- United States

- /

- Electrical

- /

- NasdaqGS:POWL

Uncovering 3 Undiscovered Gems in the United States Market

Reviewed by Simply Wall St

Over the last 7 days, the market has dropped 4.2%. As for the longer term, the market has risen by 14% in the last year. Looking forward, earnings are forecast to grow by 15% annually. In this fluctuating environment, identifying stocks with strong fundamentals and growth potential can be particularly rewarding. Here are three lesser-known stocks that show promise amid these conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Hamilton Beach Brands Holding | 34.31% | 1.65% | 4.46% | ★★★★★★ |

| Morris State Bancshares | 10.20% | -0.32% | 6.73% | ★★★★★★ |

| Mission Bancorp | 25.37% | 16.23% | 20.16% | ★★★★★★ |

| Teekay | NA | -6.48% | 55.79% | ★★★★★★ |

| Omega Flex | NA | 1.31% | 3.88% | ★★★★★★ |

| Gravity | NA | 15.31% | 24.42% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.12% | 10.04% | ★★★★★★ |

| Tiptree | 68.59% | 20.55% | 20.06% | ★★★★★☆ |

| CSP | 2.17% | -5.57% | 73.73% | ★★★★★☆ |

| FRMO | 0.19% | 6.49% | 15.82% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Willdan Group (NasdaqGM:WLDN)

Simply Wall St Value Rating: ★★★★★★

Overview: Willdan Group, Inc., along with its subsidiaries, offers professional, technical, and consulting services primarily in the United States and has a market cap of $507.16 million.

Operations: Willdan Group generates revenue primarily from its Energy segment ($464.27 million) and its Engineering and Consulting segment ($87.63 million). The company's net profit margin is a key financial metric to watch.

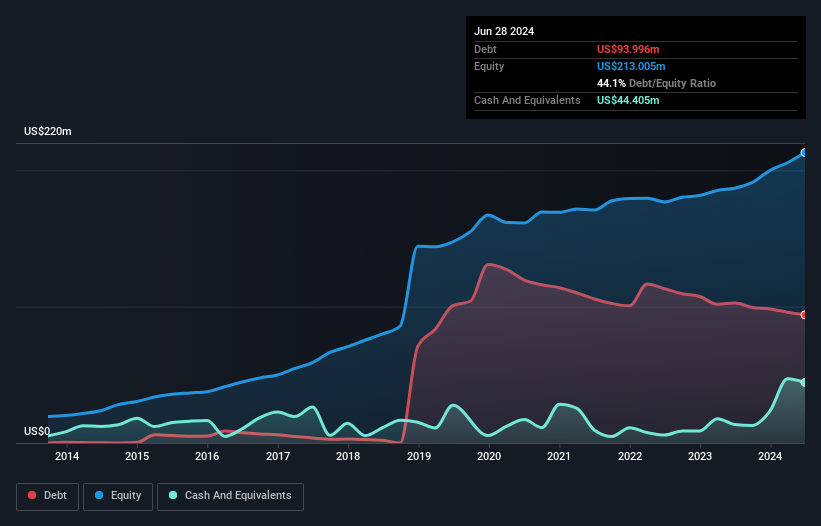

Willdan Group, a small-cap player in professional services, reported Q2 2024 sales of US$141 million, up from US$119.08 million last year. Net income soared to US$4.59 million from US$0.397 million previously, with earnings per share rising to US$0.33 from US$0.03. The company's net debt to equity ratio stands at a satisfactory 23.3%, and it trades at 75% below its estimated fair value, indicating potential for significant upside.

- Delve into the full analysis health report here for a deeper understanding of Willdan Group.

Explore historical data to track Willdan Group's performance over time in our Past section.

Powell Industries (NasdaqGS:POWL)

Simply Wall St Value Rating: ★★★★★★

Overview: Powell Industries, Inc., along with its subsidiaries, specializes in the design, development, manufacturing, sale, and servicing of custom-engineered equipment and systems and has a market cap of approximately $1.82 billion.

Operations: Powell Industries generates revenue primarily from its Electric Equipment segment, amounting to $945.93 million. The company's market cap stands at approximately $1.82 billion.

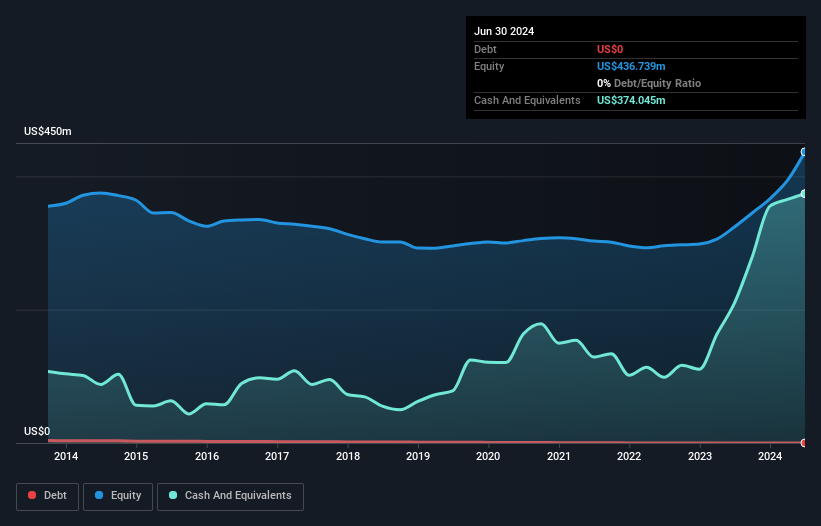

Powell Industries has shown impressive earnings growth of 253.6% over the past year, far outpacing the Electrical industry average of 19.8%. Trading at a price-to-earnings ratio of 15.1x, it offers good value compared to the US market's 17x. The company reported Q3 sales of US$288.17 million and net income of US$46.22 million, with basic earnings per share rising to US$3.85 from last year's US$1.55, reflecting robust financial performance and profitability without any debt concerns.

- Unlock comprehensive insights into our analysis of Powell Industries stock in this health report.

Understand Powell Industries' track record by examining our Past report.

Hamilton Beach Brands Holding (NYSE:HBB)

Simply Wall St Value Rating: ★★★★★★

Overview: Hamilton Beach Brands Holding Company, with a market cap of $342.42 million, designs, markets, and distributes small electric household and specialty housewares appliances in the United States and internationally.

Operations: Hamilton Beach Brands Holding generates $644.78 million in revenue primarily from its subsidiary, Hamilton Beach Brands, Inc. The company's cost structure and margins are not provided in the available data.

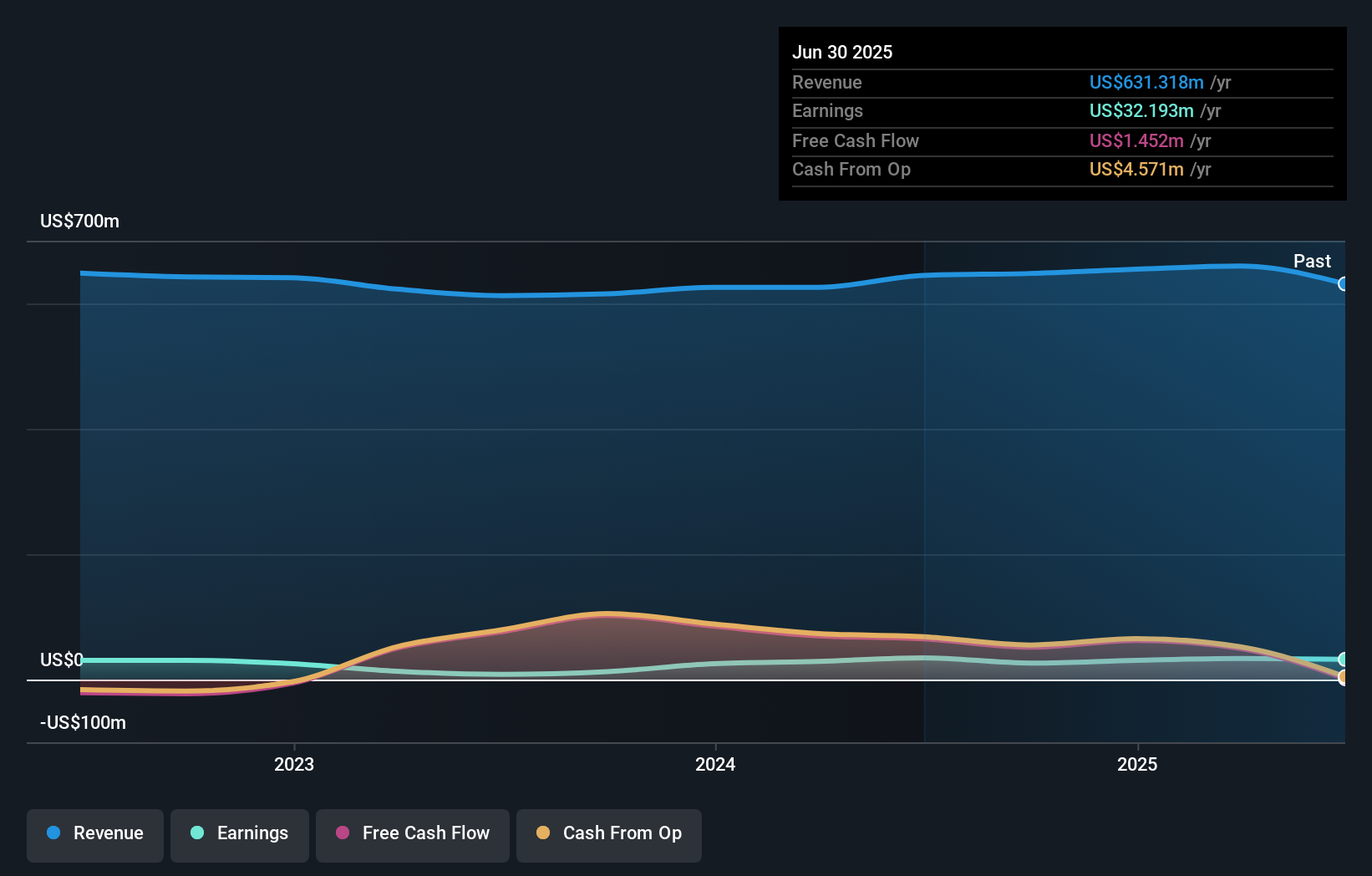

Hamilton Beach Brands Holding (HBB) has shown remarkable performance, with earnings surging by 316.6% over the past year, significantly outpacing the Consumer Durables industry. The company’s net debt to equity ratio stands at a satisfactory 8%, and its interest payments are well covered by EBIT at 40.7x coverage. HBB's recent addition to multiple Russell indexes reflects growing market recognition, while its volatile share price over the last three months suggests potential for both risk and reward.

- Dive into the specifics of Hamilton Beach Brands Holding here with our thorough health report.

Learn about Hamilton Beach Brands Holding's historical performance.

Make It Happen

- Reveal the 216 hidden gems among our US Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:POWL

Powell Industries

Designs, develops, manufactures, sells, and services custom-engineered equipment and systems.

Outstanding track record with flawless balance sheet.