- United States

- /

- Electrical

- /

- NasdaqGS:POWL

Powell Industries (POWL): Exploring Valuation After Strong Growth in Revenue, Earnings, and Profitability

Reviewed by Kshitija Bhandaru

Powell Industries (POWL) is drawing attention following recent analysis highlighting its steady annual revenue and earnings growth. Investors are also watching for the impacts of stronger profitability and improved free cash flow margin.

See our latest analysis for Powell Industries.

Powell Industries has been riding a wave of momentum, with a one-week share price return of nearly 10% and a 30-day gain of 13.5% helping lift its year-to-date rise to about 45%. Even more impressive, total shareholder return has climbed 22% over the past year and a remarkable 1,440% over three years. This signals that investors are recognizing both the company's growth potential and its improving financial health.

If strong performance stories like this have you thinking bigger, consider the next step and discover fast growing stocks with high insider ownership.

But after such a meteoric rise, does Powell Industries still offer untapped upside for investors? Or has the market already priced in the company's future growth prospects, leaving little room for further gains?

Most Popular Narrative: 22.8% Overvalued

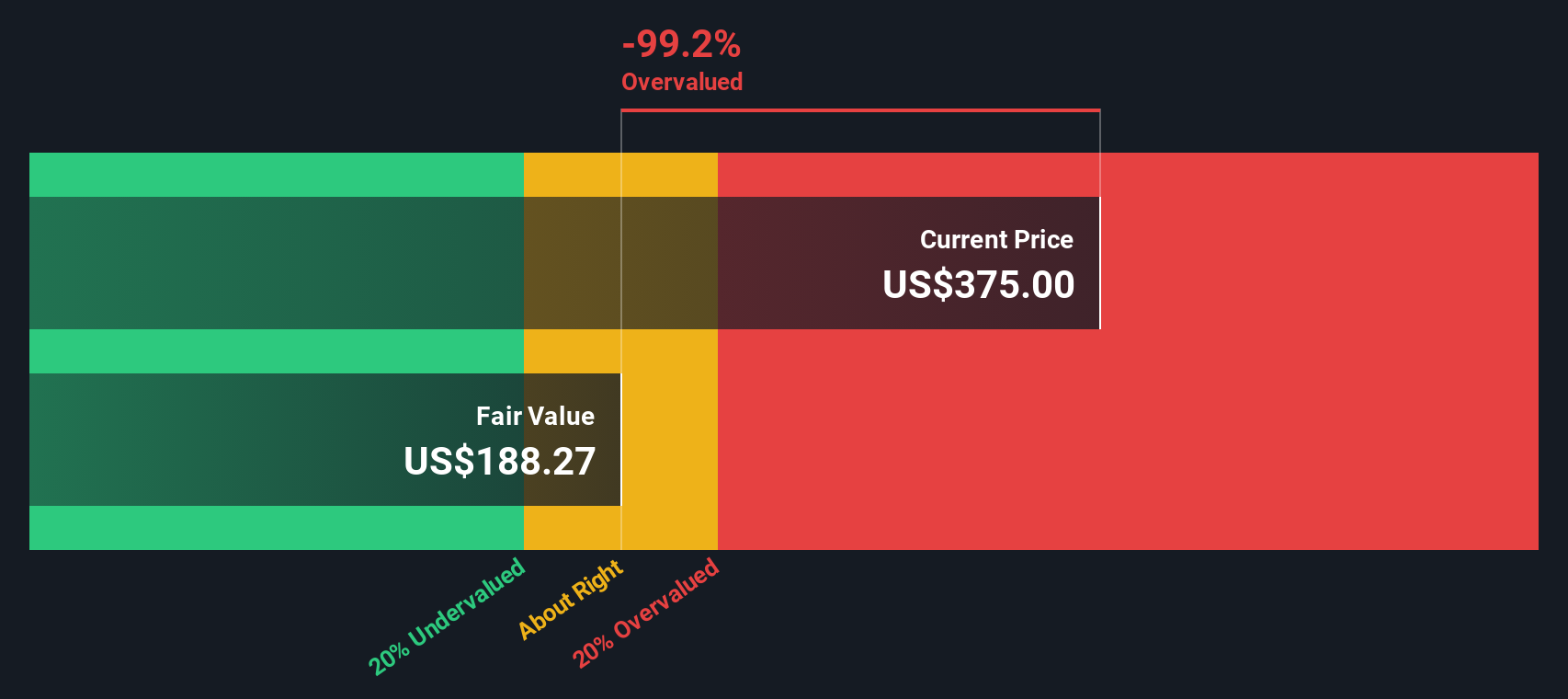

The current market price stands well above the consensus fair value, indicating that excitement over Powell Industries’ prospects may be running ahead of analyst projections.

The market may be pricing in sustained outsized revenue growth and backlog conversion driven by robust order activity in electric utility, data center, and offshore energy infrastructure. These sectors are benefiting from the accelerating buildout of electrification and grid modernization, resulting in potentially over-optimistic top-line expectations.

Curious which aggressive revenue and profit assumptions are backing this bullish stance? The model suggests an earnings trajectory and profit levels usually reserved for sector leaders. Want to see the foundation for today’s premium valuation? Uncover the thinking and numbers fueling this market view inside the full narrative.

Result: Fair Value of $269.26 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Powell's record backlog and expanding capacity could drive sustained revenue growth. Strong operational execution may help preserve recent margin gains.

Find out about the key risks to this Powell Industries narrative.

Another View: SWS DCF Model Puts a Different Price on Powell

While the consensus price target and multiples suggest investors see the stock as pricey, our SWS DCF model takes a closer look at Powell Industries’ cash flows and arrives at a much lower fair value, about $191.22 per share. This implies the shares could be significantly overvalued on a cash flow basis. Does this gap signal caution for those focused on fundamentals?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Powell Industries Narrative

If you have your own perspective or want to dig into the numbers yourself, it only takes a few minutes to craft your own narrative, so Do it your way.

A great starting point for your Powell Industries research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Why stop at just one opportunity? Supercharge your research and tap into new investing themes with these powerful tools from Simply Wall Street:

- Snag potential bargains by scanning for value in these 877 undervalued stocks based on cash flows, where stocks could be trading below their cash flow worth.

- Boost your portfolio’s future focus and kickstart your hunt for the next breakthrough with these 24 AI penny stocks powering artificial intelligence trends.

- Enhance your passive income by finding reliable yield opportunities among these 18 dividend stocks with yields > 3% offering attractive returns above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:POWL

Powell Industries

Designs, develops, manufactures, sells, and services custom-engineered equipment and systems.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives