- United States

- /

- Electrical

- /

- NasdaqGM:SHLS

Does Shoals Technologies Group's Q3 Profit Turnaround Signal a New Era for SHLS?

Reviewed by Sasha Jovanovic

- Shoals Technologies Group announced its third quarter 2025 results, reporting sales of US$135.8 million and net income of US$11.88 million, up substantially from the same period last year.

- This marks a turnaround from last year’s third quarter net loss to a profit, highlighting stronger operational performance and improved earnings per share.

- We’ll explore how Shoals’ transition to consistent quarterly profitability may influence its investment narrative going forward.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Shoals Technologies Group Investment Narrative Recap

To be a Shoals Technologies Group shareholder, you need to believe in the long-term growth of utility-scale solar and adjacent clean energy markets, as well as Shoals’ ability to translate its strong order backlog and expanding customer base into sustainable, profitable growth. The Q3 2025 earnings turnaround adds support to the ongoing catalyst of scaling operations efficiently, but margin pressures from pricing and elevated remediation costs remain the most significant short-term risk. The positive news does not materially alter these risks, with profitability still closely tied to maintaining margin discipline.

Of the recent company announcements, Shoals’ new patent for its Big Lead Assembly (BLA) IP stands out as highly relevant. Innovations to reduce the cost and complexity of solar projects could help Shoals defend pricing and margin, aligning directly with what investors are watching following the Q3 results, whether the company’s product enhancements can offset headwinds from competitive price pressures and increased legal or warranty expenses.

By contrast, investors should also be aware that margin compression, if persistent, may undercut the company’s path to...

Read the full narrative on Shoals Technologies Group (it's free!)

Shoals Technologies Group is projected to reach $589.7 million in revenue and $80.2 million in earnings by 2028. This outlook reflects an anticipated 13.8% annual revenue growth and an increase in earnings of about $59.1 million from the current $21.1 million.

Uncover how Shoals Technologies Group's forecasts yield a $8.72 fair value, a 17% downside to its current price.

Exploring Other Perspectives

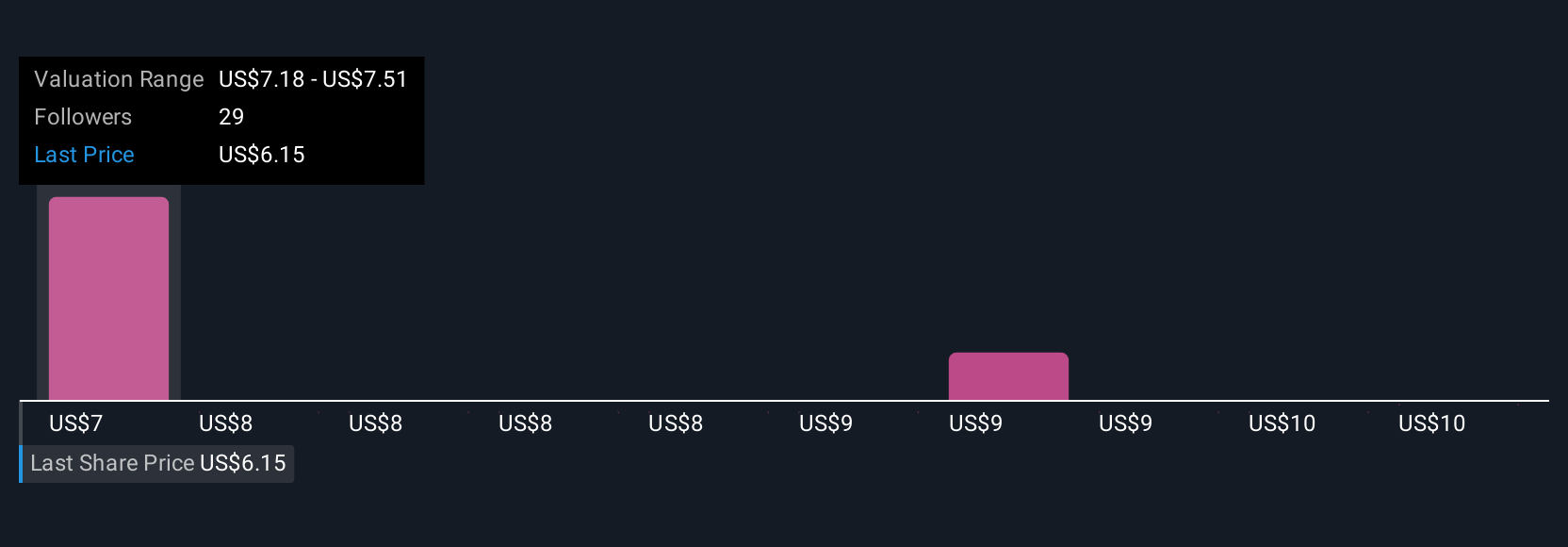

Simply Wall St Community users value Shoals stock between US$7.95 and US$8.73 based on two unique fair value estimates. While many are focused on innovations like the new BLA patent, margin pressure remains a key issue likely to shape future results, so it is worth considering these differing viewpoints.

Explore 2 other fair value estimates on Shoals Technologies Group - why the stock might be worth as much as $8.72!

Build Your Own Shoals Technologies Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Shoals Technologies Group research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Shoals Technologies Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Shoals Technologies Group's overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:SHLS

Shoals Technologies Group

Provides electrical balance of system (EBOS) solutions and components in the United States and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives