- United States

- /

- Electrical

- /

- NasdaqCM:PLUG

Plug Power's Inc. (NASDAQ:PLUG) Sentiment is Increasing and the Recent Infrastructure Bill may Become a Catalyst

Plug Power's Inc. (NASDAQ:PLUG), shares saw an 11% drop to US$25.10 in the week since the company reported its quarterly result. On the whole, it seems that the stock has stabilized back to fundamentals after a high enthusiasm run from the beginning of 2021. We will take a better look at the fundamentals and see what analysts are expecting for the company.

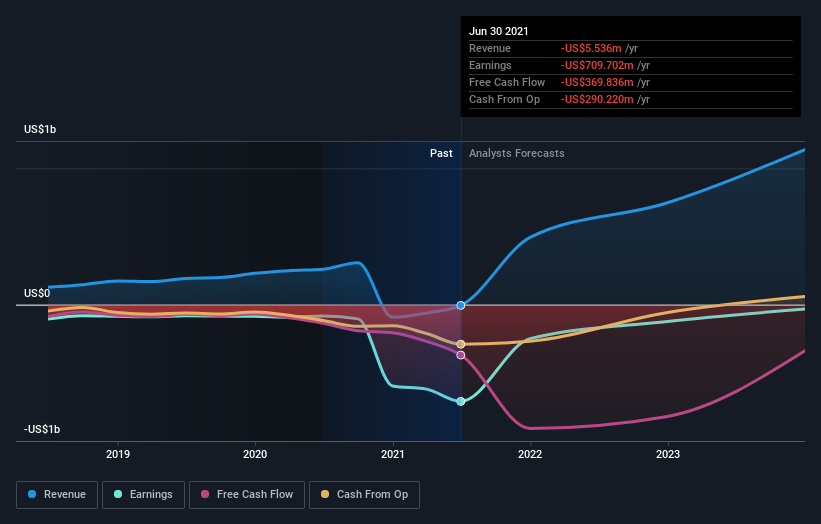

For their second quarter, Plug Power shipped 3,666 GenDrives compared to 2,683 units YoY. Net Revenue was US$124m, but trailing twelve month revenue still needs to recover from the US$-309m drop from Q4 2020, and is currently at US$-5.6m.

It is interesting to note, that Plug Power made a shelf registration with the SEC on 13th Aug - consisting of 24.9m shares. This can allow the company to raise capital in favorable conditions, in order to develop their production and other business capacity.

Statutory losses also blew out, with the loss per share reaching US$0.18, some 148% bigger than the analysts expected.

The long term performance is key, so we will take a look at what the analysts are forecasting for next year, and see if there's been a change in sentiment towards the company.

View our latest analysis for Plug Power

The company is expected to recover and get back on track after the slump at the end of 2020. Revenue will see healthy growth rates, but the development of production will require high capital investments and a break to profitability is still some ways off for the company.

Their business model relies to a large extent on the uptake of carbon-neutral policies in the US, and the country's shift toward cleaner - albeit possibly more expensive, energy sources. That is why the leadership was excited when the US Senate passed, a US$1 Trillion infrastructure bill, that will also impact the development of this sector.

Taking into account the latest results, the current consensus, from the 20 analysts covering Plug Power, is for revenues of US$492.9m in 2021, which would reflect a slow continuation of revenues as seen before the Q4 drop

Losses are predicted to fall substantially, shrinking 72% to US$0.43. Yet prior to the latest earnings, the analysts had been forecasting revenues of US$468.4m and losses of US$0.28 per share in 2021. While this year's revenue estimates increased, there was also a regrettable increase in loss per share expectations, suggesting the consensus has a bit of a mixed view on the stock.

It will come as no surprise that expanding losses caused the consensus price target to fall 5.3% to US$40.86 with the analysts implicitly ranking ongoing losses as a greater concern than growing revenues.

A better way to look at price targets, is to view their range. There are some variant perceptions on Plug Power, with the most bullish analyst pricing it at US$78.00 and the most bearish at US$13.00 per share. This shows us a variety of views, and may render the price targets as unreliable.

Conclusion

Sentiment for Plug-Power seems to be picking up, as an array of call option contracts are lined up for the stock, and the passing of the bi-partisan infrastructure bill by the US senate may prove to be a catalyst for the company. Plug Power is in their "buildup" phase of operations, and we should be able to see a pick-up of revenues but high capital expenditures in parallel.

This is also reflected in analysts estimates, as they expect to see a rise in net sales, and also a net loss for some time in the future. The price target has quite a large range, so it may prove to be an unreliable source for investors.

Plug Power looks like it is slowly picking up steam, but the stock is risky nonetheless, since a variety of macro factors and government policies determine if the company will be successful enough to justify a rise in the stock price.

With that in mind, we wouldn't be too quick to come to a conclusion on Plug Power. Long-term earnings power is much more important than next year's profits. At Simply Wall St, we have a full range of analyst estimates for Plug Power going out to 2023, and you can see them free on our platform here..

Even so, be aware that Plug Power is showing 3 warning signs in our investment analysis , and 1 of those is a bit concerning...

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NasdaqCM:PLUG

Plug Power

Develops hydrogen and fuel cell product solutions in North America, Europe, Asia, and internationally.

Flawless balance sheet low.