- United States

- /

- Construction

- /

- NasdaqGS:STRL

Sterling Infrastructure (STRL): Assessing Valuation Following $400 Million Share Buyback Announcement

Reviewed by Simply Wall St

Sterling Infrastructure (STRL) just announced a fresh share buyback program, approving up to $400 million in repurchases over the next two years. Share buybacks can signal management’s confidence and may draw attention from value-focused investors.

See our latest analysis for Sterling Infrastructure.

Sterling Infrastructure’s buyback news comes as the company rides a wave of momentum. Its 2024 share price return stands at an impressive 98.5%, and the latest total shareholder return over 12 months reached 67.3%. Recent quarters have seen some volatility, but over the past five years, shareholders have enjoyed a remarkable 1,980% total return, highlighting sustained performance and strong growth perceptions around the business.

If Sterling’s moves have you curious about other standout performers, consider exploring the market’s fast growers with high insider ownership. You can broaden your search and discover fast growing stocks with high insider ownership

With shares nearly doubling this year and a new buyback in play, the question now is whether Sterling Infrastructure’s stellar run leaves further upside or if investors are already paying for tomorrow’s growth today.

Most Popular Narrative: 26.6% Undervalued

Sterling Infrastructure’s narrative-driven fair value estimate stands at $453, a full 36% above its recent closing price. This gap highlights optimism surrounding the company’s future growth and margin trajectory.

Record-high and growing backlog, particularly in E-Infrastructure Solutions (up 44% year-over-year to $1.2 billion), coupled with a robust pipeline of future phase work approaching $2 billion, provides strong multi-year revenue visibility and stability, mitigating downside risk to revenues and supporting sustained earnings growth.

Want to know why the market’s so confident? The fair value here is powered by aggressive top-line forecasts and margin assumptions not typical for this industry. Want to see the bold projections and daring expectations built into these estimates? Take a closer look at the narrative’s numbers and see what could really move the stock.

Result: Fair Value of $453 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained revenue growth is vulnerable to shifts in mega-project activity and potential slowdowns in infrastructure stimulus funding. These factors could challenge Sterling’s momentum.

Find out about the key risks to this Sterling Infrastructure narrative.

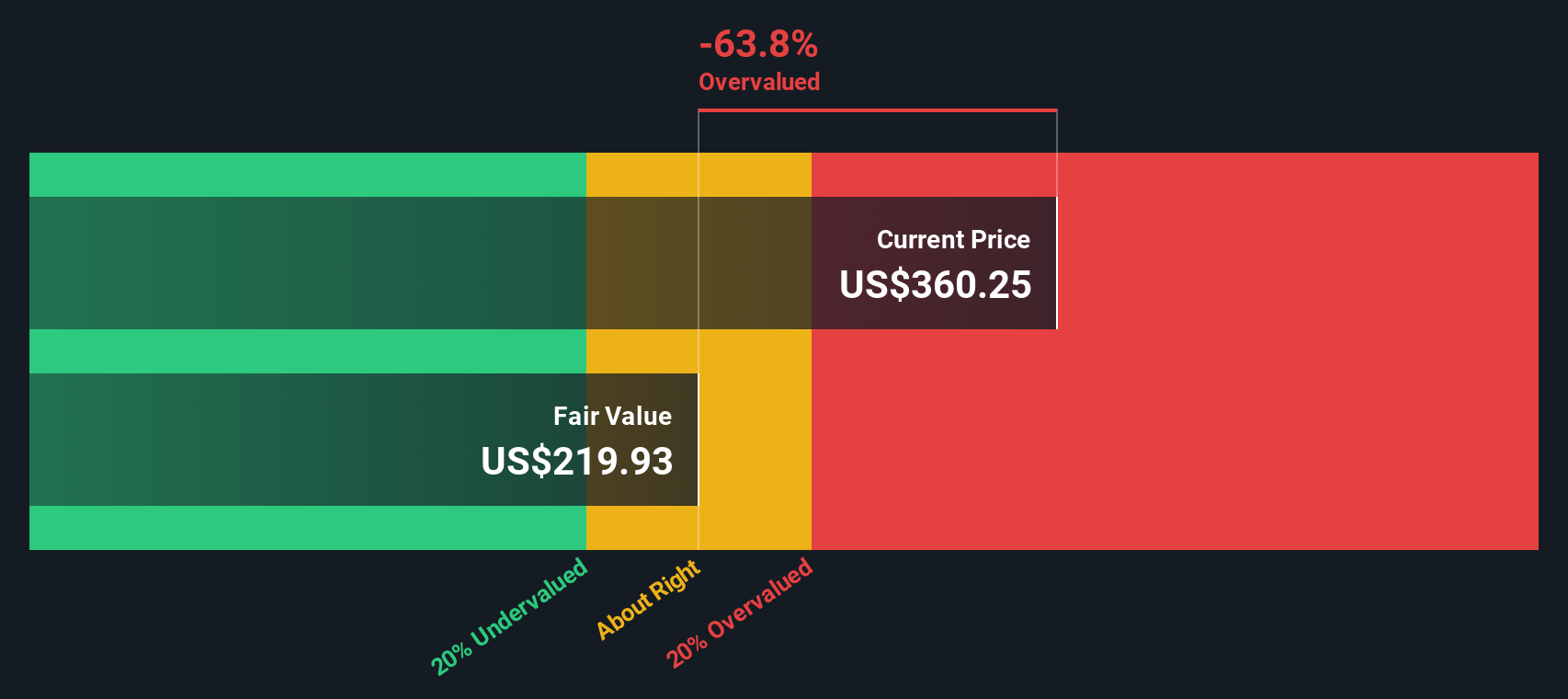

Another View: Discounted Cash Flow Perspective

Taking a different angle, our DCF model estimates Sterling's fair value at $314. This is actually below its recent market price, suggesting that the current optimism may already be reflected. As a result, there could be less margin for error if growth falters. Which approach offers the best read on value?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sterling Infrastructure for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 931 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sterling Infrastructure Narrative

If this perspective doesn’t fully align with your own, take a few minutes to review the figures and shape your own narrative in just moments. Do it your way

A great starting point for your Sterling Infrastructure research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Serious about staying ahead? Every day you wait is a chance for others to spot the next breakout first. These three screeners offer unique angles to put you one step ahead.

- Capitalize on global disruption by tapping into these 26 AI penny stocks. These companies are making waves in intelligent automation, productivity enhancements, and AI-driven business models.

- Secure your portfolio with reliable cash flow. See which companies boast attractive yields through these 14 dividend stocks with yields > 3%, delivering income opportunities above 3%.

- Position yourself at the forefront of financial innovation with these 81 cryptocurrency and blockchain stocks, focused on companies leveraging blockchain and next-generation digital assets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:STRL

Sterling Infrastructure

Engages in the provision of e-infrastructure, transportation, and building solutions in the United States.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success