- United States

- /

- Electrical

- /

- NasdaqGM:SHLS

Shoals Technologies Group (SHLS): High Valuation Fuels Debate as Earnings Growth Slows Below Long-Term Trend

Reviewed by Simply Wall St

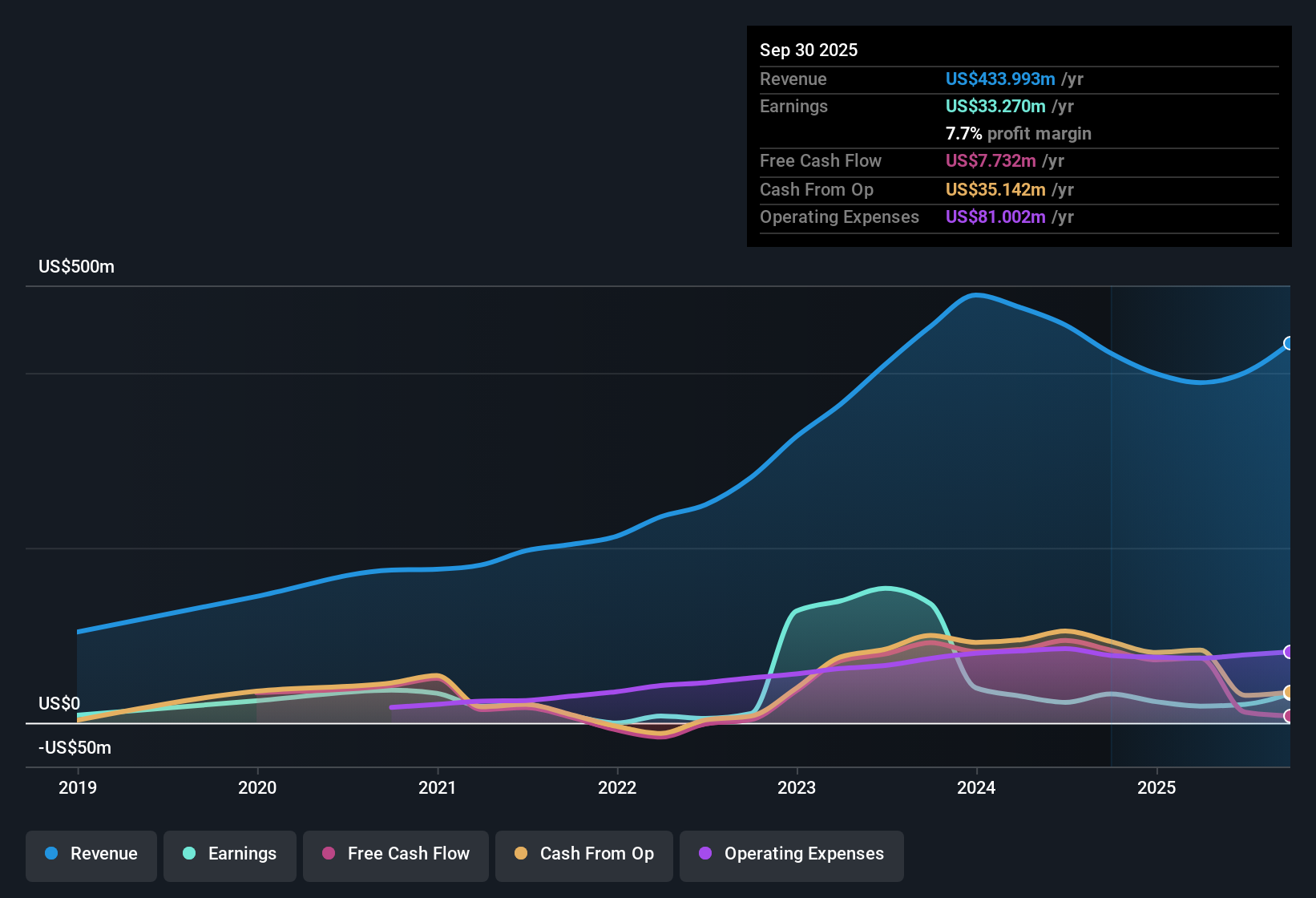

Shoals Technologies Group (SHLS) posted earnings growth of 1.2% over the past year, falling short of its five-year average of 7.1% per year. Looking ahead, analysts expect Shoals’ earnings to grow at an impressive 26.4% per year, with revenue forecasts indicating an 11% annual rise. Both figures are slightly ahead of the broader US market. The company currently maintains a 7.7% profit margin, just under last year’s 7.8%, giving investors a picture of steady, if modest, profitability as the company gears up for faster growth.

See our full analysis for Shoals Technologies Group.Next, let’s see how these results compare to the narratives investors and analysts have built around Shoals. Some talking points are likely to get a boost, while others may be up for debate.

See what the community is saying about Shoals Technologies Group

Gross Margins Flag Further Pressure

- Shoals’ gross margin dropped to 37.2% from 40.3% year-over-year, even though overall profit margins remained relatively stable at 7.7% compared to 7.8% a year earlier.

- Analysts' consensus view highlights persistent margin compression, which contrasts with the company’s narrative of long-term earnings strength.

- Although operational efficiencies and a focus on higher-margin, innovative products are intended to support margins, competitive pressures and promotional pricing are eroding overall profitability, as shown by the lower gross margin.

- Bulls may emphasize the potential for future margin expansion due to automation and lean manufacturing, yet the trend in the latest results indicates Shoals must reverse these pressures to validate the optimistic outlook.

- Consensus suggests that stabilizing or increasing gross margins is crucial for the earnings growth trajectory to remain intact over time. The latest figures bring that outcome into focus.

- To see how the latest margin results add nuance to the broader Shoals story, dive deeper into the full analyst narrative for the company's outlook. 📊 Read the full Shoals Technologies Group Consensus Narrative.

Cash Outflows Limit Flexibility

- In Q2, Shoals spent $11.2 million on legal and warranty remediation, contributing to a negative free cash flow of $26.0 million, which could impact its ability to fund planned growth.

- The consensus narrative raises concerns that these elevated cash outflows and remediations directly challenge Shoals’ ability to self-finance investment and manage execution risks.

- Even with strong revenue forecasts, negative free cash flow provides less buffer to absorb unplanned costs or competitive setbacks.

- Ongoing legal and warranty expenses highlight a risk that Shoals’ future cash generation may lag earnings unless operational issues are resolved promptly.

Premium Valuation Stokes Debate

- Shoals currently trades at a forward price-to-earnings ratio of 46.9x, well above the US electrical industry average of 30.3x and its peer average of 32.5x. The current share price of $9.33 is also above its DCF fair value of $7.87.

- Analysts' consensus view sees this premium valuation as a point of tension, as rewards depend on Shoals outperforming market expectations for both margin recovery and revenue diversification.

- If Shoals meets its ambitious forecasts, the current valuation may be justified. However, any sustained cost pressures or setbacks in margin improvement allow little room for disappointment.

- The consensus price target is $9.48, only slightly above the last close, indicating limited upside unless Shoals delivers growth that outpaces the industry and supports the higher multiple.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Shoals Technologies Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have another take on these results? Share your perspective and build your own narrative in just a few minutes: Do it your way.

A great starting point for your Shoals Technologies Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Shoals faces compressed margins, negative free cash flow, and valuation risks, which heighten concerns about its ability to balance growth with financial stability.

If you're seeking companies with stronger valuations and better downside protection, filter for attractive opportunities using these 836 undervalued stocks based on cash flows before making your next investment move.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:SHLS

Shoals Technologies Group

Provides electrical balance of system (EBOS) solutions and components in the United States and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives