- United States

- /

- Electrical

- /

- NasdaqGS:POWL

Unveiling Three Undiscovered Gems in United States Stocks

Reviewed by Simply Wall St

In the wake of a tumultuous week for U.S. markets, where a weak July jobs report triggered significant sell-offs and heightened volatility, investors are increasingly seeking stability in undervalued small-cap stocks. Amid this climate of uncertainty, identifying resilient companies with strong fundamentals becomes crucial for navigating market turbulence.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Jiayin Group | NA | 23.46% | 30.79% | ★★★★★★ |

| Mission Bancorp | 25.37% | 16.23% | 20.16% | ★★★★★★ |

| Teekay | NA | -6.48% | 55.79% | ★★★★★★ |

| Omega Flex | NA | 1.31% | 3.88% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.12% | 10.04% | ★★★★★★ |

| Gravity | NA | 15.31% | 24.42% | ★★★★★★ |

| CSP | 2.17% | -5.57% | 73.73% | ★★★★★☆ |

| Meta Data | 2151.54% | -34.97% | -16.25% | ★★★★☆☆ |

| FRMO | 0.19% | 6.49% | 15.82% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

PC Connection (NasdaqGS:CNXN)

Simply Wall St Value Rating: ★★★★★★

Overview: PC Connection, Inc., along with its subsidiaries, offers a range of IT solutions globally and has a market cap of approximately $1.91 billion.

Operations: The company generates revenue through three primary segments: Business Solutions ($1.08 billion), Enterprise Solutions ($1.18 billion), and Public Sector Solutions ($501.03 million).

PC Connection (CNXN) is making notable strides, with earnings growing by 16.8% over the past year, outpacing the Electronic industry’s -8.8%. The company trades at 6.1% below its estimated fair value and remains debt-free, highlighting a robust financial position. Recent Q2 results showed sales of US$736 million and net income of US$26 million compared to US$734 million and US$20 million last year. Additionally, CNXN announced a quarterly dividend of $0.10 per share payable on August 30, 2024.

- Unlock comprehensive insights into our analysis of PC Connection stock in this health report.

Review our historical performance report to gain insights into PC Connection's's past performance.

Powell Industries (NasdaqGS:POWL)

Simply Wall St Value Rating: ★★★★★★

Overview: Powell Industries, Inc., along with its subsidiaries, designs, develops, manufactures, sells, and services custom-engineered equipment and systems with a market cap of approximately $1.84 billion.

Operations: Powell Industries generates revenue primarily from its Electric Equipment segment, which accounted for $945.93 million. The company has a market cap of approximately $1.84 billion.

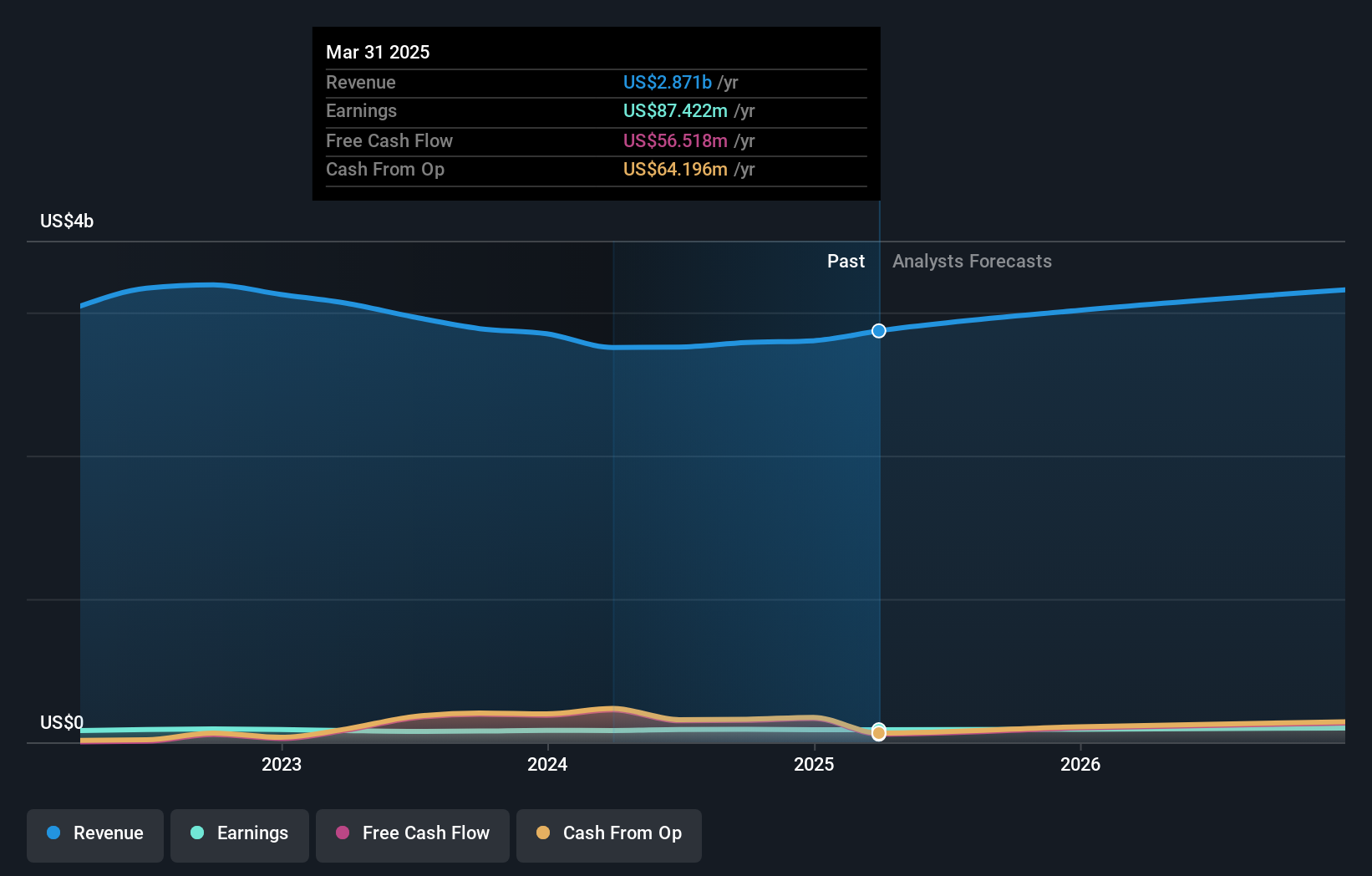

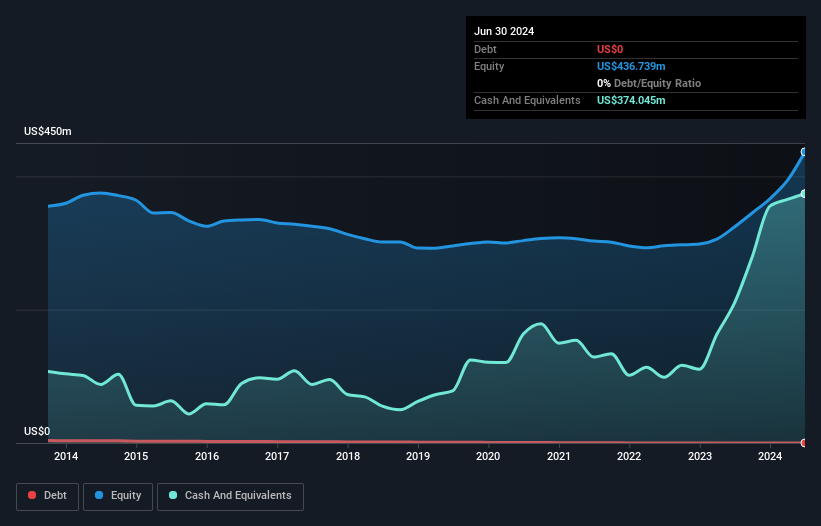

Powell Industries has experienced significant growth, with earnings increasing by 253.6% over the past year, outpacing the Electrical industry’s 19.8%. The company reported third-quarter sales of US$288.17 million and net income of US$46.22 million, a notable rise from last year's figures of US$192.37 million and US$18.45 million respectively. With no debt on its balance sheet and a price-to-earnings ratio of 14.1x, Powell appears to be trading at an attractive value compared to market peers.

- Click here to discover the nuances of Powell Industries with our detailed analytical health report.

Gain insights into Powell Industries' past trends and performance with our Past report.

OFG Bancorp (NYSE:OFG)

Simply Wall St Value Rating: ★★★★★★

Overview: OFG Bancorp, with a market cap of $1.98 billion, is a financial holding company offering various banking and financial services.

Operations: The company's primary revenue streams come from its diverse banking and financial services. With a market cap of $1.98 billion, OFG Bancorp generates significant income through these operations, focusing on efficient cost management to enhance profitability.

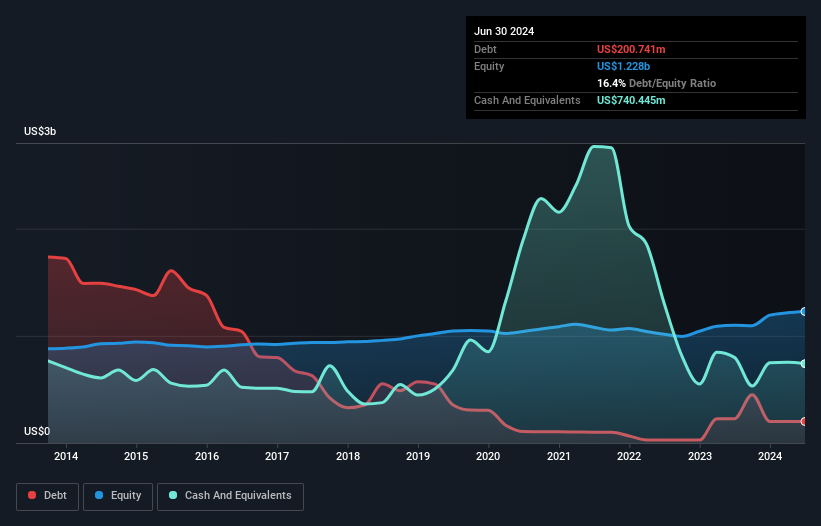

OFG Bancorp, with total assets of US$11.3 billion and equity of US$1.2 billion, is trading at 63.2% below its estimated fair value. The company has deposits totaling US$9.6 billion and loans amounting to US$7.5 billion, with a net interest margin of 6.1%. OFG's earnings grew by 7.6% over the past year, outpacing the industry’s -15.4%. It has an appropriate allowance for bad loans at 1%, ensuring high-quality earnings amidst primarily low-risk funding sources (96%).

- Click to explore a detailed breakdown of our findings in OFG Bancorp's health report.

Evaluate OFG Bancorp's historical performance by accessing our past performance report.

Make It Happen

- Gain an insight into the universe of 220 US Undiscovered Gems With Strong Fundamentals by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:POWL

Powell Industries

Designs, develops, manufactures, sells, and services custom-engineered equipment and systems.

Outstanding track record with flawless balance sheet.