9x. Such a premium suggests investors are already pricing in a significant amount of future growth, which raises the stakes for any missteps or surprises. Will the company’s performance continue to justify this elevated price, or is there more risk than reward from here?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own VSE Narrative

If you see things differently or want to investigate the numbers firsthand, you can craft a personalized analysis in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding VSE.

Looking for More Investment Opportunities?

Don’t limit yourself to just one winning idea. Make your research count by jumping on unique market trends and fresh sectors before the crowd catches on.

- Unlock hidden value and seize attractive entry points by reviewing these 917 undervalued stocks based on cash flows, which are often overlooked by most investors and are poised for stronger returns.

- Tap into game-changing technology by acting early on these 25 AI penny stocks. These stocks accelerate the pace of innovation across numerous industries.

- Enhance your portfolio’s income potential and stability when you check out these 17 dividend stocks with yields > 3%, which consistently deliver superior yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VSEC

VSE

Provides aviation aftermarket parts distribution and maintenance, repair, and overhaul services for air transportation assets for commercial and government markets.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives