- United States

- /

- Construction

- /

- NasdaqGS:STRL

Does Sterling Infrastructure’s 125% Surge in 2025 Reflect Its Real Value After New Contracts?

Reviewed by Bailey Pemberton

- Curious if Sterling Infrastructure is still a good value after its jaw-dropping run? Let's take a look at what the numbers and the market are telling us.

- The stock has soared an incredible 125.3% year-to-date and is up 145.9% over the past year, showing a serious momentum shift that has caught investors' attention.

- Driving these moves, Sterling has featured in headlines about its innovative infrastructure contracts, ongoing expansion projects, and new strategic partnerships. These are signs that growth ambitions are being recognized by the market. Additionally, industry focus on infrastructure investment has shone a spotlight on companies like Sterling recently.

- Even after such a strong performance, Sterling Infrastructure scores just 1/6 on our valuation checks, which means only one key metric flashes undervalued. Next, we will break down the different ways to value a company like Sterling, but stick around to discover a much more insightful perspective on value at the end of this article.

Sterling Infrastructure scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Sterling Infrastructure Discounted Cash Flow (DCF) Analysis

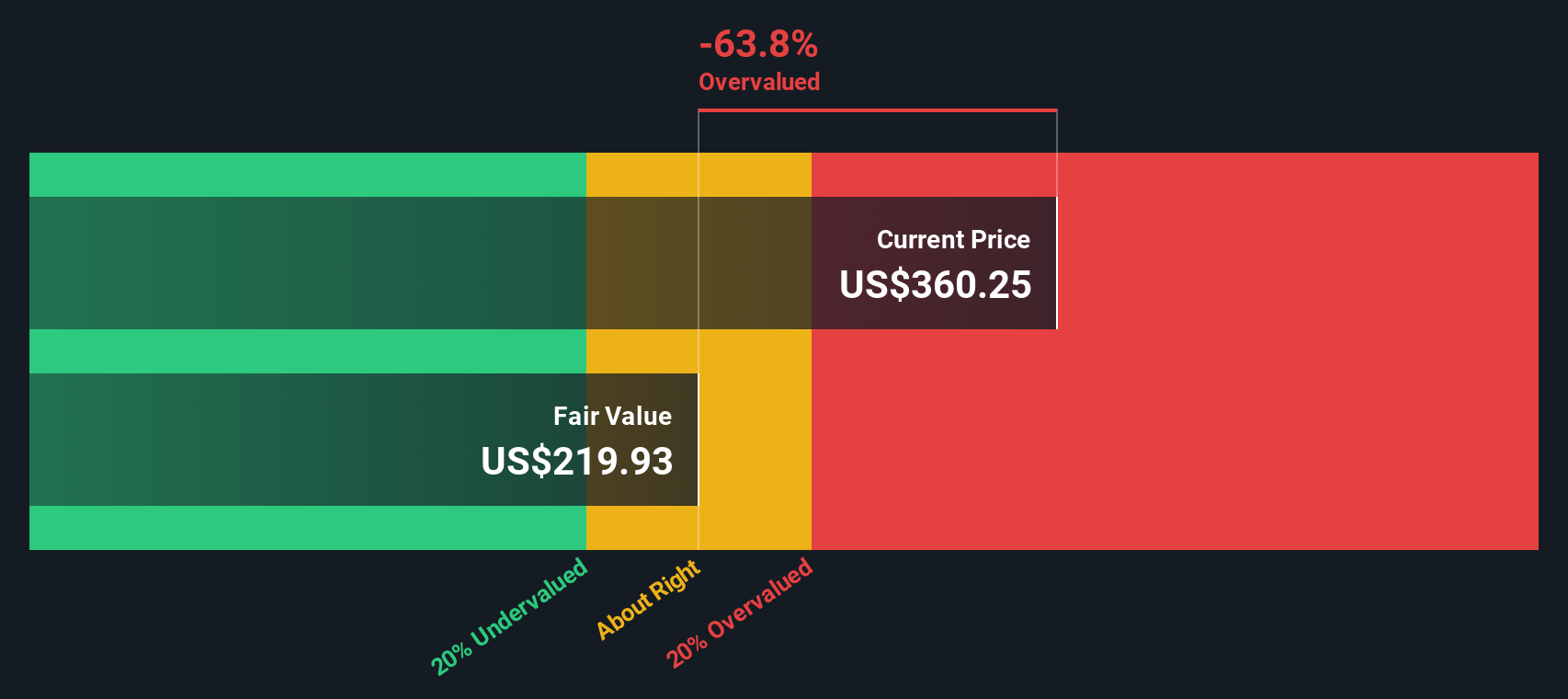

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its expected future cash flows and then discounting those projections back to today's dollars. Essentially, it aims to determine what Sterling Infrastructure is really worth based on how much cash it can be expected to generate for shareholders over time.

Sterling's latest reported Free Cash Flow stands at $423.5 million. Analysts offer concrete cash flow projections for the next few years, with estimates up to 2027. After that point, future numbers are extrapolated based on market assumptions. For example, Free Cash Flow is projected to rise to about $403.4 million in 2026 and $380.3 million by 2027, and then continue stabilizing in the following years as per Simply Wall St's calculations. All of these cash flows are discounted to present value in the model using a two-stage approach.

After running this analysis, the DCF model estimates an intrinsic value for Sterling Infrastructure of $208.40 per share. Compared to the current market price, this implies the stock is trading approximately 81.3% above its intrinsic value. In other words, the shares are significantly overvalued according to this cash flow-based approach.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Sterling Infrastructure may be overvalued by 81.3%. Discover 832 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Sterling Infrastructure Price vs Earnings (P/E Ratio)

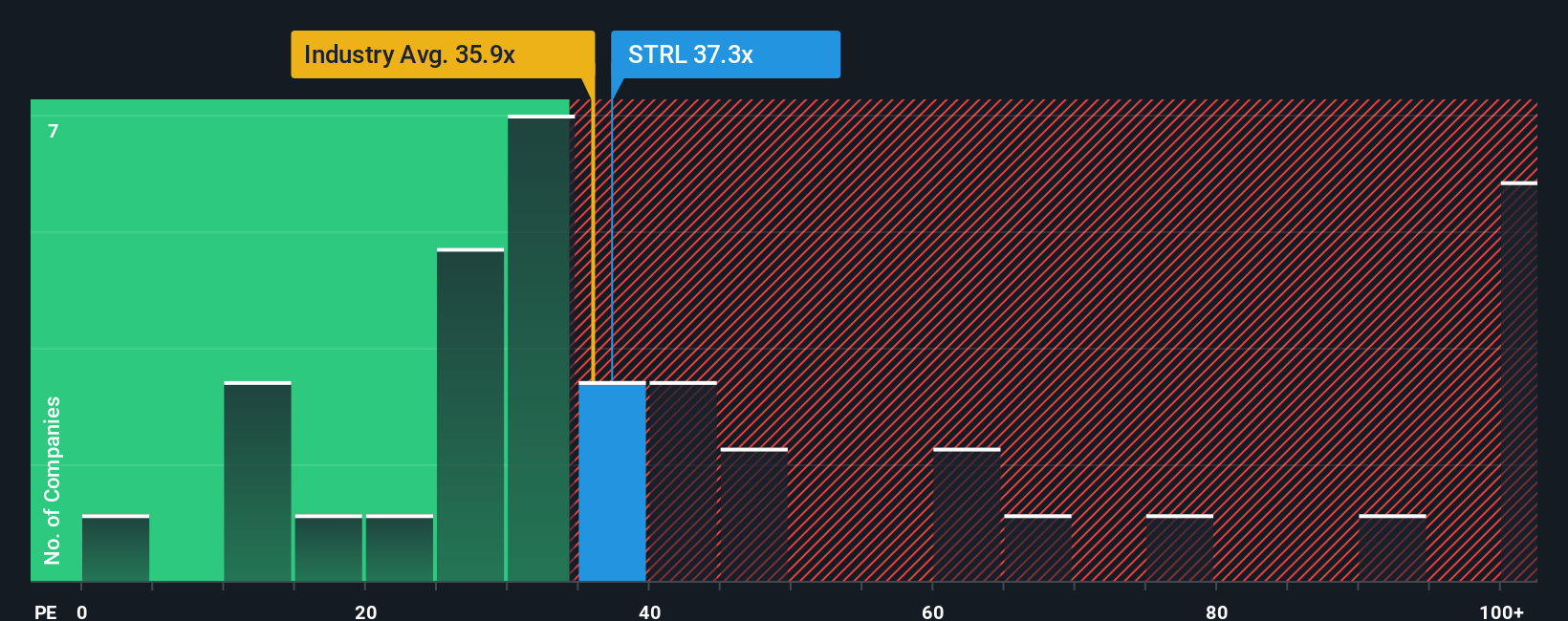

The Price-to-Earnings (P/E) ratio is a go-to valuation metric for analyzing profitable companies because it measures how much investors are willing to pay for each dollar of current earnings. This makes it a helpful tool for assessing whether a stock is expensive or cheap relative to its profitability.

What is considered a "fair" P/E ratio is influenced by how fast a company is growing and the level of risks involved. High-growth companies typically justify higher P/E ratios, while more stable or riskier businesses tend to trade at lower multiples. It is also important to check how a company's P/E compares to its peers and the broader industry.

Sterling Infrastructure is currently trading at a P/E of 40.3x. For context, the average P/E in the Construction industry is 34.5x, and the peer group sits even higher at 51.8x. While this suggests Sterling is priced above the industry average but below its peers, Simply Wall St provides additional insight with its proprietary "Fair Ratio." This measure takes into account Sterling's unique blend of growth prospects, profit margins, risk profile, and market cap instead of relying solely on general industry standards.

According to Simply Wall St, Sterling's Fair P/E Ratio is 35.6x. Since its current P/E is meaningfully higher, this signals the stock could be a little pricey when considering its growth, risks, and fundamentals together.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Sterling Infrastructure Narrative

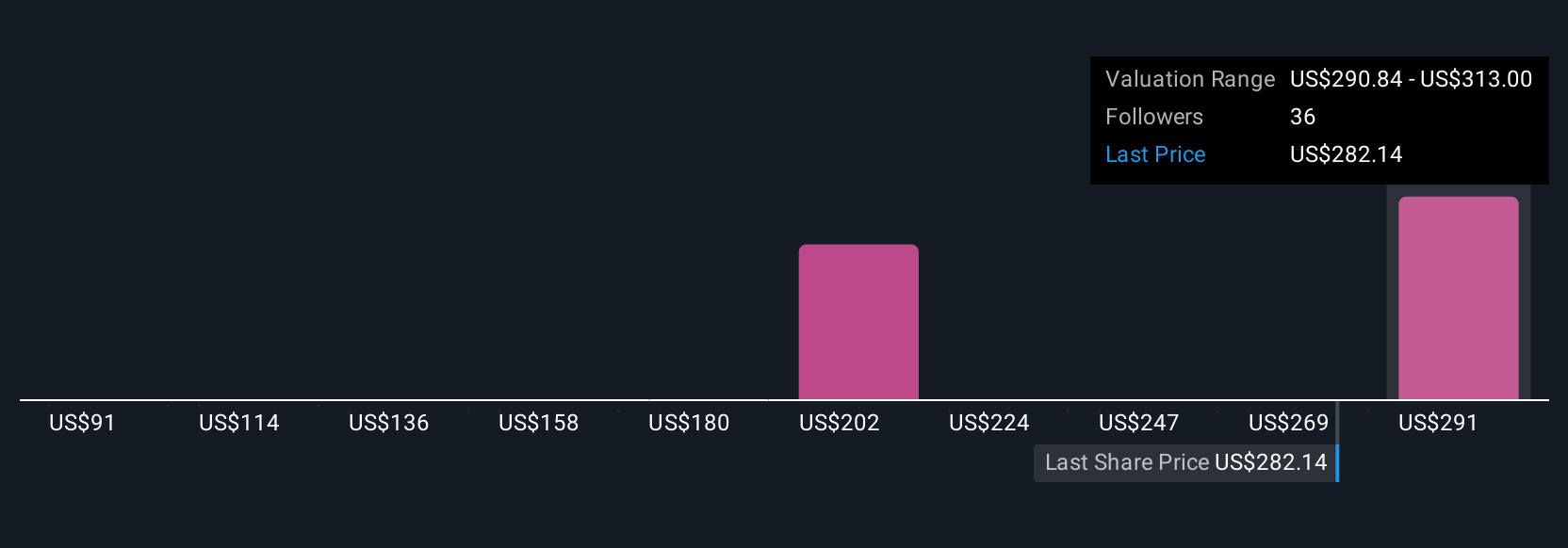

Earlier we mentioned that there is an even better way to understand valuation. Let's introduce you to Narratives. A Narrative is how you tie a company's story and outlook to your own financial forecasts. It is a personal, data-driven scenario where you estimate fair value by combining your views on Sterling Infrastructure’s future revenue, earnings, and margins.

Rather than just relying on static numbers or general ratios, Narratives help you connect what you believe about the business to a specific financial forecast and a resulting value per share. This approach is much more dynamic and accessible, and it is available to anyone on Simply Wall St’s Community page, where millions of investors share and refine Narratives each day.

Narratives make buy and sell decisions clearer. You can directly compare your Fair Value with the current share price, and as new news or earnings arrive, your values update in real time, so your view stays relevant. For instance, some investors see Sterling Infrastructure’s fair value as high as $355 if growth and margins stay strong, while others estimate just $254 if margin pressures increase or mega-project tailwinds fade.

Do you think there's more to the story for Sterling Infrastructure? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:STRL

Sterling Infrastructure

Engages in the provision of e-infrastructure, transportation, and building solutions in the United States.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives