- United States

- /

- Construction

- /

- NasdaqCM:LMB

Three Undiscovered Gems In The United States With Promising Potential

Reviewed by Simply Wall St

Over the last 7 days, the market has dropped 3.4%. In contrast to the last week, the market is up 20% over the past year, with earnings expected to grow by 15% per annum over the next few years. In this dynamic environment, identifying stocks with strong fundamentals and growth potential can be key to capitalizing on future gains.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Mission Bancorp | 25.37% | 16.23% | 20.16% | ★★★★★★ |

| Teekay | NA | -6.48% | 55.79% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.12% | 10.04% | ★★★★★★ |

| Omega Flex | NA | 1.31% | 3.88% | ★★★★★★ |

| First National Bank Alaska | 221.06% | 2.98% | 1.82% | ★★★★★☆ |

| Banco Latinoamericano de Comercio Exterior S. A | 311.64% | 21.07% | 24.77% | ★★★★★☆ |

| Planet Image International | 119.30% | 2.39% | 0.80% | ★★★★★☆ |

| Valhi | 38.71% | 2.57% | -19.76% | ★★★★★☆ |

| FRMO | 0.17% | 12.99% | 23.62% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Karooooo (NasdaqCM:KARO)

Simply Wall St Value Rating: ★★★★★★

Overview: Karooooo Ltd. offers a mobility software-as-a-service (SaaS) platform for connected vehicles across South Africa, the rest of Africa, Europe, the Asia-Pacific region, the Middle East, and the United States, with a market cap of $1.17 billion.

Operations: Karooooo Ltd. generates revenue primarily from its Cartrack segment (ZAR 3.74 billion) and Karooooo Logistics segment (ZAR 355.99 million), with a total revenue adjustment of ZAR 193.22 million.

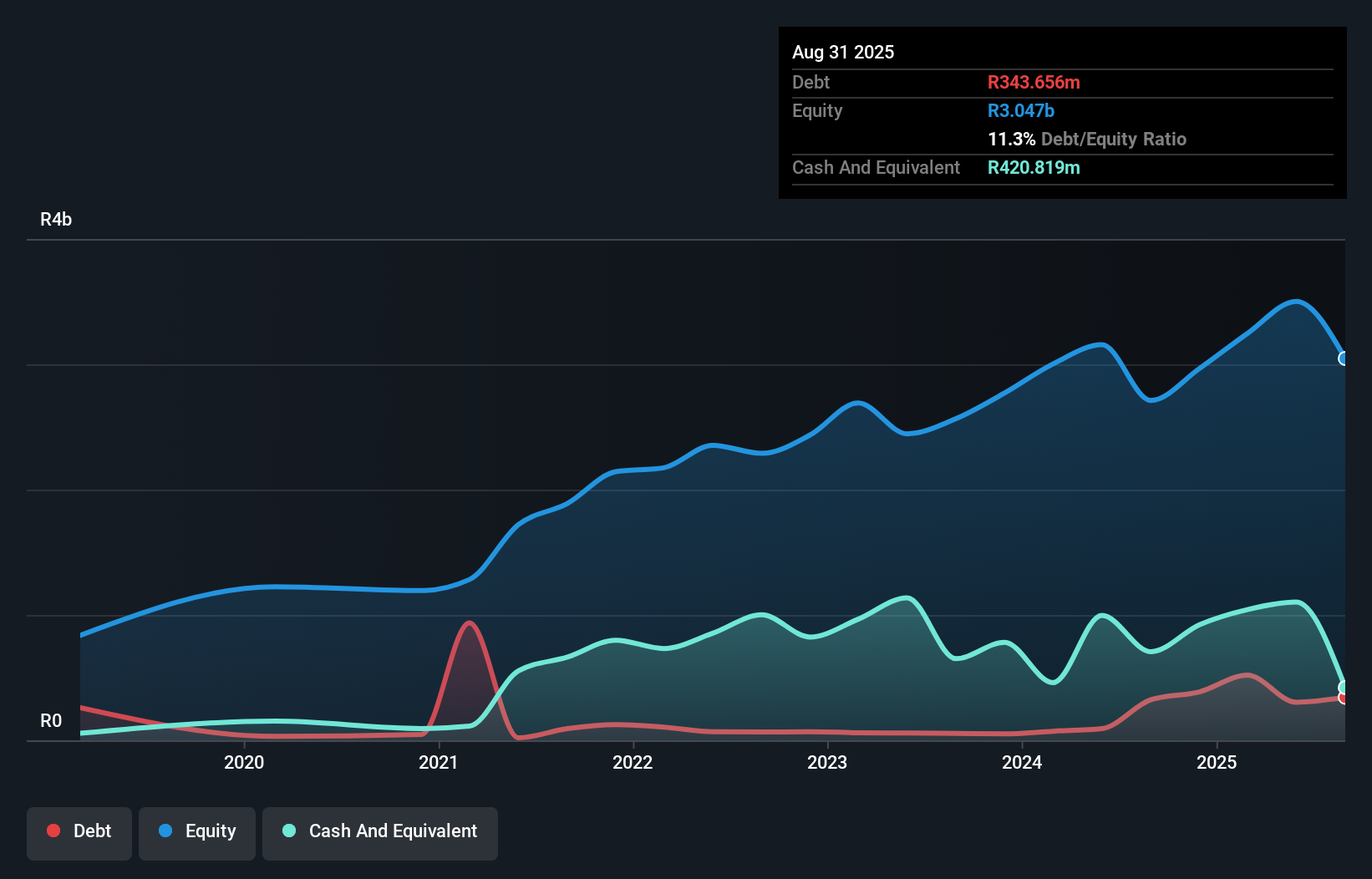

Karooooo Ltd. has shown significant financial improvements, reducing its debt to equity ratio from 21.7% to 3% over the past five years, and achieving a remarkable earnings growth of 33.5% last year, surpassing the Software industry’s 23.9%. Trading at a good value compared to peers and industry benchmarks, KARO is currently priced at 42.1% below its estimated fair value. Recent events include repurchasing 57,806 shares for US$1.45 million and appointing Deloitte & Touche as auditors for FY2025.

- Dive into the specifics of Karooooo here with our thorough health report.

Assess Karooooo's past performance with our detailed historical performance reports.

Limbach Holdings (NasdaqCM:LMB)

Simply Wall St Value Rating: ★★★★★★

Overview: Limbach Holdings, Inc. operates as a building systems solutions company in the United States with a market cap of $726.78 million.

Operations: Revenue for Limbach Holdings, Inc. is derived from Owner Direct Relationships (ODR) at $301.47 million and General Contractor Relationships (GCR) at $210.20 million.

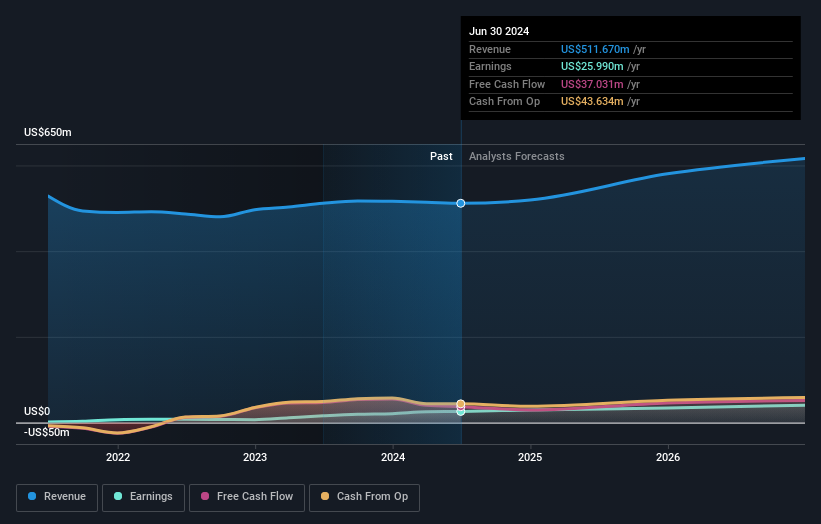

Limbach Holdings has seen significant improvements over the past five years, reducing its debt to equity ratio from 88% to 7.2%. The company reported net income of US$5.96 million for Q2 2024, up from US$5.32 million a year ago, with basic earnings per share rising to US$0.53 from US$0.50. Trading at 50% below its estimated fair value and boasting high-quality earnings, Limbach's recent inclusion in the Russell 2000 Defensive Index highlights its potential for growth in the construction industry.

- Unlock comprehensive insights into our analysis of Limbach Holdings stock in this health report.

Evaluate Limbach Holdings' historical performance by accessing our past performance report.

Powell Industries (NasdaqGS:POWL)

Simply Wall St Value Rating: ★★★★★★

Overview: Powell Industries, Inc., along with its subsidiaries, specializes in designing, developing, manufacturing, selling, and servicing custom-engineered equipment and systems with a market cap of $1.86 billion.

Operations: Powell Industries generates its revenue primarily from the Electric Equipment segment, which brought in $945.93 million.

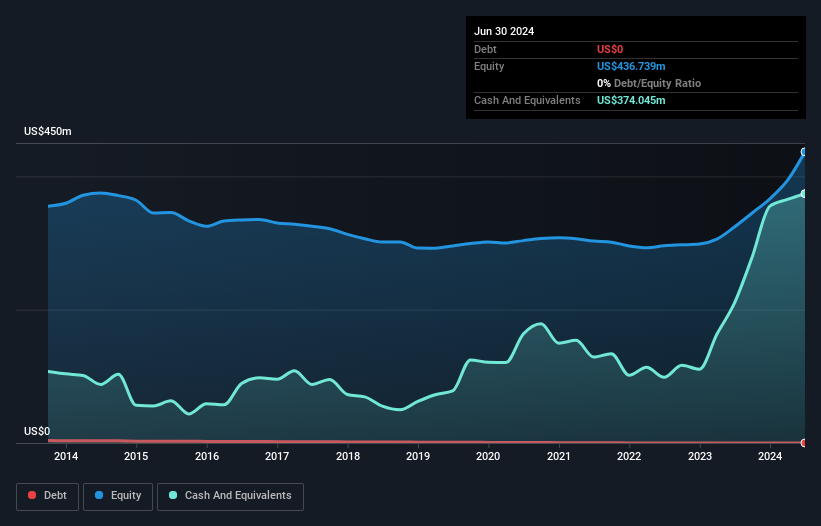

Powell Industries, a small cap in the electrical sector, reported impressive earnings growth of 253.6% over the past year, significantly outpacing its industry peers. The company's net income for Q3 2024 was US$46.22 million compared to US$18.45 million a year ago, reflecting strong operational performance. With no debt on its books and a price-to-earnings ratio of 14.3x below the US market average of 17.5x, Powell presents an attractive value proposition despite recent share price volatility and substantial insider selling over the past quarter.

- Navigate through the intricacies of Powell Industries with our comprehensive health report here.

Examine Powell Industries' past performance report to understand how it has performed in the past.

Turning Ideas Into Actions

- Unlock more gems! Our US Undiscovered Gems With Strong Fundamentals screener has unearthed 205 more companies for you to explore.Click here to unveil our expertly curated list of 208 US Undiscovered Gems With Strong Fundamentals.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:LMB

Limbach Holdings

Operates as a building systems solution company in the United States.

Flawless balance sheet with solid track record.