- United States

- /

- Electrical

- /

- NasdaqCM:PLUG

Is Plug Power’s Big Price Drop an Opportunity or More Trouble Ahead?

Reviewed by Bailey Pemberton

- Wondering if Plug Power stock is undervalued, overhyped, or somewhere in between? Let’s dig in and find out what the numbers and the story behind them really say about its valuation.

- Plug Power’s share price has taken a wild ride lately, dropping 30.4% over the past week and falling 44.1% in the last month. Longer-term investors have faced an even steeper 87.7% drop over three years.

- Recent headlines have spotlighted Plug Power’s capital raising efforts and ongoing concerns about its liquidity, sparking plenty of debate among analysts. The market seems split between seeing these developments as prudent planning or as a red flag for more uncertainty ahead.

- Plug Power is marked as undervalued in 2 out of our 6 valuation checks, giving it a score of 2/6. Traditional valuation methods, however, might miss bigger questions. Stay tuned, because towards the end of the article, we’ll explore a better way to get the full picture.

Plug Power scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Plug Power Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today’s value. This approach allows investors to see what a stock should be worth if it can deliver the expected cash flows in the years ahead.

For Plug Power, the DCF model uses Free Cash Flow (FCF) as its primary input. Currently, Plug Power has a negative free cash flow of $-904.43 million. Analyst forecasts expect this to improve gradually, projecting positive cash flow of $257.1 million by 2029 and further gains after that. While analysts only provide reliable estimates about five years out, further projections are extrapolated based on industry expectations, with FCF potentially climbing to over $1.3 billion by 2035.

Based on these cash flow projections and their discounted values, the DCF model calculates Plug Power’s intrinsic value at $7.14 per share. The current market price represents a 73.4% discount to this estimate, so the stock appears significantly undervalued according to this method.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Plug Power is undervalued by 73.4%. Track this in your watchlist or portfolio, or discover 896 more undervalued stocks based on cash flows.

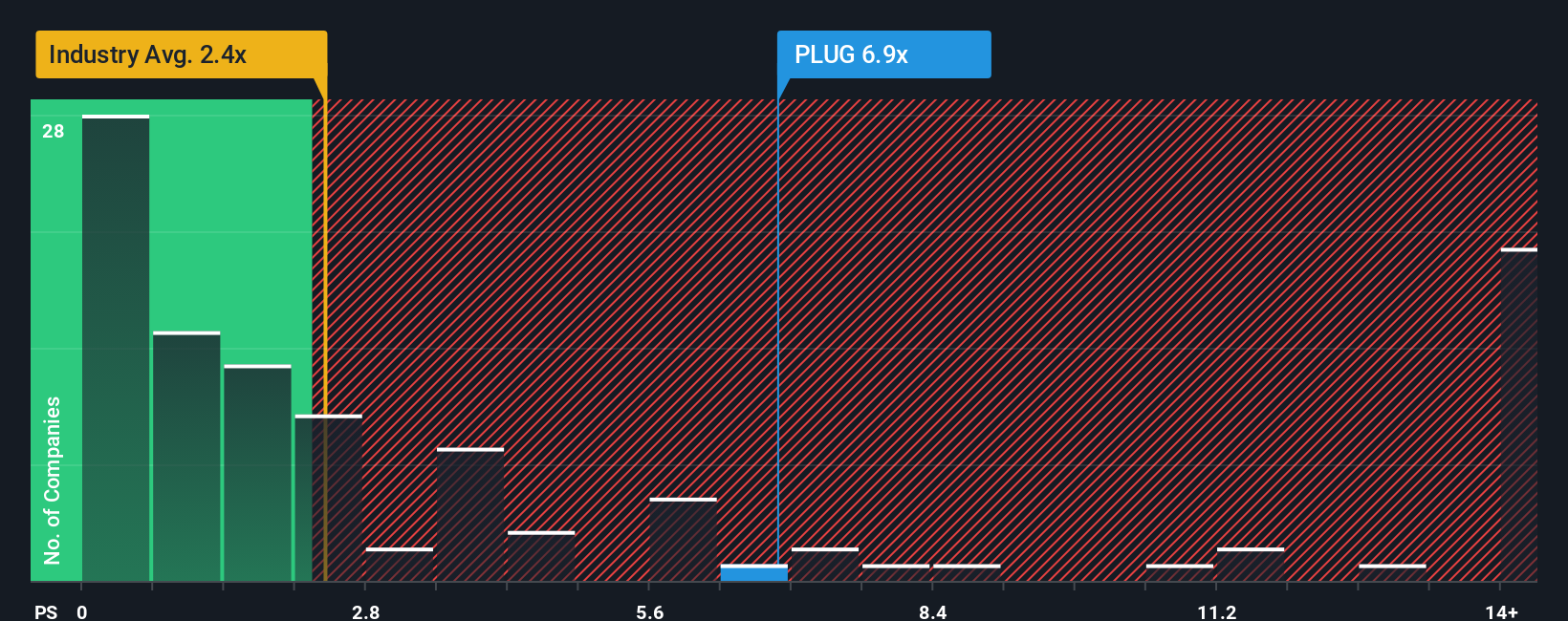

Approach 2: Plug Power Price vs Sales

The Price-to-Sales (P/S) ratio is often used to value companies that are not currently profitable, making it a good fit for Plug Power. This metric compares a company’s market value to its revenue, providing a sense of how much investors are willing to pay for each dollar of sales.

In general, a company’s P/S ratio can reflect expectations for future growth and risk. Firms with fast growth prospects or lower risk tend to command higher P/S multiples, while stagnating or riskier businesses trade at lower ratios. So, interpreting the ratio in context is essential, especially for newer or rapidly evolving industries like clean energy.

Plug Power is currently trading at a P/S ratio of 3.86x. For comparison, the average P/S in the Electrical industry is 1.94x, and the peer average is 3.25x. By Simply Wall St’s proprietary “Fair Ratio” model, which weighs a company’s growth potential, typical industry valuation, margins, market cap, and specific risks, Plug Power’s fair P/S ratio is calculated as 0.15x. Unlike simple industry or peer comparisons, the Fair Ratio customizes its expectations for Plug Power’s own financial position and outlook to provide a more balanced view.

In this case, Plug Power’s current P/S of 3.86x is much higher than its Fair Ratio of 0.15x, suggesting the stock is trading at a significant premium relative to what its fundamentals and risk profile warrant.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1417 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Plug Power Narrative

Earlier we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple, powerful tool that lets you connect your own story or belief about Plug Power with key financial numbers, such as assumptions for fair value, future revenue, earnings, and margins. Instead of just relying on generic metrics, Narratives help you express your outlook, see how it shapes a forecast, and discover what that really means for the stock’s value.

This approach brings together what you know about the company, such as their business model, market opportunities, strengths, or risks, and links it directly to a fair value calculation. On Simply Wall St’s Community page, millions of investors use Narratives to track their perspective, reflect on how new events (like news or earnings) affect their outlook, and decide whether to buy or sell by comparing their own Fair Value against the latest Price.

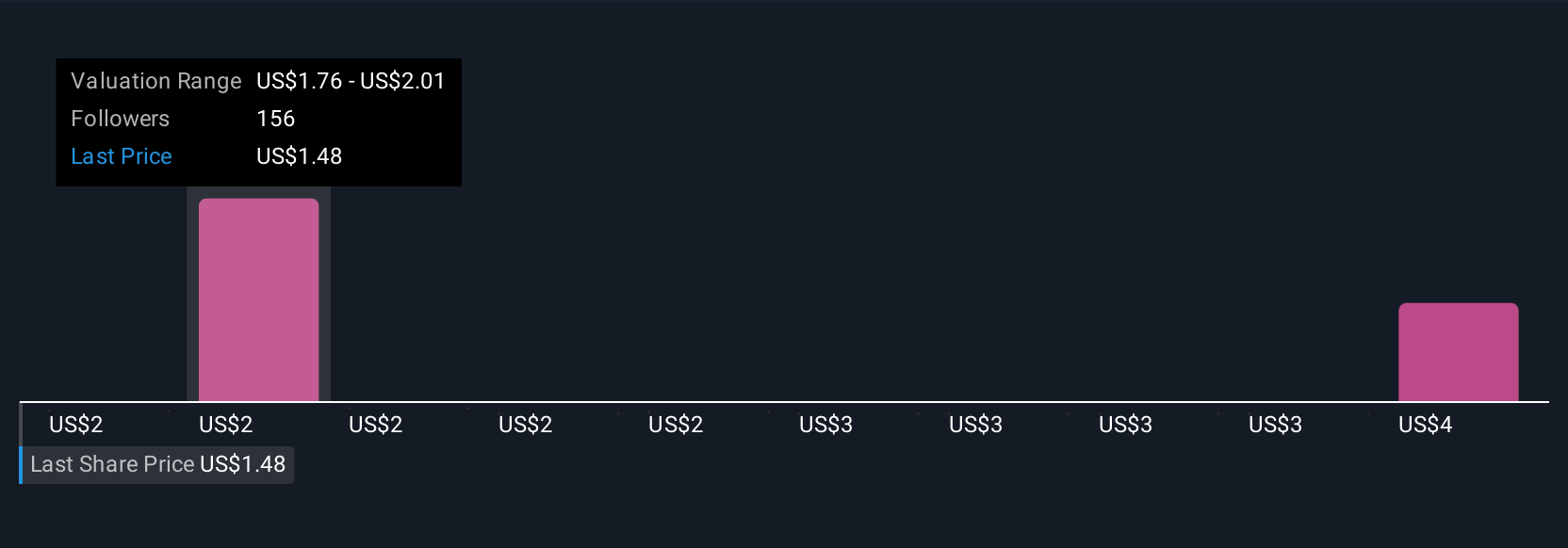

Because Narratives update dynamically as new information arrives, you can quickly sense-check or adjust your thesis as things change. For example, one Plug Power investor may write a bullish Narrative around robust policy support and set a fair value near the top analyst target of $5.00. Another, more cautious investor may focus on ongoing risks and use $0.55 as their fair value anchor.

Do you think there's more to the story for Plug Power? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:PLUG

Plug Power

Develops hydrogen fuel cells product solutions in North America, Europe, Asia, and internationally.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives