- United States

- /

- Machinery

- /

- NasdaqGM:SYM

Does Symbotic's Healthcare Move and Revenue Growth Mark a New Chapter for SYM?

Reviewed by Sasha Jovanovic

- Symbotic reported its fiscal 2025 earnings, posting US$2.25 billion in annual revenue, up from US$1.79 billion a year earlier, and announced entry into the healthcare market through a Medline partnership.

- The addition of Medline as Symbotic's first healthcare customer signals diversification beyond their core retail and wholesale customer base, opening avenues for broader industry impact.

- We'll review how Symbotic's strong revenue growth and move into healthcare could reshape its future investment potential.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Symbotic Investment Narrative Recap

To own Symbotic stock, you need to believe in ongoing warehouse automation demand, the company's ability to lead in next-generation robotics, and its capacity to broaden into verticals like healthcare. The recent Medline partnership and strong revenue growth point to progress on these catalysts, but the key short-term issue remains how quickly Symbotic can deploy its next-gen storage system; any slowdown here may affect revenue momentum, while customer project delays and high concentration still pose risks.

Among recent developments, the August 2025 launch of Symbotic's next-generation storage technology stands out. As customers look for higher efficiency and better density, the new system could drive growth; however, successful rollout is crucial, and delays or slow uptake could pressure earnings and near-term results. Despite strong headline growth, it’s worth noting that customer deployment timing and the ramp-up of new technology could affect...

Read the full narrative on Symbotic (it's free!)

Symbotic's outlook anticipates $4.1 billion in revenue and $348.5 million in earnings by 2028. This is based on an expected annual revenue growth rate of 23.0% and an increase in earnings of $359 million from the current level of -$10.5 million.

Uncover how Symbotic's forecasts yield a $50.82 fair value, a 8% downside to its current price.

Exploring Other Perspectives

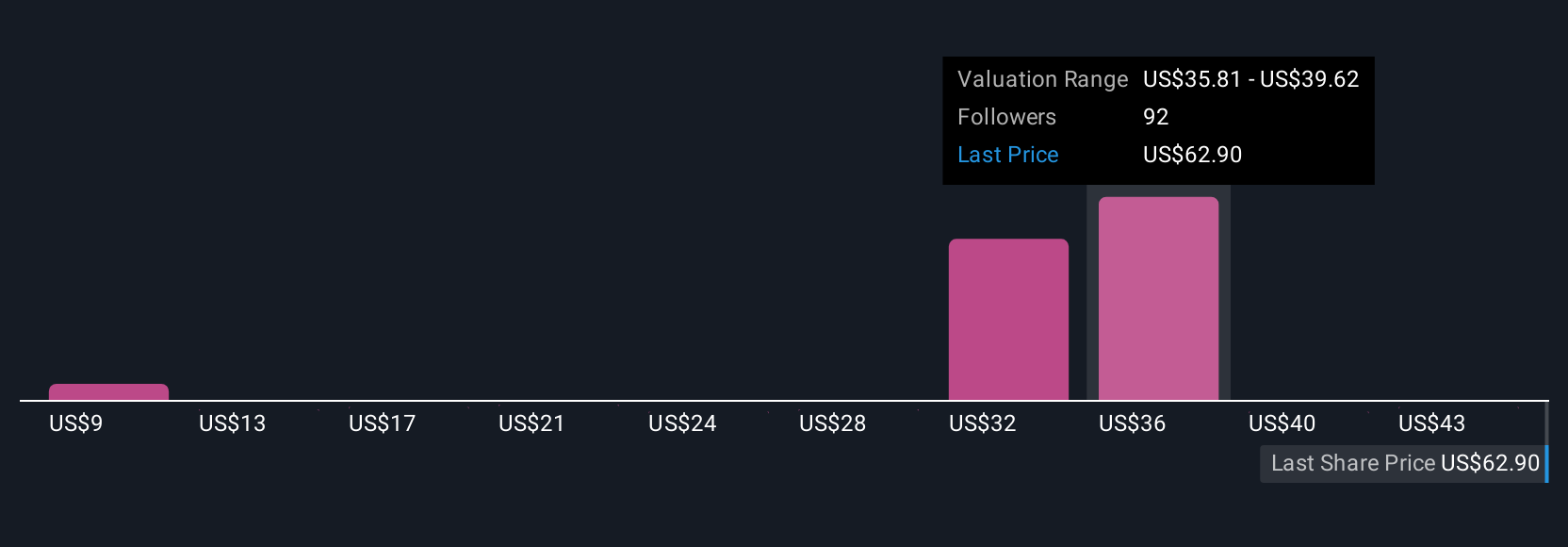

Community fair value estimates from 28 individual perspectives range from US$9.16 to US$70.61 per share before the latest results. With execution risks tied to next-gen system adoption, your view on revenue growth consistency will shape your outlook; see how others assess the opportunity.

Explore 28 other fair value estimates on Symbotic - why the stock might be worth less than half the current price!

Build Your Own Symbotic Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Symbotic research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Symbotic research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Symbotic's overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:SYM

Symbotic

An automation technology company, develops technologies to enhance operating efficiencies in modern warehouses.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success