- United States

- /

- Aerospace & Defense

- /

- NasdaqCM:RKLB

Rocket Lab (RKLB): Reassessing Valuation After 74th Electron Launch and New iQPS Multi-Launch Deal

Reviewed by Simply Wall St

Rocket Lab (RKLB) just pulled off its 74th Electron mission by sending a synthetic aperture radar satellite into orbit for Japan’s iQPS. Along with a fresh multi-launch agreement, this move solidifies the company’s leadership in Earth-imaging deployments.

See our latest analysis for Rocket Lab.

After its landmark 74th Electron launch, Rocket Lab’s momentum is turning heads. Even as the 1-week and 1-month share price returns have pulled back sharply, the stock’s year-to-date share price return stands at an eye-popping 106.89%. Meanwhile, long-term investors have seen it all pay off with a 249.39% total shareholder return over the past year and a staggering 900.78% total return over three years, underscoring strong optimism about the company’s progress and future launches.

If you’re intrigued by Rocket Lab’s recent gains and want to see what else is taking off in aerospace and defense, you’ll want to explore See the full list for free.

Yet with the stock more than doubling year to date and analysts boosting their targets, the question remains: is Rocket Lab still an undervalued growth play, or has the market already priced in the company’s next phase?

Most Popular Narrative: 12% Undervalued

With a fair value set at $58.67 and Rocket Lab’s last close at $51.64, the narrative suggests there may be more room for share price growth. This outlook weighs the company’s trajectory against major sector tailwinds and its own ambitious roadmap.

Rocket Lab's move toward end-to-end space solutions, including the acquisition of Geost and expanding vertically integrated payload, satellite, and launch service capabilities, uniquely positions the company to capture larger national security and defense contracts such as the Golden Dome and SDA constellations. This supports significant top-line growth and enhanced gross margins in future quarters. Escalating demand for real-time data, earth observation, and global connectivity is driving increasing recurring revenue opportunities through satellite constellation launches and manufacturing. Rocket Lab's high Electron launch cadence and in-house satellite production are enabling the company to capitalize on these industry tailwinds and support multi-year revenue growth and backlog expansion.

Want to peek under the hood of this high-stakes valuation? The narrative hints at outsized growth estimates and a profit outlook shaped by bold financial projections. Curious which headline-making assumptions power this fair value? Dive in for the full story behind the numbers.

Result: Fair Value of $58.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued high R&D spending and potential setbacks with Neutron’s debut launch could quickly challenge the current growth and valuation story.

Find out about the key risks to this Rocket Lab narrative.

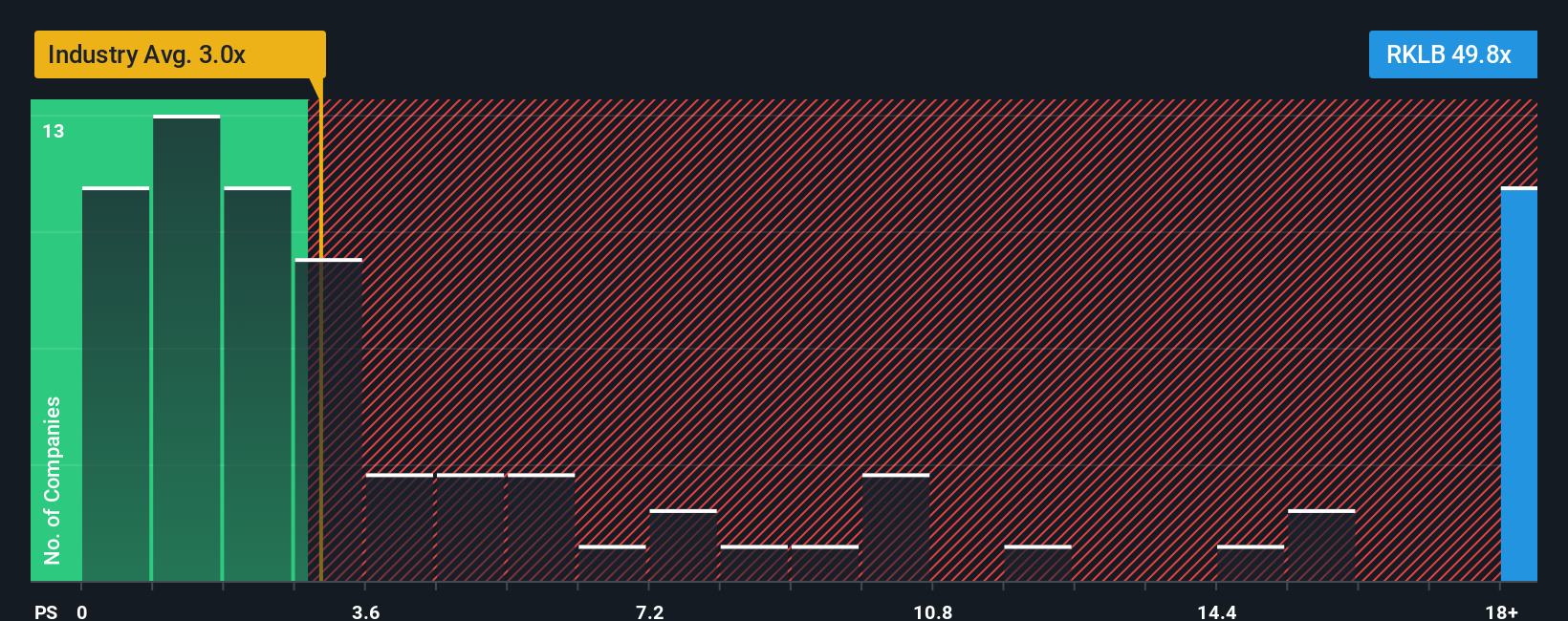

Another View: Multiples Tell a Different Story

While the fair value calculation points to Rocket Lab being undervalued, its current price-to-sales ratio of 49.6x is much higher than the US Aerospace & Defense industry average of 3x and the peer average of 12.6x. Even when compared to the sector’s fair ratio of 7x, Rocket Lab appears significantly overpriced. This suggests the market is already pricing in a lot of future growth. Could this premium leave investors exposed if expectations shift?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Rocket Lab Narrative

If you want to challenge these findings or carve out your own view on Rocket Lab, our tools let you build a custom narrative in just minutes. Do it your way

A great starting point for your Rocket Lab research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for Your Next Smart Investment?

Step ahead of the crowd and act on powerful ideas with our screener tools. Opportunities move fast, and you deserve to be in front, not behind.

- Uncover high-yield opportunities and kickstart your passive income journey by checking out these 16 dividend stocks with yields > 3%.

- Move early on digital disruption by scouting these 25 AI penny stocks that are reshaping industries with artificial intelligence innovation.

- Seize the advantage in tomorrow’s financial frontier and investigate these 82 cryptocurrency and blockchain stocks making waves in blockchain technology and digital assets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:RKLB

Rocket Lab

A space company, provides launch services and space systems solutions in the United States, Canada, Japan, and internationally.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives