- United States

- /

- Electrical

- /

- NasdaqCM:PLUG

Plug Power (PLUG): Assessing Valuation After $375 Million Convertible Note Offering and Plans for Share Authorization Expansion

Reviewed by Simply Wall St

Plug Power (PLUG) has just completed a $375 million convertible note offering and is now asking shareholders to approve doubling its authorized shares. These moves highlight a renewed focus on funding options and future expansion.

See our latest analysis for Plug Power.

Plug Power's recent $375 million convertible notes offering and its push to expand authorized shares have turned investor attention back to its funding path, especially after a tough run. Although the share price has rallied 18.8% in the past 90 days, recent momentum has faded with a steep 33.6% slide over the past month and a year-to-date price return of -15.9%. This emphasizes just how challenging the longer-term environment has been. Looking at the big picture, the past year saw total shareholder return at -10.9%, and the five-year total return still sits deep in negative territory at -92.6%.

If the funding news has you thinking about other high-potential plays, it’s a smart moment to broaden your outlook and discover fast growing stocks with high insider ownership

With these moves in the spotlight, the question comes into focus: is Plug Power’s current stock price reflecting only recent struggles, or could today’s depressed value present a real buying opportunity if the market is underestimating future growth?

Most Popular Narrative: 29.7% Undervalued

Plug Power’s last close of $1.96 trails the narrative's fair value estimate of $2.79. This notable valuation gap reflects investor skepticism, although analyst confidence is grounded in significant industry catalysts.

The recent long-term extension and clarity of U.S. hydrogen production (45V) and investment (48E) tax credits is accelerating customer adoption and improving project economics. This is renewing interest and driving a robust pipeline, especially for electrolyzers and material handling, supporting future revenue growth and margin expansion.

Want to discover what’s really driving this big valuation disconnect? There is a bold growth assumption at the heart of this narrative that only a handful of companies could achieve. The financial leap from today's deep losses to profits in just a few years is no ordinary forecast. Could Plug Power close that gap? The underlying projections will likely surprise even seasoned investors.

Result: Fair Value of $2.79 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, especially if Plug Power’s margin targets slip again or if delays in large project approvals cast doubt on near-term revenue visibility.

Find out about the key risks to this Plug Power narrative.

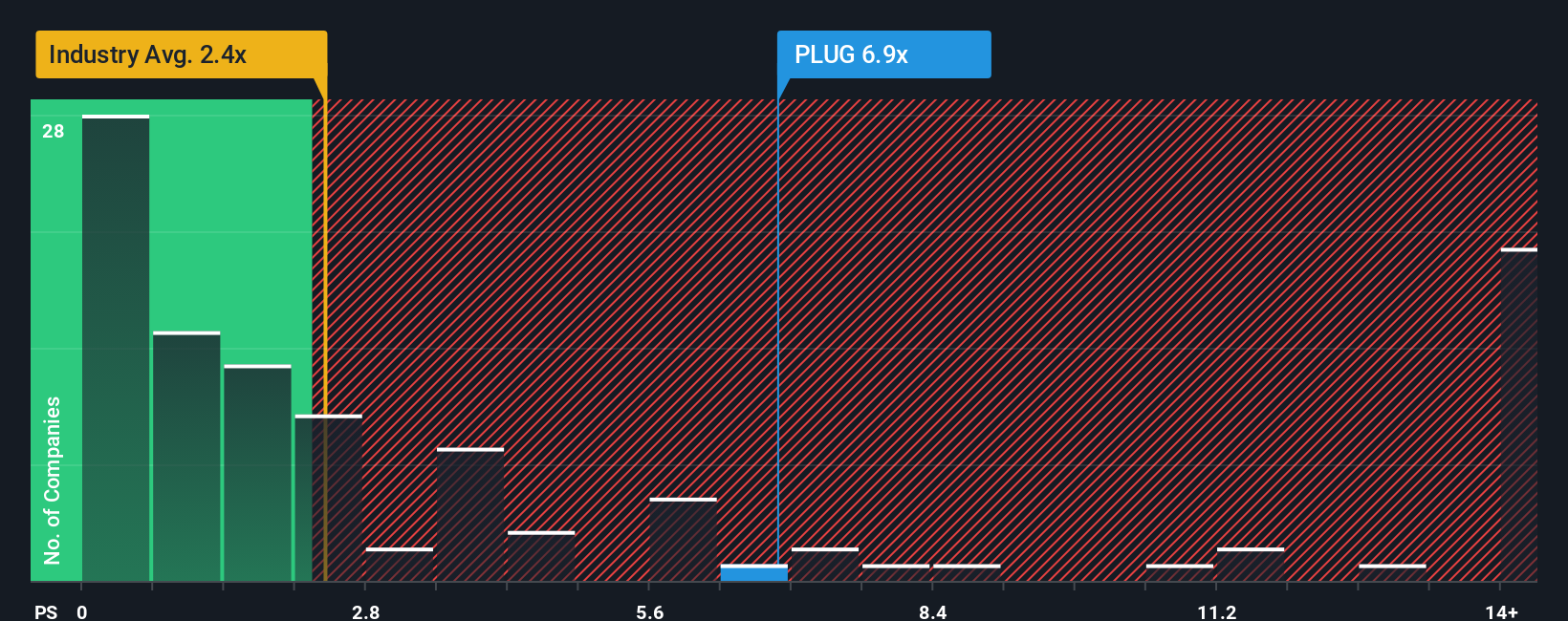

Another View: Multiples Tell a Cautionary Story

While the narrative points to Plug Power trading well below fair value, a different lens paints a less optimistic picture. On a sales basis, the company's price-to-sales ratio sits at 4x, not only above its peer average of 3.2x but also more than double the US Electrical industry average of 1.8x. Even more striking, our fair ratio for the business is just 0.1x. This wide gap suggests the market could see a sharp correction if optimism fades. Are investors overlooking valuation risk in their search for a turnaround story?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Plug Power Narrative

If this perspective doesn't match your own, or if you like digging into the numbers yourself, you can build your own story in just minutes. Do it your way

A great starting point for your Plug Power research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t limit your opportunities to just one stock. The best investors scan the entire market to spot hidden gems, strong trends, and reliable income prospects before everyone else.

- Capitalize on the next wave of medical technology with these 30 healthcare AI stocks and track cutting-edge healthcare innovations shaping tomorrow’s treatments.

- Power up your portfolio with these 924 undervalued stocks based on cash flows to find investments that offer strong fundamentals and attractive entry points for value-focused growth.

- Pursue high-yield opportunities through these 14 dividend stocks with yields > 3% to position yourself for steady passive income from solid dividend payers.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:PLUG

Plug Power

Develops hydrogen fuel cells product solutions in North America, Europe, Asia, and internationally.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth