- United States

- /

- Machinery

- /

- NasdaqGM:PDYN

Potential Upside For Sarcos Technology and Robotics Corporation (NASDAQ:STRC) Not Without Risk

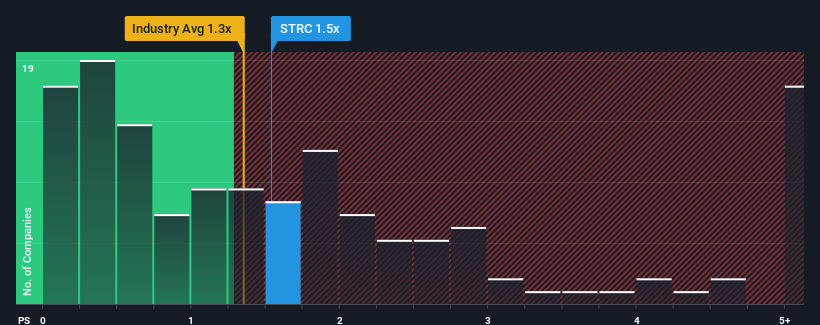

There wouldn't be many who think Sarcos Technology and Robotics Corporation's (NASDAQ:STRC) price-to-sales (or "P/S") ratio of 1.5x is worth a mention when the median P/S for the Machinery industry in the United States is similar at about 1.3x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Sarcos Technology and Robotics

What Does Sarcos Technology and Robotics' Recent Performance Look Like?

Recent times have been advantageous for Sarcos Technology and Robotics as its revenues have been rising faster than most other companies. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Sarcos Technology and Robotics.How Is Sarcos Technology and Robotics' Revenue Growth Trending?

In order to justify its P/S ratio, Sarcos Technology and Robotics would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered an exceptional 22% gain to the company's top line. Pleasingly, revenue has also lifted 31% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 78% per annum during the coming three years according to the dual analysts following the company. That's shaping up to be materially higher than the 9.8% per year growth forecast for the broader industry.

In light of this, it's curious that Sarcos Technology and Robotics' P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Bottom Line On Sarcos Technology and Robotics' P/S

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Sarcos Technology and Robotics currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Before you settle on your opinion, we've discovered 4 warning signs for Sarcos Technology and Robotics that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:PDYN

Palladyne AI

A software company, focuses on delivering software that enhances the utility and functionality of third-party stationary and mobile robotic systems in the United States.

Excellent balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives