- United States

- /

- Electrical

- /

- NasdaqGM:SHLS

Is Shoals Technologies Group Fairly Priced After a 52.7% Rally and Recent Volatility?

Reviewed by Bailey Pemberton

- Wondering if Shoals Technologies Group is a hidden bargain or priced just right? You are not alone. Questions about its true value are buzzing among investors right now.

- After a 52.7% rally so far this year and a strong 50.5% gain over the past 12 months, the stock has also experienced more volatility recently, dipping 12.3% in the last week but rising 8.7% for the month.

- The solar solutions provider has caught extra attention from industry watchers as renewable energy policy shifts and large infrastructure deals make headlines. This broader sector momentum, along with increasing demand for clean technology, appears to be fueling both optimism and renewed scrutiny around Shoals Technologies Group's outlook.

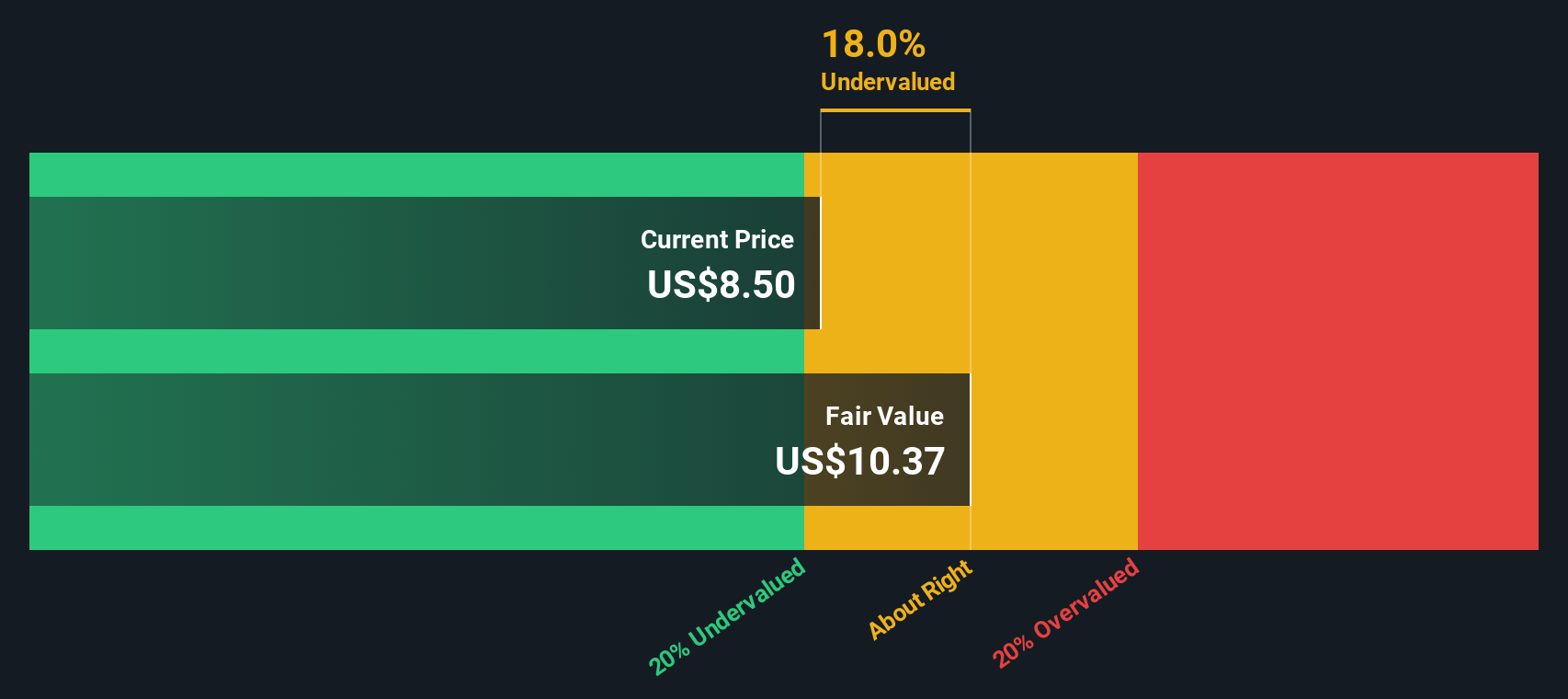

- Shoals currently scores a 1/6 on our undervaluation checks, so there is plenty to unpack about its market price. Next, we will break down the classic valuation approaches used to judge Shoals. Make sure to stick around, as we will reveal an even more insightful angle at the end of this article.

Shoals Technologies Group scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Shoals Technologies Group Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a fundamental valuation method that estimates the present value of a company by projecting its future cash flows and discounting them back to today. For Shoals Technologies Group, this approach looks at expected cash generation and considers the time value of money to provide an intrinsic value per share.

Shoals Technologies Group reported Free Cash Flow of $20.0 million over the last twelve months. Analyst forecasts suggest rapid growth ahead, with projections for annual Free Cash Flow climbing to $75.1 million by 2026 and reaching approximately $92.7 million in 2029. Beyond the next five years, further projections are extrapolated based on trends and sector assumptions. All figures are in US Dollars.

According to this DCF approach, the intrinsic fair value for Shoals Technologies Group’s stock is $7.89 per share. However, with the current market price reflecting a premium of 17.2 percent above this estimate, the stock appears overvalued using this model.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Shoals Technologies Group may be overvalued by 17.2%. Discover 841 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Shoals Technologies Group Price vs Earnings

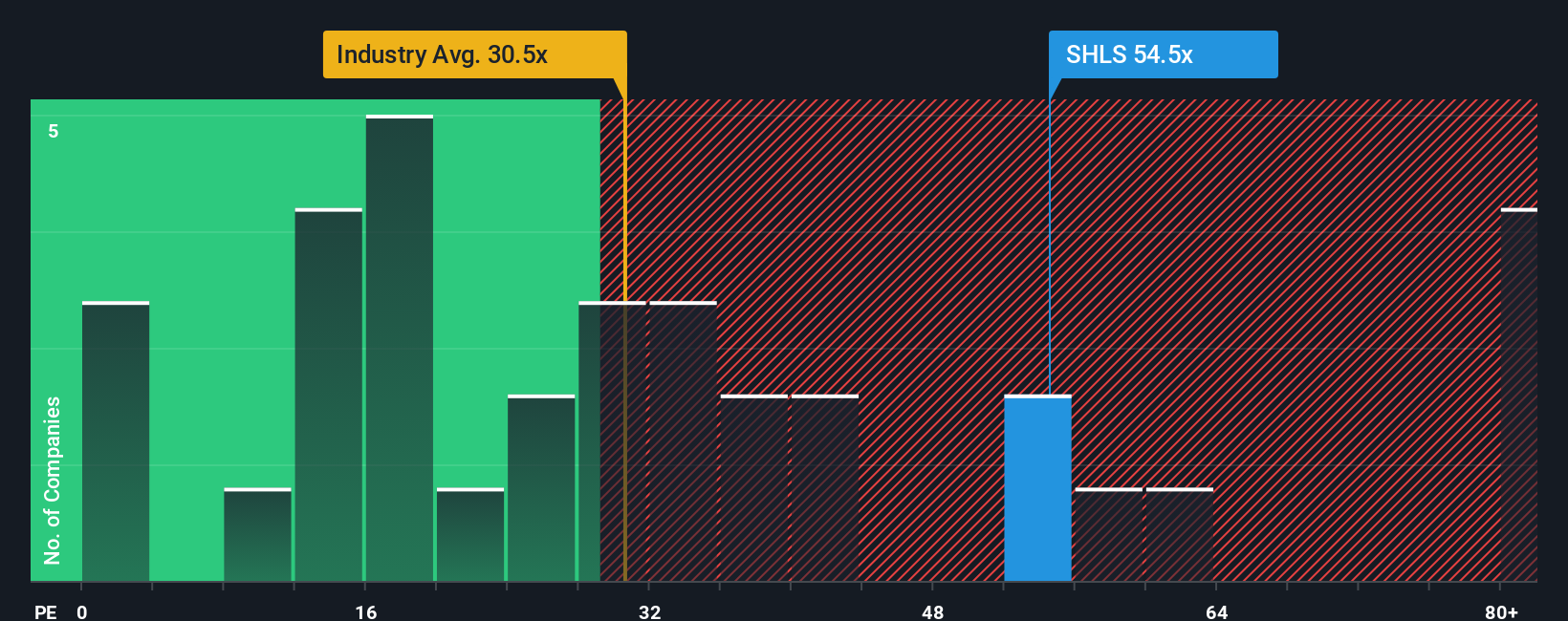

The Price-to-Earnings (PE) ratio is the most common valuation metric for profitable companies like Shoals Technologies Group because it directly connects what investors are willing to pay with each dollar of company earnings. Since Shoals is generating positive net income, the PE ratio offers a practical lens for comparing its stock price with both industry standards and its own profitability.

Growth prospects and risk play a major part in determining what a "normal" or "fair" PE ratio should be. Companies with faster earnings growth or lower perceived risk often justify higher PE ratios, while slower and riskier businesses tend to trade at lower multiples. This makes benchmark comparisons important but incomplete.

Shoals Technologies Group is currently trading at a PE ratio of 46.5x. That is well above the Electrical industry average of 30.3x and higher than the average of its peer group at 32.4x. However, Simply Wall St uses a Fair Ratio model to go a step further. The Fair Ratio for Shoals, which takes into account its specific growth forecasts, profit margins, market cap, risks and industry context, is calculated at 51.2x. This context-sensitive Fair Ratio provides a more accurate reference point than industry or peer averages alone.

Because Shoals Technologies Group’s actual PE ratio is only slightly below its Fair Ratio, the difference is not significant enough to call the stock meaningfully under or overvalued compared to its intrinsic operational metrics. It suggests the stock is about fairly valued on this measure.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

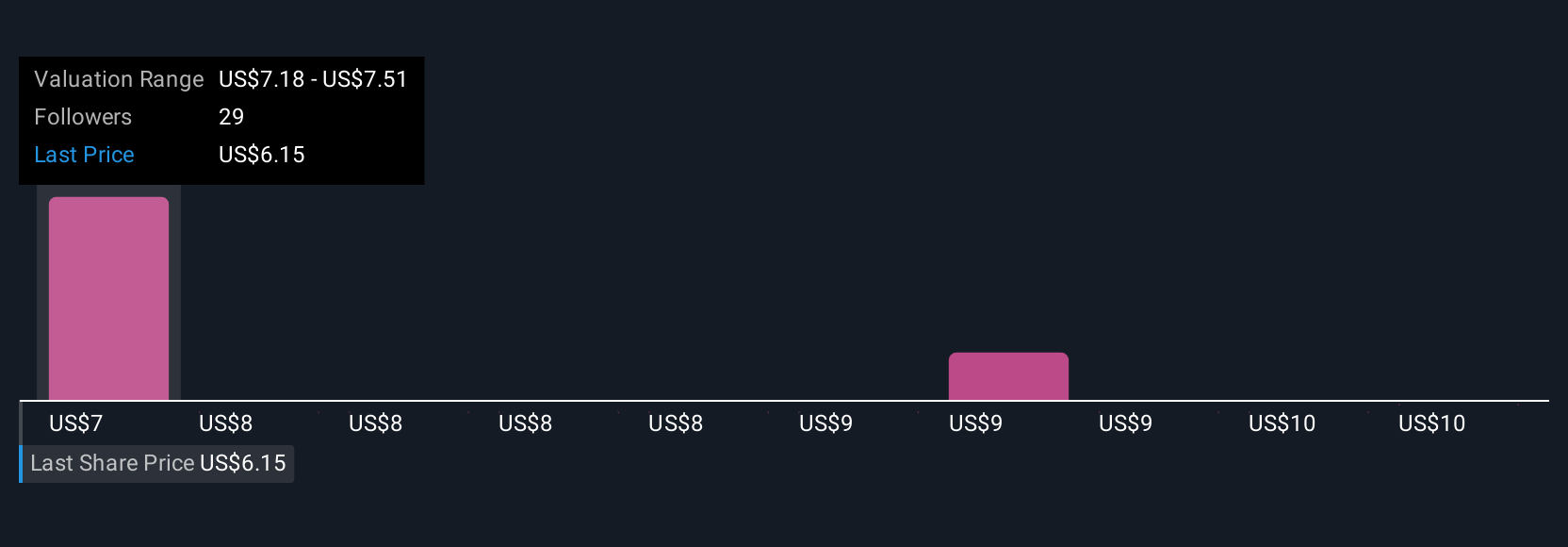

Upgrade Your Decision Making: Choose your Shoals Technologies Group Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your personal story or perspective on a company, combining your expectations for its future, such as revenue, earnings, and profit margins, with your view of what those assumptions are actually worth today.

With Narratives, you link a company's story (your forecast, key risks, and growth drivers) directly to financial projections and then to a fair value. This creates a much more powerful decision-making framework than numbers alone.

Simply Wall St’s platform, trusted by millions of investors, makes Narratives easy to use and update. Just head to the Community page for Shoals Technologies Group to see how others are thinking, or to contribute your own perspective.

Any time new information, like breaking news or fresh earnings, emerges, Narratives get dynamically updated. This ensures your fair value remains relevant and grounded in the latest facts.

This tool helps you decide confidently whether to buy or sell by showing if your Narrative’s Fair Value is above or below the current Share Price.

For example, the most optimistic investors see Shoals thriving on rapid demand growth and margin expansion, targeting a fair value near $11. The most cautious are wary of margin pressure and risk, setting their fair value closer to $4.

Do you think there's more to the story for Shoals Technologies Group? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:SHLS

Shoals Technologies Group

Provides electrical balance of system (EBOS) solutions and components in the United States and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives