- United States

- /

- Machinery

- /

- NasdaqGM:PDYN

Risks Still Elevated At These Prices As Sarcos Technology and Robotics Corporation (NASDAQ:STRC) Shares Dive 25%

The Sarcos Technology and Robotics Corporation (NASDAQ:STRC) share price has softened a substantial 25% over the previous 30 days, handing back much of the gains the stock has made lately. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 86% loss during that time.

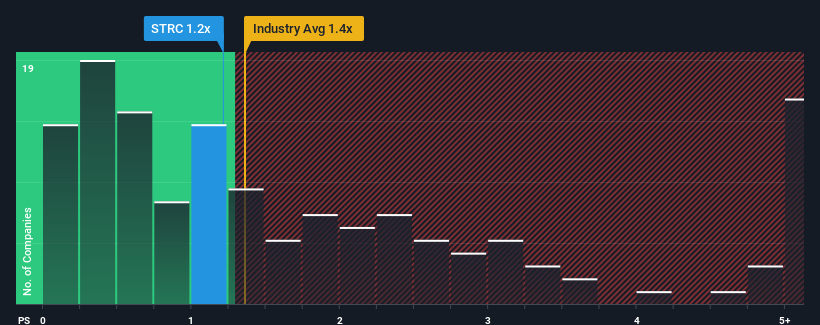

In spite of the heavy fall in price, it's still not a stretch to say that Sarcos Technology and Robotics' price-to-sales (or "P/S") ratio of 1.2x right now seems quite "middle-of-the-road" compared to the Machinery industry in the United States, where the median P/S ratio is around 1.4x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Sarcos Technology and Robotics

How Has Sarcos Technology and Robotics Performed Recently?

Recent times have been advantageous for Sarcos Technology and Robotics as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Sarcos Technology and Robotics.How Is Sarcos Technology and Robotics' Revenue Growth Trending?

Sarcos Technology and Robotics' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 22%. The latest three year period has also seen an excellent 31% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 47% as estimated by the only analyst watching the company. Meanwhile, the broader industry is forecast to expand by 1.4%, which paints a poor picture.

With this in consideration, we think it doesn't make sense that Sarcos Technology and Robotics' P/S is closely matching its industry peers. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

What Does Sarcos Technology and Robotics' P/S Mean For Investors?

With its share price dropping off a cliff, the P/S for Sarcos Technology and Robotics looks to be in line with the rest of the Machinery industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

While Sarcos Technology and Robotics' P/S isn't anything out of the ordinary for companies in the industry, we didn't expect it given forecasts of revenue decline. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If the poor revenue outlook tells us one thing, it's that these current price levels could be unsustainable.

And what about other risks? Every company has them, and we've spotted 4 warning signs for Sarcos Technology and Robotics (of which 1 shouldn't be ignored!) you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:PDYN

Palladyne AI

A software company, focuses on delivering software that enhances the utility and functionality of third-party stationary and mobile robotic systems in the United States.

Excellent balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives