- United States

- /

- Electrical

- /

- NasdaqCM:PLUG

Why Plug Power (PLUG) Is Down 21.6% After Suspending US Hydrogen Projects and Raising $375 Million

Reviewed by Sasha Jovanovic

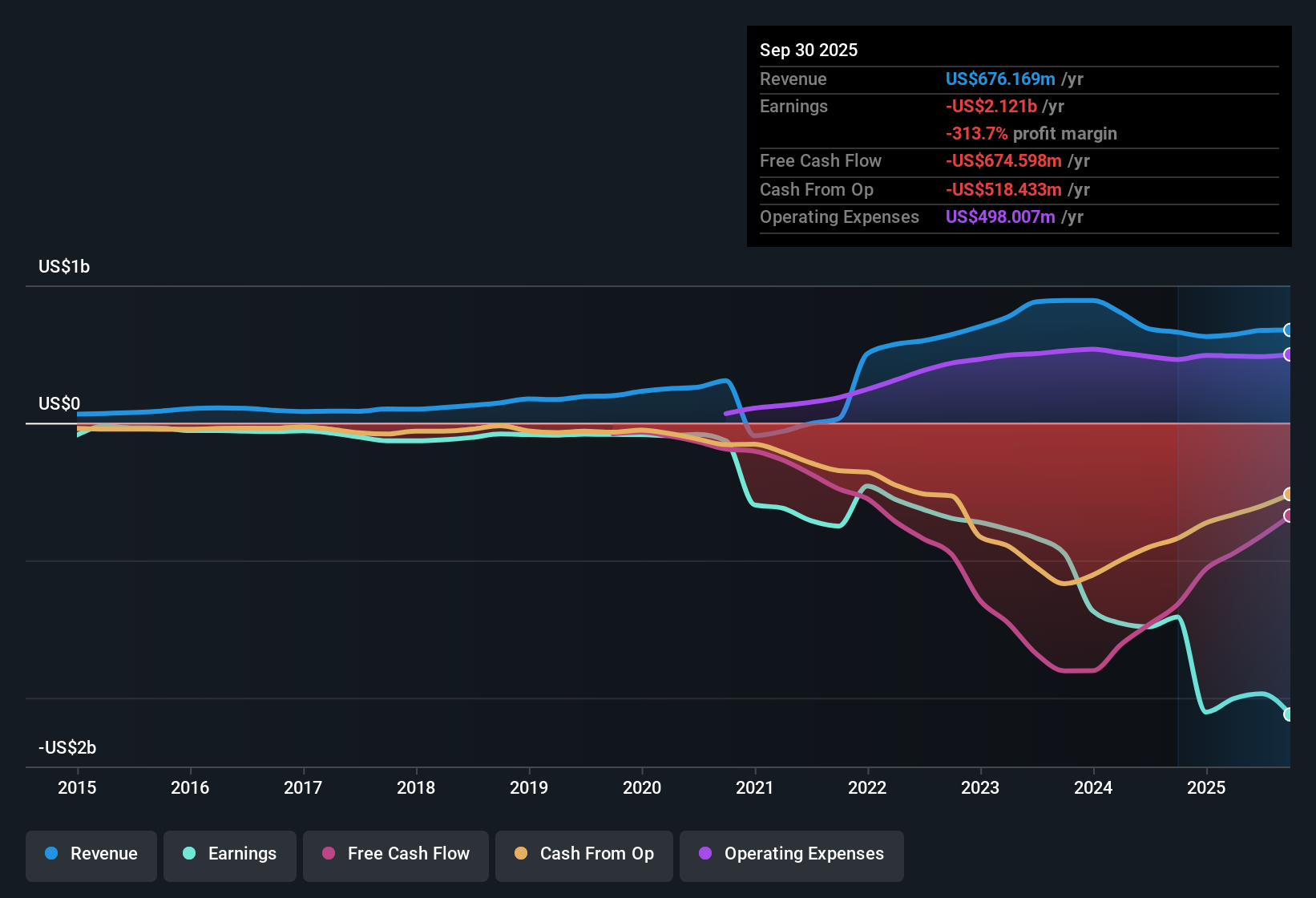

- Earlier in November 2025, Plug Power completed a US$375 million convertible bond offering and announced significant liquidity initiatives, following disappointing third-quarter financial results and the suspension of multiple hydrogen projects in the US.

- These measures highlight the company’s focus on asset monetization and partnerships to mitigate financial pressures, while simultaneously accelerating expansion into the European electrolyzer and data center markets.

- We’ll now examine how Plug Power’s project suspensions and liquidity-raising efforts may reshape its long-term investment outlook.

Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

Plug Power Investment Narrative Recap

To see value in Plug Power, investors need to believe in a long-term scale-up of green hydrogen and fuel cell adoption, with improved margins and enhanced financial stability as critical short-term catalysts. The recent US$375 million convertible bond offering and project suspensions directly address liquidity pressures and short-term cash needs, but also raise the profile of dilution and execution risks, especially since success now leans even more on large European projects and profitable data center expansion. While not immediately altering the biggest risk (persistent negative margins and high cash burn), these moves can influence the timing and visibility of profitability milestones and future funding requirements.

The most relevant announcement to this development is the suspension of several US hydrogen projects and the decision to monetize electricity rights, as this directly ties to the company’s pursuit of liquidity and reshuffling of capital priorities. At the same time, Plug Power’s new electrolyzer supply contracts in the UK and commercial progress in Europe signal potential for offsetting revenue, but emphasize the need for timely project execution to support near-term cash flow goals and reduce dependence on government incentives.

However, investors should also be aware that, unlike operational improvements, access to fresh capital may come with its own tradeoffs...

Read the full narrative on Plug Power (it's free!)

Plug Power's narrative projects $1.2 billion revenue and $124.7 million earnings by 2028. This requires 22.2% yearly revenue growth and a $2.1 billion earnings increase from current earnings of -$2.0 billion.

Uncover how Plug Power's forecasts yield a $2.78 fair value, a 30% upside to its current price.

Exploring Other Perspectives

Twenty-one members of the Simply Wall St Community recently valued Plug Power shares in a wide range from US$1.52 to US$6.98. At the same time, analysts caution that continued negative margins and cash needs could pressure the company’s ability to meet near-term targets, suggesting there is plenty for investors to weigh as they consider various viewpoints.

Explore 21 other fair value estimates on Plug Power - why the stock might be worth 29% less than the current price!

Build Your Own Plug Power Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Plug Power research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Plug Power research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Plug Power's overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:PLUG

Plug Power

Develops hydrogen fuel cells product solutions in North America, Europe, Asia, and internationally.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives