- United States

- /

- Machinery

- /

- NasdaqGM:SYM

Assessing Symbotic Stock After 245% Surge and New AI Logistics Partnerships

Reviewed by Bailey Pemberton

- Wondering if Symbotic is priced right for your portfolio? You are not alone, as the company has quickly become a hotspot for investors interested in automation and AI-driven warehouse solutions.

- Symbotic's share price has been on a tear, up 10.4% in just the last week, 5.4% for the past month, and a staggering 245.2% year-to-date. This suggests both excitement about its growth story and possibly shifting risk appetites.

- Recently, investor optimism was fueled by heightened industry interest in AI-powered logistics, with announcements of new partnerships and the growing adoption of automation across retail supply chains capturing headlines. This wave of positive news has intensified curiosity about whether the recent stock surge truly reflects Symbotic’s underlying value or just exuberance.

- As it stands, Symbotic scores just 1 out of 6 on our undervaluation checks, so there is much to unpack about how this number is calculated and what it actually means. We will dive into a few standard valuation approaches next, but stick around because there is an even more insightful way to assess value that we will reveal by the end of the article.

Symbotic scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Symbotic Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model projects a company’s expected future cash flows and discounts them back to today’s value, providing an estimate of what the business is intrinsically worth today. This model is widely used to estimate fair value, especially for fast-growing or innovative companies such as Symbotic.

Symbotic’s current Free Cash Flow stands at $804.5 million. Analysts have provided Free Cash Flow forecasts for the next five years, with values ranging from $474.9 million in 2026 to $1.76 billion in 2030. Beyond those years, Simply Wall St extends the forecast using extrapolation techniques that account for changes in growth rates and industry expectations.

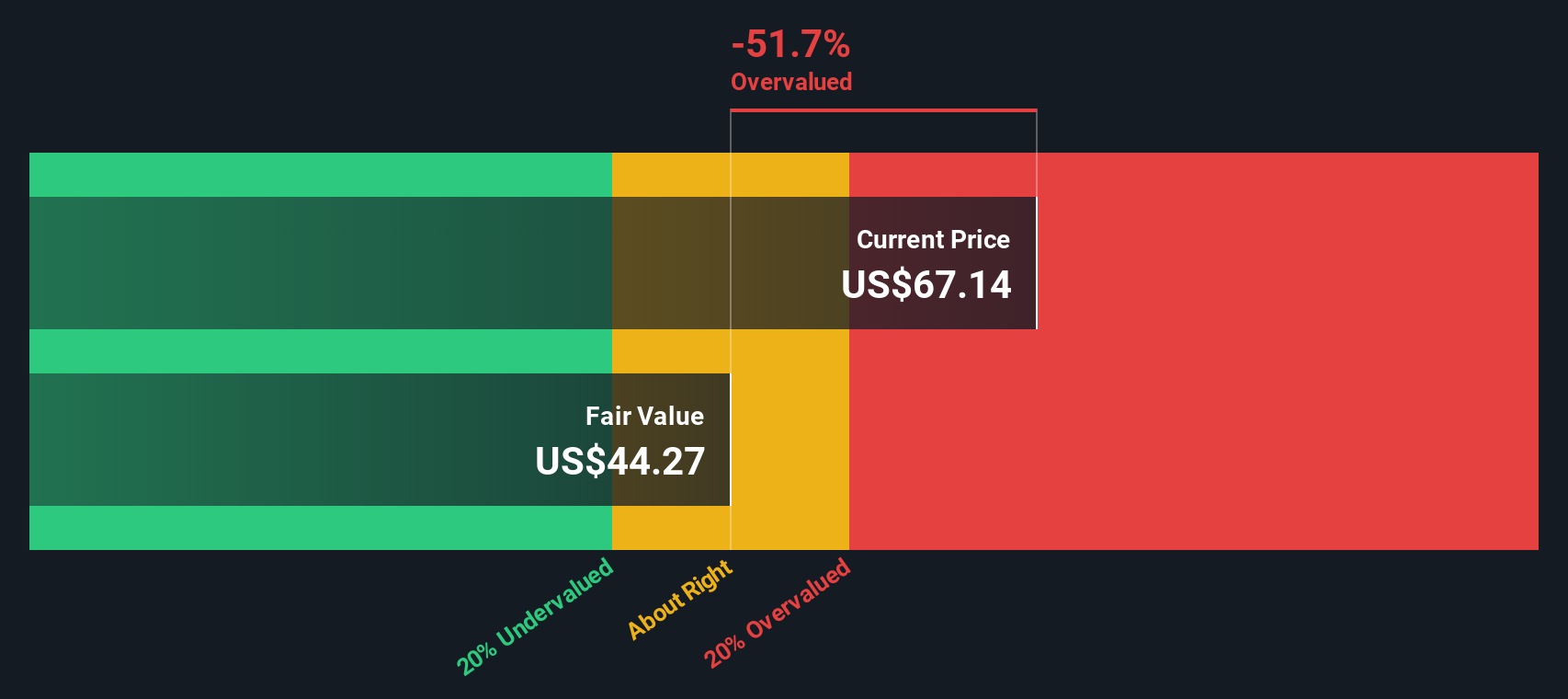

Based on the DCF model’s cash flow projections, the intrinsic value for Symbotic is $71.12 per share. Compared to the current share price, this analysis suggests the stock is about 19.9% overvalued.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Symbotic may be overvalued by 19.9%. Discover 928 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Symbotic Price vs Sales (P/S)

The Price-to-Sales (P/S) ratio is a popular way to value companies in high-growth or early-stage industries where profits may not yet be consistent. This makes it a suitable metric for evaluating Symbotic. The P/S ratio helps investors understand how much they are paying for each dollar of the company's sales, which is especially useful for fast-expanding technology and automation companies.

When considering what a "normal" or "fair" P/S ratio should be, growth potential and risk are important factors. Investors tend to pay a higher multiple for companies expected to deliver above-average revenue growth or those with lower perceived risks, while companies with uncertain prospects might trade at lower multiples.

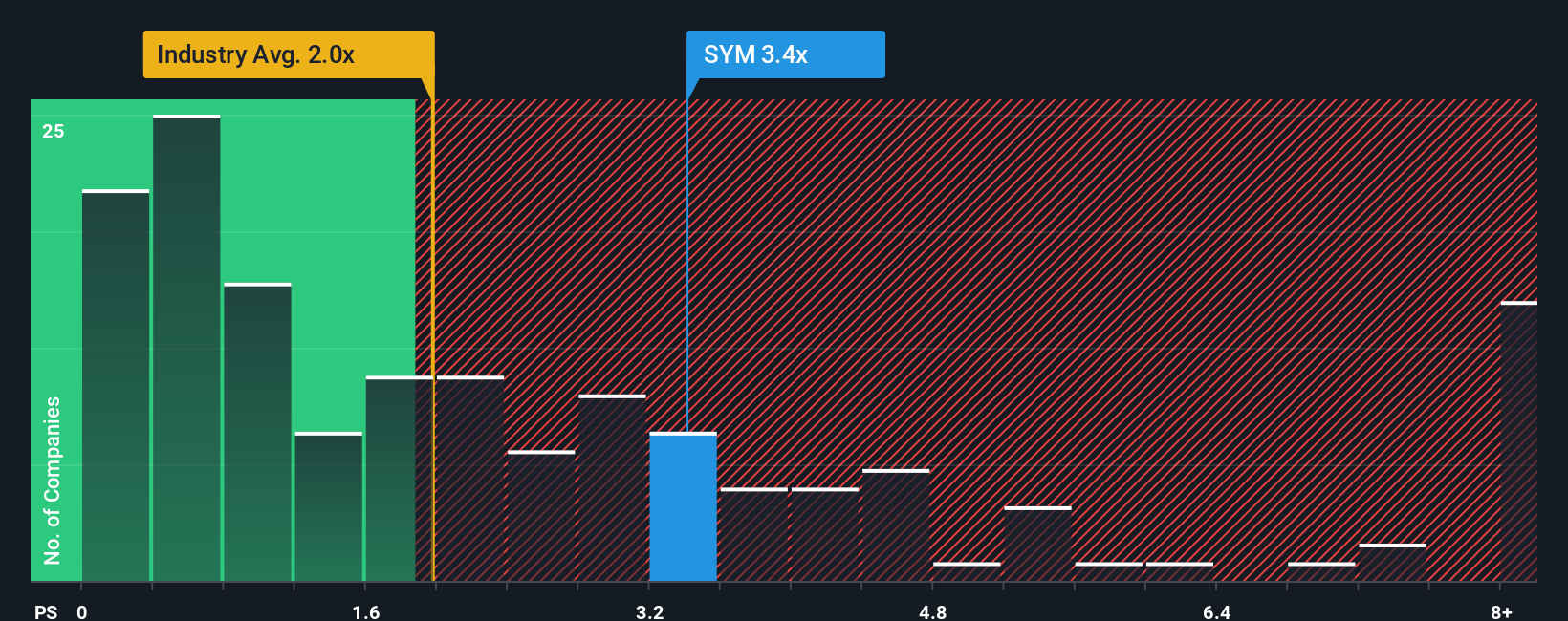

Symbotic currently trades at a P/S ratio of 4.31x. For context, this sits above both the industry average of 1.99x and the peer group average of 3.73x. However, comparing blindly to these averages can be misleading since they do not account for company-specific qualities like growth rates or risk profiles.

This is where Simply Wall St’s Fair Ratio comes in. Their proprietary Fair Ratio for Symbotic is 4.34x, which incorporates a tailored view of the company’s expected earnings growth, industry norms, profitability, company size, and risk. This approach makes it a more personalized benchmark than generic industry or peer numbers. The closeness of Symbotic’s actual P/S to the Fair Ratio suggests its valuation closely matches its prospects and risk profile.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1441 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Symbotic Narrative

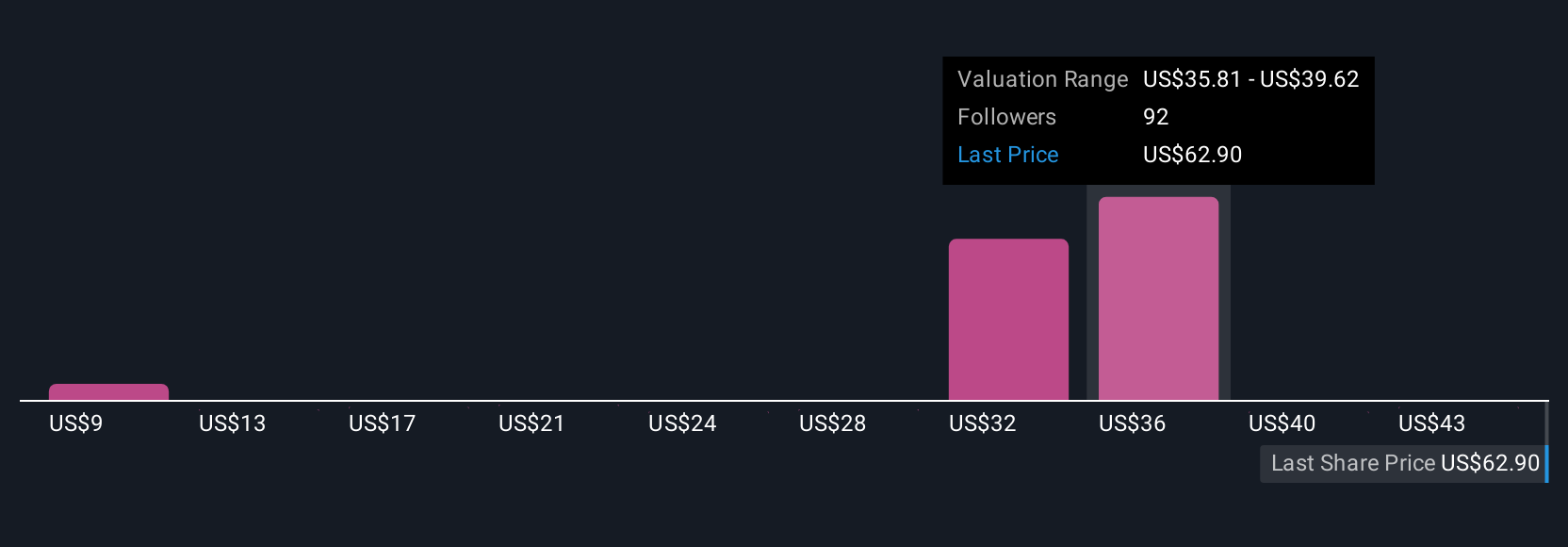

Earlier, we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a brief story investors create about a company, expressing what they believe will drive its future growth, profitability, and ultimate fair value. Instead of just relying on numbers, Narratives connect the company’s real-world story, including its strengths, challenges, and industry shifts, to a financial forecast and a fair value estimate.

Narratives are designed to be simple, accessible, and interactive, and are available directly on the Simply Wall St Community page, where millions of investors share their perspectives. By sharing your Narrative for Symbotic, whether you see sustained automation demand, margin improvements, or competitive risks, you can link your view of the business to concrete estimates for revenue, profits, and valuation.

This approach empowers you to make more confident buy or sell decisions. You can instantly compare your Fair Value, based on your story and assumptions, with Symbotic’s current market price. Your Narrative automatically updates as new news or earnings are released. For example, one investor might forecast robust earnings and set a fair value near the bullish $60.00 target, while another, focusing on deployment delays, might estimate fair value closer to the lowest $10.00 estimate. This highlights how Narratives help you ground your decisions in your personal outlook.

Do you think there's more to the story for Symbotic? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:SYM

Symbotic

An automation technology company, develops technologies to enhance operating efficiencies in modern warehouses.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026